Around six weeks into a joint collaboration to offer insurers and reinsurers a new collateralised whole-account reinsurance offering backed by insurance-linked securities (ILS), Hyperion X and Vario Partners LLP told us they are seeing significant interest.

At the beginning of April we reported that Hyperion X, the data analytics focused entity of global holding company Hyperion Insurance Group, had partnered with specialist capital markets focused risk advisor Vario Partners LLP to launch a collateralised whole-account ILS backed protection product.

At the beginning of April we reported that Hyperion X, the data analytics focused entity of global holding company Hyperion Insurance Group, had partnered with specialist capital markets focused risk advisor Vario Partners LLP to launch a collateralised whole-account ILS backed protection product.

We caught up with the team behind it to discuss progress, to find out more about how cedents can tap into this new source of capital markets backed coverage and to hear how the market has reacted to it.

Bryan Joseph, founding partner of Vario Partners, told us that the collaboration is seeing, “Massive interest, many conversations and more focus on capital.”

The product has been named Insurance Capital Enhancement (ICE) notes, which will be the insurance-linked investment instrument underpinning and collateralising the whole-account protection on offer.

Nick Griffiths, Executive Director at RKH Reinsurance Brokers (another Hyperion Insurance Group entity) explained that the ICE notes are likely to fit a cedent’s capital structure at a useful protection level.

“I would expect that it would fit in around the 1:100, or 1% EP on a net basis. There is some flexibility in this dependent on the cedent and historical results,” Griffiths explained.

Joseph further explained, “Reinsurance itself is a form of capital, as the reinsured is renting capacity on the balance sheet of the reinsurer.

“ICE is designed to be part of the capital structure and would form part of the “permanent” capital of the issuer by being a specific type of hybrid reinsurance from the debt capital markets. If they opt for our solvency trigger, then it will feel like RT1 capital.”

The whole-account offering, while a complement for wider capital actions, reinsurance and retrocessional coverage, is not seen as a full-replacement for these.

Griffiths said, “ICE notes will be a new instrument for Cedents when they are looking at their capital management decisions.”

While Joseph offered, “ICE Notes are an addition to re/insurers capital and not a replacement for existing reinsurance protection.”

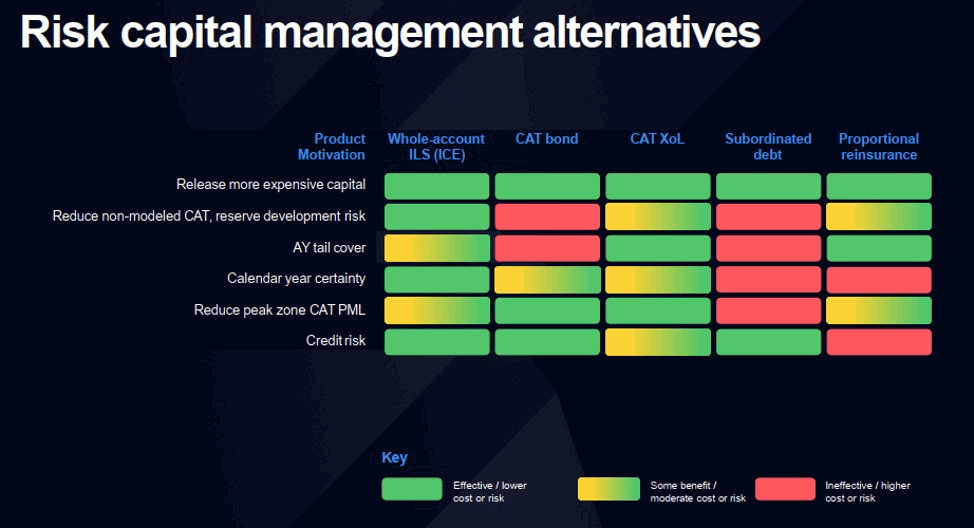

To better explain how the whole-account, ILS backed ICE notes compare to other forms of more traditional risk transfer and risk capital management tools, Hyperion X shared the below table with us.

As you can see from the above table, given the situation insurance and reinsurance market’s currently find themselves in due to the threat of the global Covid-19 pandemic, the current accident year certainty offered by a whole account ILS protection could be extremely attractive at this time.

Balance-sheet hedging and protection if coming to the fore this year, as cedents look to lock down some level of certainty around their portfolio performance through this year and beyond, something a whole-account cover backed by capital market investors may be an effective tool for.

Griffiths explained that the whole account ILS transaction has a lead time no longer than a catastrophe bond, in fact it could be shorter for some cedents, with an execution lead-time of between two and three months envisaged.

On the investor side, given the hit seen across global asset classes from the pandemic and the reduced prospects of a speedy return to global growth and economic activity, the ICE product may prove very attractive to certain institutional investors.

David Flandro, Managing Director of Hyperion X explained, “Large, institutional investors are now in a once-in-a-decade situation. They are actively re-balancing portfolios and seeking non-correlative asset to hedge new allocations to risk assets. In fixed income, there is a desire for diversification away from pure credit risk, funds are underweight insurance relative to its proportion of the economy, and there is a hunger for yield in regulated and structurally sound assets.”

There are capital benefits beyond the pure portfolio protection that an ICE whole-account ILS transaction can provide to ceding companies, Mark Shumway, Head of Strategic Advisory at Hyperion X said.

“ICE notes provide a layer of collateralized contingent capital that can provide a ceiling on all losses for covered calendar years. This capital directly supports an issuer’s rating agency and regulatory capital adequacy in multiple aspects, including two quantifiable benefits reflected in risk-based capital analyses,” Shumway explained.

Adding that, “First, issuers subject to capital requirements based in part on estimated exposure to high severity losses (e.g. carriers rated by A.M. Best, Fitch, Moody’s, or S&P, or subject to Solvency II or Solvency II-equivalent regulations—i.e. most of the global insurance market by assets), see a direct reduction in required capital through the reduction of net exposure to severe loss events—on both occurrence and aggregate bases. This reduction in exposure provides the same net benefit as an equivalent or near-equivalent increase in Tier 1 (equity) capital. In fact, because the limit is collateralized, risk transfer through ICE notes can be more efficient than through traditional reinsurance or parametric coverage. Further, as opposed to parametric cover, ICE notes incur no material basis risk charges (offset to capital benefit) because the trigger is the calendar year loss ratio or a solvency ratio.

“Additionally, because the ICE note limit applies to all losses recognized during the coverage period, including the adverse development of losses from prior accident years, there is a reduction in reserve risk under rating agency and economic capital models. As with high severity loss risk, the degree of realized ICE note capital benefit from reserve risk reduction will vary based on underlying exposures. Our team is working with potential issuers to model these benefits to assist with rating analyst and regulator communications.”

The returns available to investors backing the ICE notes are variable and dependent on a range of risk-related factors, Bryan Joseph told us.

“It depends on the amount of limit purchased and the trigger and level selected. The Notes are competitive and, in a number of cases cheaper than some forms of subordinated debt that companies purchase,” he said.

Griffiths said that demand for limit backing ICE notes could be significant, and “We have seen a huge range of interest to date, ranging from $30m of limit, up to $1bn.”

Joseph noted that company size will have a bearing on limits required, “Smaller companies are more interested in $50m limits and these are really private transactions. Larger entities are looking at $200m and greater limits, which can be absorbed by the capital markets.”

The whole-account ILS backed protection that these Insurance Capital Enhancement (ICE) notes can provide is neatly connected to company performance, ensuring that coverage is across a ceding insurer or reinsurers book and also can be structured to provide ongoing coverage as well.

The ICE notes have a principal write-off trigger, based on a loss ratio or a solvency ratio, so encompassing all insurance losses that feed into a ceding companies calendar year result, importantly also factoring in the development of prior accident year losses.

That’s truly useful protection that can buffer a company against adverse development, as well as fresh losses.

In the current situation, where insurance and reinsurance firms face a still unknowable level of loss impact due to the pandemic, the certainty this whole-account protection would provide is likely to prove extremely attractive.

For the issuers or cedents, who are likely to see the ICE notes as an efficient form of both capital and risk transfer, notes can be renewed on a rolling basis and as a result the benefits of tail development cover beyond the initial five-year issuance period can also be included, extending the usefulness of the product.

The Insurance Capital Enhancement (ICE) notes can provide a welcome addition and diversification to reinsurance and retrocession, but also act as an integrated part of the ceding entities capital stack, dovetailing neatly to provide true balance-sheet protection, across the underwriting portfolio, while also providing buffers against solvency related stresses as well.

As a result, this is a whole of company protection, not just whole account and its usefulness could, for some companies, be the capital lever they need to be able to reduce uncertainty and allow them to focus on moving forwards, safe in the knowledge their portfolio and tail risks are covered, gaining greater certainty over their capital and risks at the same time.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.