Hurricane Agatha is verging on reaching major Category 3 storm status as it nears the Mexican coastline with 110 mph sustained winds, but the central pressure remains far higher than would be needed to trigger the Government of Mexico’s World Bank issued catastrophe bond.

Hurricane Agatha formed over the weekend and rapidly intensified as it moved over warm waters close to the Mexico.

Hurricane Agatha formed over the weekend and rapidly intensified as it moved over warm waters close to the Mexico.

While intensification may continue up to landfall, so Agatha may attain major hurricane status before it reaches the coast, wind shear is hindering its strengthening somewhat and so it is not expected that the central pressure will deepen considerably now before landfall occurs.

With 110 mph sustained winds and gusts of more than 130 mph, hurricane Agatha is a severe threat to the region it makes landfall in, which is expected to be in the state of Oaxaca, Mexico later this afternoon or evening local time.

The NHC says that “little change in strength is expected today before Agatha reaches the coast of Oaxaca. Rapid weakening is expected after landfall, and Agatha is forecast to dissipate over southeastern Mexico by late Tuesday.”

However, once Agatha’s remnants emerge into the Gulf of Mexico, there is a low probability chance of it regaining some strength and perhaps becoming a tropical storm again, before making a second landfall. So this may be something to watch over the next day or so.

The Pacific coast of Mexico, where hurricane Agatha will strike, is covered under the Mexican governments World Bank issued catastrophe bond.

Mexico sponsored the $485 million IBRD / FONDEN 2020 transaction in March 2020 and the fourth Class D tranche of notes provides parametric disaster insurance protection against Pacific hurricanes to the country.

The Class D tranche is $125 million in size and at issue the notes had a modelled expected loss of 4.06%.

The parametric trigger is based on landfall location and minimum central pressure of a hurricane that approaches Mexico, with a line drawn along the coast with different grades of exposure, corresponding to the need for a deeper, or lower, minimum central pressure at the time a hurricane crosses the parametric box (or line) structure.

At this stage, it looks like the World Bank issued catastrophe bond for Mexico will not be affected by hurricane Agatha.

We’ve seen documentation that suggests for the Class D cat bond notes to face even the lowest 25% loss of principle, it would require hurricane Agatha’s central pressure to drop to 935mb or lower.

With the central pressure currently reported as 964 mb, in the latest update from the National Hurricane Center, it seems very unlikely the pressure could plummet almost 30 mb to breach the parametric trigger for Mexico’s catastrophe bond.

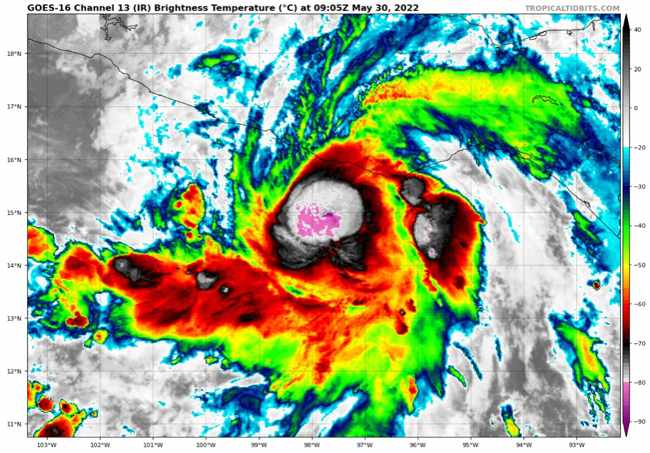

Hurricane Agatha’s latest position can be seen below:

While it appears Mexico’s catastrophe bond will be safe from hurricane Agatha, there can always be a little uncertainty, especially if Agatha does intensify further in the hours running up to landfall.

Once again, a storm chaser is on the ground and attempting to get into the eye of Agatha as the storm makes landfall and we all remember what happened with previous storms.

It is Josh Morgerman of iCyclone, an experienced hurricane chaser and reporter, who is back on the ground in the approach of hurricane Agatha, so again there is likely to be some on the ground data to add to NOAA’s final tropical storm report, from which the data is confirmed for the trigger of the Mexico cat bond.

But if Agatha doesn’t intensify any more, as the NHC expects, then it’s unlikely to matter as the pressure won’t be near enough to the cat bond trigger input required to default the notes, so a calculation process is unlikely to be called on.

We’ll update you should anything change in this regards and you can read all about the Mexican government’s $485 million IBRD / FONDEN 2020 transaction in our catastrophe bond Deal Directory.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.