Fee income earned rose in 2021 for Hiscox ILS, the insurance-linked securities (ILS) and collateralised reinsurance underwriting unit of specialist underwriter Hiscox Group.

Fee income earned from management of third-party reinsurance capital in the insurance-linked securities funds operated by Hiscox ILS had dipped a little in 2020.

That was likely due to capital under management having been a little lower, while fees may have declined on capital that was trapped at any stage of the last few heavy catastrophe loss years.

But the fee income from ILS management has rebounded at Hiscox in 2021, which will have been assisted by new inflows of ILS capital from third-party investors.

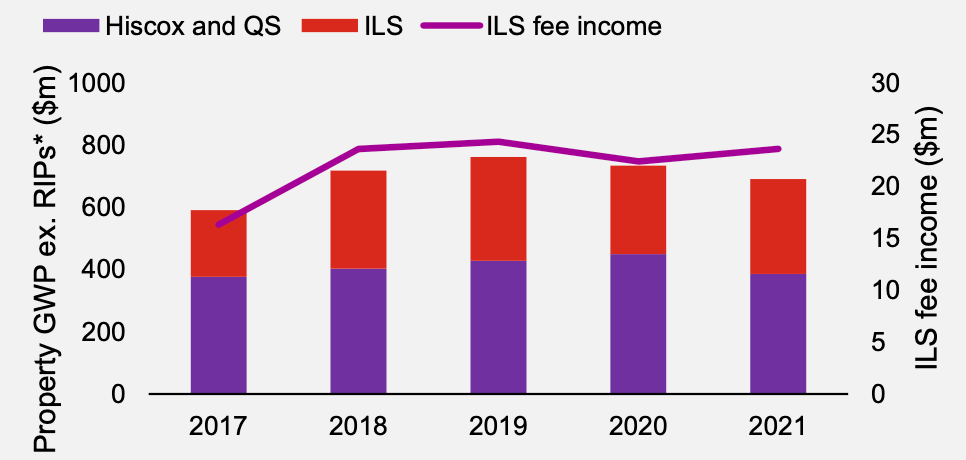

The company shared a chart in its investor and analyst call this week, showing that ILS fee income had increased to approximately $25 million for the full-year 2021.

The chart above also shows that increased ILS capital under management in 2021 has helped to offset a slight decline in property GWP on Hiscox’s balance-sheet and in quota shares.

This likely reflects the carrier working out the right mix of capital sources and how best to manage property catastrophe exposures, using its diversified capital sources.

Hiscox ILS now has an eight year track-record for managing ILS assets and at the recent reinsurance renewals the company had some new fund-raising success, bringing in an additional $217 million in new assets in time for the January renewal season.

That meant Hiscox ILS began 2022 with an increased $1.6 billion in ILS assets under management, which bodes well for increasing the fee income from ILS for the full-year again in 2022.

Watch our recent video interview with Vincent Prabis, Managing Principal, Hiscox ILS.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.