Reinsurance cedants are increasingly concerned by the heavy use of retrocession and the gross to net strategy of some reinsurers, a survey from rating agency Moody’s suggests.

The gross to net strategy of some traditional reinsurers also came into question in the survey results, as there was some concern over the reliance on retrocession, especially at this time when retro capacity has been dented and is less available.

Moody’s explained, “Over the past five years, some reinsurers have significantly increased their use of retrocession, which is primarily supported by alternative capital. This has boosted their gross capacity, and provided them with a stream of fee income from operating sidecars and ILS management platforms. However, it has also made them increasingly reliant on supply and demand dynamics in the alternative capital market. This is a growing source of operational and execution risk, particularly as alternative capital capacity remains tight, and price increases for retrocession outpace reinsurance price increases.”

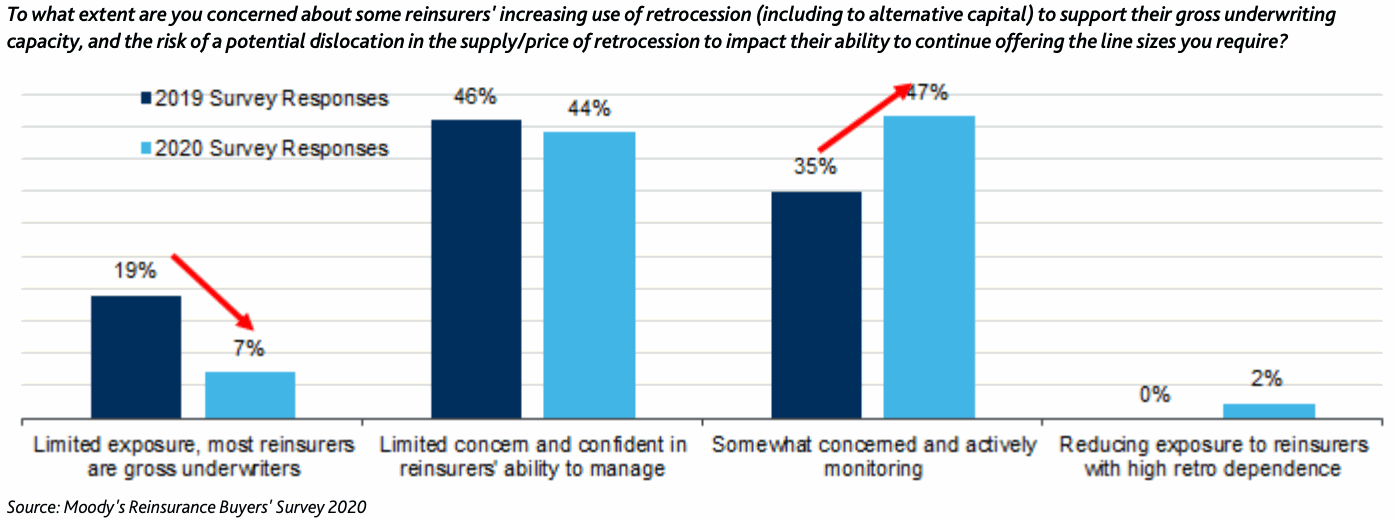

Some 47% of cedants responding to the survey (up from 35% last year) are concerned about the retro situation, and are actively monitoring their reinsurers’ use of retrocession.

Interestingly, 2% of cedants (up from zero last year) actually said they had reduced their exposure to one or more reinsurance carriers which they felt had an elevated dependence on retrocession.

It’s not clear though how well the survey distinguished between straight procured retrocessional reinsurance arrangements and other managed structures containing third-party capital (such as sidecars or funds), which of course is also central to the gross to net strategy of some major players.

It’s likely cedants would shy away the most from those reinsurance carriers with little control over their retrocession, as it is a straight purchase.

Rather than those for which third-party capital management in owned and managed vehicles has become a core provider of retro capital, much more on their own terms.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.