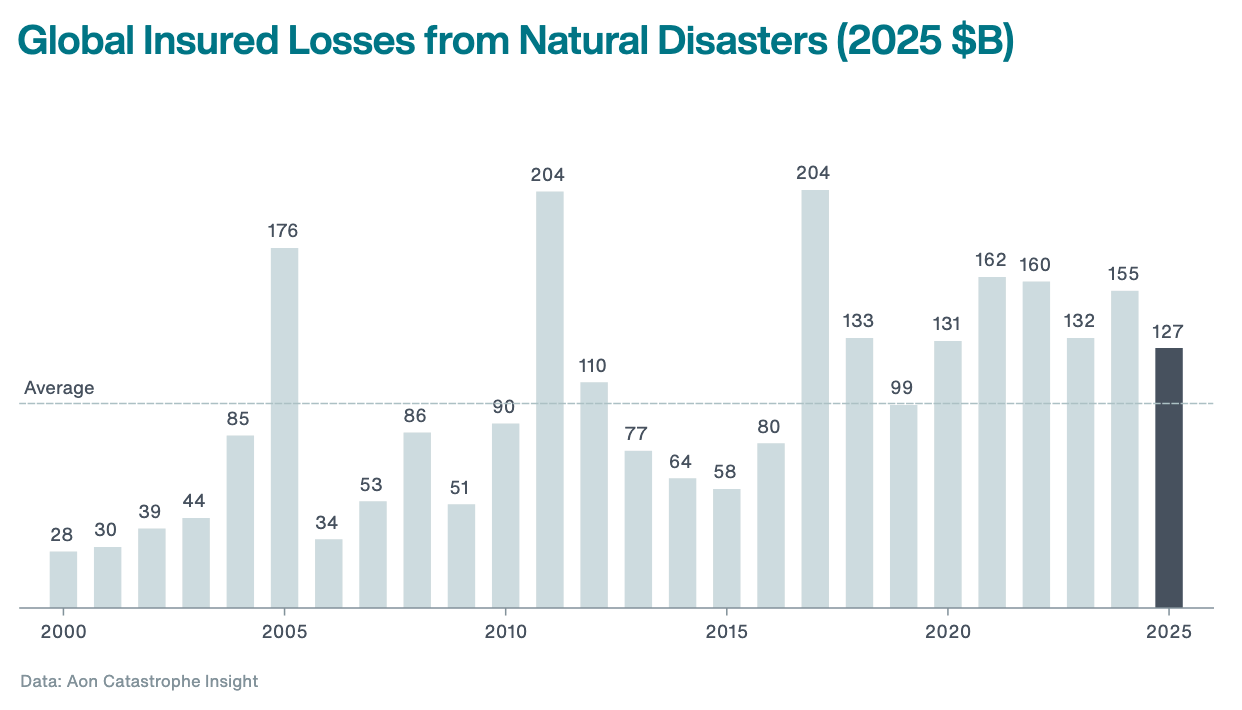

According to insurance and reinsurance broking group Aon, global insured losses from natural disaster events in 2025 reached $127 billion, marking the sixth consecutive year that insurance payouts have exceeded the $100 billion threshold.

The firm also reported that global economic losses from natural disasters reached $260 billion in 2025, marking the lowest level recorded since 2015.

According to the broker, this contrast reflects the continued influence of concentrated, high-severity frequency peril events, particularly in the United States, which are driving substantial insured losses even in years with comparatively moderate overall hazard activity.

Aon also highlights that, in many regions, particularly emerging markets, more than half of economic losses remained uninsured, leaving millions of communities and businesses exposed to financial risk.

Global insured catastrophe losses at $127 billion for 2025 were again well over the average, but over-time the contributors to the burden insurance and reinsurance capital providers pay have been changing.

In its latest Climate and Catastrophe Insight report, Aon also revealed that severe convective storms (SCS) have surpassed tropical cyclones to become the costliest insured peril of the 21st century, largely as a result of repeated, damaging outbreaks across the US.

In 2025 alone, Aon estimates that SCS generated $61 billion in insured losses globally, making it the third-highest annual total on record for this peril.

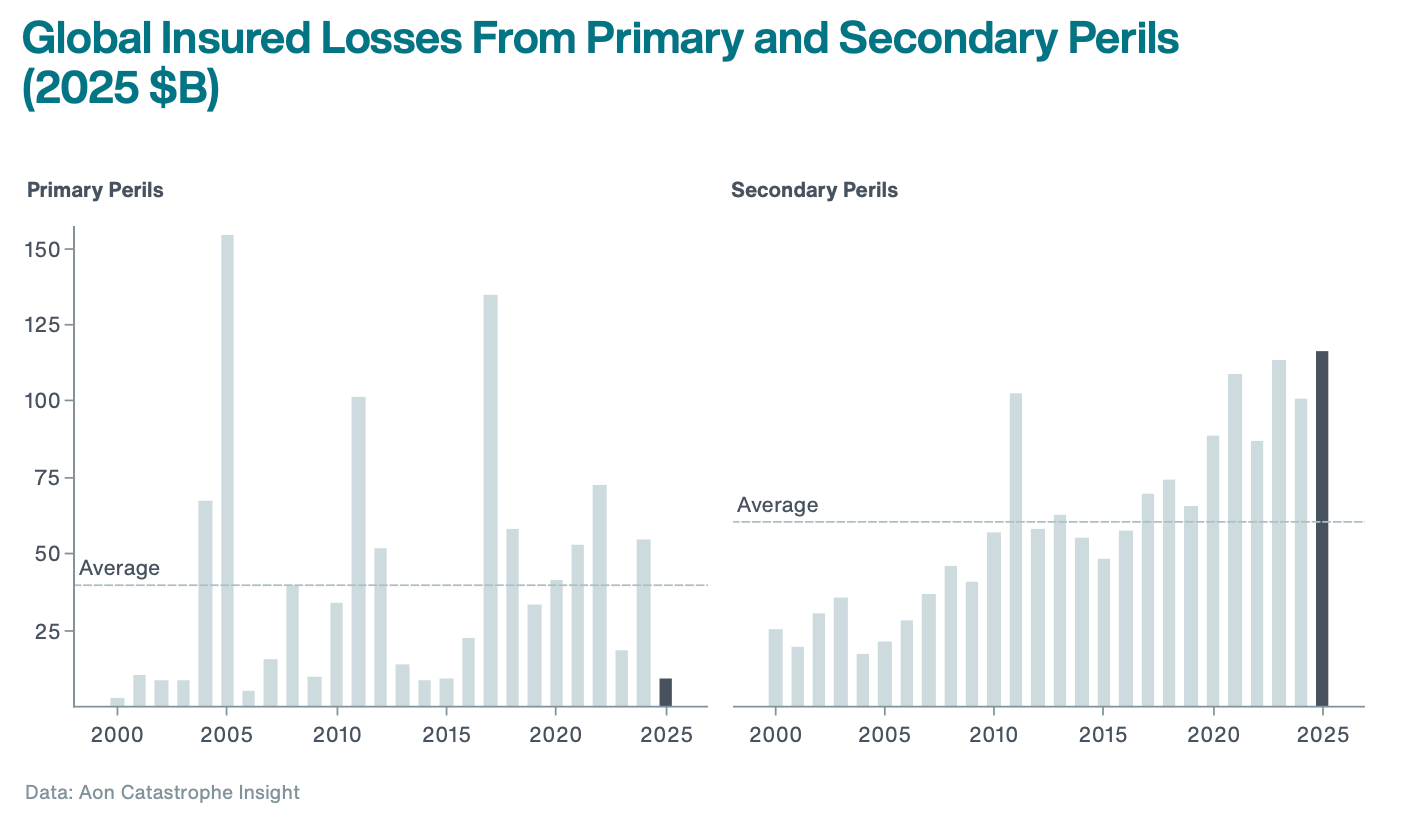

Aon said that so-called secondary perils extended their lead over primary perils in 2025, in large part thanks to the severe convective storm contribution.

The broker’s analysis shows that on a cumulative basis since 2000, secondary perils have generated industry insured losses of at least $1.56 trillion, while perils such as tropical cyclones, earthquakes, and European windstorms that are typically considered to be primary or peak, generated roughly $1.04 trillion.

The chart below shows the steady rise in insured losses from secondary perils, versus the lumpier and sometimes outsized contribution from the more peak catastrophe peril events.

Aon’s report also showed that insurers covered close to half of all global economic losses during 2025, reducing the protection gap to 51%, the lowest level on record, a result the broker attributes to the concentration of high-value events in the US.

During 2025, approximately 49 events resulted in economic losses of at least a billion dollars, whereas 30 events produced insured losses of a comparable magnitude, significantly exceeding the historical average.

Aon identifies the January Palisades and Eaton wildfires in California as the costliest events of 2025, resulting in total economic losses amounting to $58 billion and insured losses reaching $41 billion, making them the most expensive wildfires ever recorded globally.

In addition, total fatalities worldwide reached 42,000, which according to Aon was primarily driven by earthquakes and extreme heat, a figure 45% below the 21st-century average.

The broker also outlined that the Myanmar earthquake was the deadliest single disaster aside from heat-related events in 2025, with the event resulting in 5,456 deaths.

Regionally, it was the United States that bore the brunt of global insured losses, at $103 billion, representing 81% of the grand total.

Across the wider Americas, Aon identified Hurricane Melissa as the most damaging event in 2025, with the storm producing $11 billion in economic losses and $2.5 billion in insured losses across Jamaica, Cuba and neighbouring areas.

Across South America, prolonged drought conditions, especially in Brazil, led to roughly $5 billion in agricultural losses, while flooding also impacted Mexico, Ecuador and Bolivia.

Meanwhile, across Europe, the Middle East and Africa (EMEA), economic losses were well below long-term averages, with severe convective storms being the primary contributor, in addition to the effects of drought, heat, and wildfires in southern Europe.

Then, in the Asia-Pacific region, Aon particularly highlighted the Myanmar earthquake, which caused $15.7 billion in economic losses, while significant flooding impacted China and cyclone losses were recorded across South and Southeast Asia.

Australia also experienced two major events that each resulted in insured losses exceeding $1 billion.

Aon’s report also points how alternative risk transfer is increasingly critical for providing the capital needed to help businesses mitigate risk and strengthen resilience supporting recovery and resilience.

The broker explained that parametric insurance solutions proved particularly effective during key events last year such as Hurricane Melissa.

And lastly, Aon advocates for increased investment in resilience by enhancing technology and infrastructure.

The broker’s report emphasises the importance of improved forecasting, more robust building standards, and updated infrastructure to mitigate long-term damage and expedite recovery for both communities and businesses.

Greg Case, president and CEO of Aon, commented: “This year’s report highlights the growing need for collaboration among organizations, insurers, governments and communities. The insurance industry is well-positioned to act as a strategic partner to help navigate these challenges, bringing record levels of capital to help clients respond to weather risks and build increasingly diverse alternative risk transfer solutions to strengthen resilience in the face of a changing climate.”

Michal Lorinc, head of Aon’s catastrophe insight and author of the report, said: “Resilience today must be both physical and financial. Organizations are urged to embed adaptation into their workforce and location strategies, invest in predictive analytics and encourage cross-functional approaches to weather risk. As climate events continue to affect people and property, the opportunity lies in using data to strengthen preparedness, rethink risk management strategies and build partnerships that support faster recovery and long-term resilience.”

Aon’s estimate for $127 billion of insured natural disaster losses for 2025 stands in contrast to previous estimates from prominent reinsurers. Munich Re estimated losses to be approximately $108 billion, while Swiss Re pegged the losses at about $107 billion.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.