Rating agency AM Best has chimed in on the issues facing the Florida property insurance market and chief among them is the fact many are going to struggle to maintain their surpluses, leading some to downsize, shed business and move away from the coast.

All of which have been factors that are reducing demand for reinsurance slightly from the private property insurance market at these June 1st renewals.

As we’ve explained, Florida’s property catastrophe reinsurance renewals have seen rates come in below expectations, while some have deemed the outcome unspectacular.

A reduction in demand, alongside excess capacity are said to be key drivers of this, with the reduced demand coming from Floridian primary insurers that have shed business, or reduced their TIV’s in order to continue achieving the necessary surplus levels they require.

Another analyst team said that these factors, of reduced demand and excess capital, mean that many insurers are dodging a bullet, as their reinsurance renewal pricing could have been more punitive than it has turned out to be.

But the underlying issues persist and AM Best believes the Florida market needs further work to keep insurers on a sustainable track.

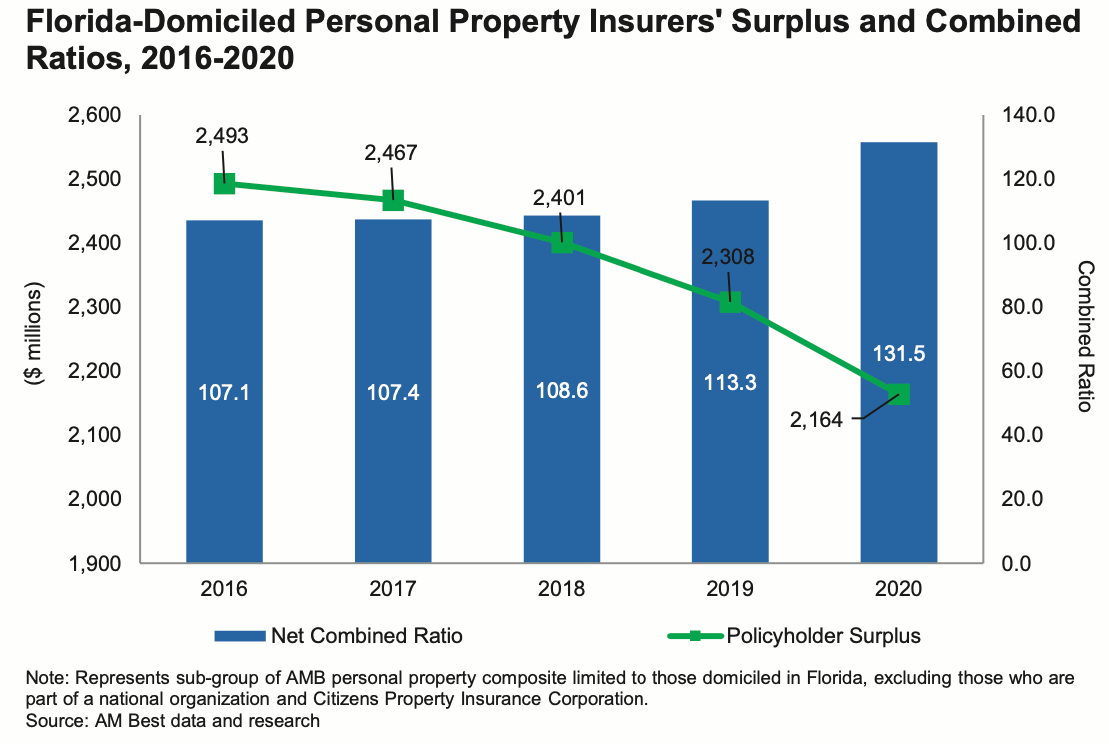

AM Best’s composite of Florida property insurance companies fall to a five-year performance and surplus low in 2020, the rating agency explained.

“Since year-end 2016, mounting pressures have led to a decline in surplus of 13.2%, or $329 million, with aggregate losses reported each year. The decline has occurred despite $987 million of capital contributions the composite has received, which has only served to offset persistent losses.”

“Given persisting and significant market hurdles, companies will find sustaining current surplus levels a challenge,” AM Best said.

Even though no major hurricanes made landfall in 2019-2020, Florida property insurance writers still reported a combined ratio of 131.5% in 2020, an 18.2 percentage-point deterioration from 2019.

Social inflationary pressures drove increased volatility in 2019 and 2020 than was seen in 2017 and 2018, two years when major hurricanes did make landfall in Florida.

The main drivers are an increased severity of claims and litigation costs, more-frequent severe convective storm losses and an increase in roof replacements, AM Best said.

While material rate increases have been requested, these are still not keeping pace and so underwriting profits have declined further.

Across the last five years, these pressures have driven a roughly 9.7% decrease in surplus and the market has begun shedding business again, with Florida Citizens reporting a 29.3% increase in personal residential policies from 2019 through Q1 2021, AM Best says.

On top of this, harder reinsurance pricing, with compounding year-on-year rate increases at the renewals are adding additional pressure.

All of this together means that “pressure has started reaching past operating performance and eroding balance sheet strength,” AM Best warns.

Sources close to the Florida property insurance market have been telling us for months that there are some carriers in the state that should by now be struggling to maintain a rating, given their surplus levels.

Many management teams are proactively adjusting their exposure levels now, to try and hold onto sufficient surplus to get them through this year.

But it does seem that, in some cases, they are now just hoping for a benign catastrophe year to help them struggle through, as any sort of major impacts could be severely detrimental for their ability to carry on doing business.

Of course, the eventual upshot of all of this should be a firmer for longer Florida property catastrophe reinsurance marketplace, with demand rising over time as Citizens buys more protection to offload risk.

We’d also expect to see the larger, more expansive but Florida headquartered insurers with the better track records growing faster, given their added diversification allows them to reduce the concentration risk associated with the state somewhat.

At the same time, the resurgence of the depopulation opportunity is also possible, as Citizens looks to return some policies back to the private market.

As with the last depopulation wave, we’d expect alternative reinsurance capital and some ILS players to participate, given the best home for some of these risks is with institutional capital with a lower-cost attached to it.

But for the policies covering poorer quality housing in coastal wind exposed areas, finding a new home may be challenging now and rates for insurance could get to levels that are deemed entirely unaffordable.

Suggesting Florida’s property insurance market challenges are not going away and that even access to efficient reinsurance capital isn’t going to save all of the companies in the sector.

There’s a reason some major US national insurance carriers left Florida, or significantly downsized their writings there years ago.

Those decisions still seem prudent.

Even though Florida can prove very profitable if you’re really effective and proactive when it comes to managing claims, at least when the wind doesn’t blow for a while.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.