The package of reforms to Florida’s property insurance market contained in the Bill being debated during this week’s Special Session has now passed its final real hurdle in the Legislature, having been approved in the House of Representatives. It’s a meaningful step in the right direction, but no panacea for all of Florida’s future insurance challenges.

This week’s Special Session of the Legislature in Florida has seemingly done its job, in swiftly approving the wide-ranging bill of reform measures, that has the potential to have a relatively significant impact on the property insurance situation in the state.

This week’s Special Session of the Legislature in Florida has seemingly done its job, in swiftly approving the wide-ranging bill of reform measures, that has the potential to have a relatively significant impact on the property insurance situation in the state.

However, the Bill has not been passed without opposition and many feel the power has now shifted away from consumers in the state, which led to broad opposition in the House from the Democrat side.

The bill is extensive, covering issues related to Florida’s property insurance market, the issues that have been causing litigation and fuelling fraud, as well as provisions for improving the reinsurance situation in the state with a further $1 billion taxpayer-backed layer below the FHCF.

The partisan concerns are largely related to the elimination of one-way attorney fees and abolishing of assignment of benefits (AOB), seen as now making it far harder for consumers to sue their insurers and take them to task.

But, with fraud and litigation such an issue in Florida, something had to be done and these were two of the most important measures for the global reinsurance industry.

“This Special Session was all about relief,” Speaker of the House Paul Renner (R-Palm Coast) explained. “I am proud of the work the House did striking a difficult but careful balance to stabilize Florida’s property insurance market and the growth of Citizens Insurance. We have created more competition in the marketplace and have taken significant measures to reduce frivolous lawsuits, all while holding insurers accountable to consumers.”

“I am proud of the reforms we enacted during this special session,” said Representative Tom Leek (R- Ormond Beach). “The carefully considered provisions in this legislation will expand capacity in the property insurance market, increase accessibility for consumers, and hold insurers accountable.”

“We have a tremendous amount of consumer protections in the property insurance legislation,” added Representative Bob Rommel (R- Naples). “I appreciate Speaker Renner for supporting bringing forward a robust legislative package which is a great start toward stabilizing Florida’s property insurance market.”

For a contrasting view, Representative Yvonne Hinson (D- Gainesville) said, “This legislation puts homeowners on the hook for everything. They will make hiring an attorney so cumbersome and costly that most homeowners will not be able to afford it.”

Democrats said they couldn’t support providing additional taxpayer backed reinsurance, the $1 billion layer called the Florida Optional Reinsurance Assistance Program (FORA), that will provide reinsurance support for layers beneath the FHCF, while not doing anything to at least freeze rates for consumers.

But, ultimately, for Florida to be able to reduce insurance rates for homeowners it does need to get its property insurance market in order and stem the tide of fraud and litigation surrounding claims.

That is the only way to rebuild reinsurance and capital markets confidence in the state’s property insurance industry and these reforms are a big step in a positive direction, although concerns about loss of power for consumers are certainly valid and the state may need to address those going forwards.

Florida Citizens’ CEO Barry Gilway is positive that the passage of the Bill will make a real difference, “These reforms will reduce litigation and stabilize the Florida property insurance market by encouraging new capital and giving reinsurers confidence to provide the coverage necessary for a healthy market. A stable market will benefit consumers by reducing the pressures that are driving up premiums.

“For Citizens, the bill provides the tools for us to return to our residual role over time while ensuring policyholders have financially sound options in the private market. This is historic legislation.”

It’s not a panacea for all of the challenges Florida’s property insurance market faces going forwards though.

Other issues matter, including risk-commensurate pricing. Something that Florida’s insurers will need to consider and get firmly on top of going forwards.

As, even with the passage of this legislative reform, which is likely to be signed by Governor Ron DeSantis this week, the reinsurance market still wants to be certain it is covering its loss costs, cost-of-capital, expenses and a margin when operating in Florida.

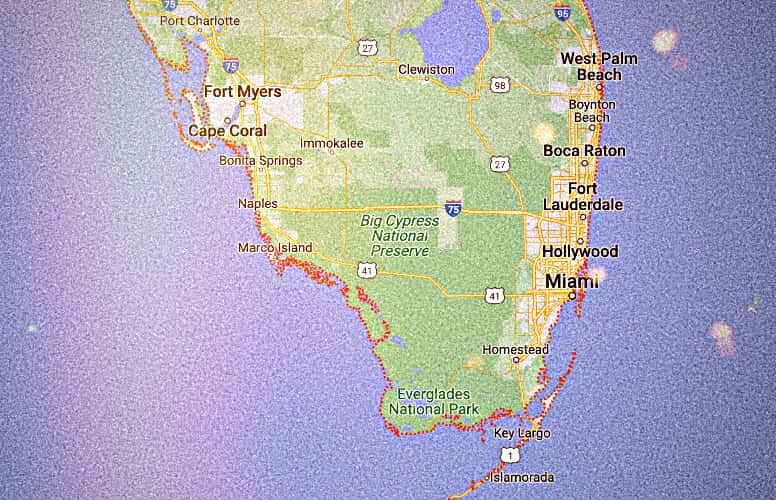

That means property insurance needs pricing commensurately with the risk and with climate change a significant concern for the industry at this time, plus burgeoning coastal insured values and as-ever ongoing concerns over the quality of some of the housing stock in storm exposed areas, Florida’s coast is always going to be an expensive place to buy insurance and to be reinsured.

At least, if the litigation and fraudulent claims issue can at least begin to be resolved by these new measures, the market might have a chance to adopt a sensible pricing framework that doesn’t penalise every Floridian for the dysfunctional state of its property insurance marketplace, and rebuild reinsurance market support at the same time.

Florida’s insurance carriers should not feel this legislation gets them off the hook either, as going forwards we believe reinsurance capital is going to be far more selective in how it partners with carriers and prices risk transfer for them.

It will take some time for reinsurance capital to regain the levels of confidence needed in Florida’s market for meaningful efficiencies to flow, we believe. So it would be foolish to rely on conditions being much easier at the next June renewals, even with these reforms in place.

In addition, while litigation and fraud has been a significant driver of Florida’s property insurance issues, insurers will need to be able to demonstrate their own financial means.

Thinly capitalised by choice may not be a tenable strategy any more, while business plans run on the back of cheap reinsurance in a super-soft market may no longer receive the support they have in the past (super-soft rates may never reoccur anyway).

Read all of our news and analysis on the Florida insurance and reinsurance market.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.