Reinsurance companies are set for their fourth technically unprofitable year of underwriting in a row according to rating agency Fitch, who forecast that combined ratios across the sector will rise to 103.5% due to the impact of Covid-19 losses.

This has implications for insurance-linked securities (ILS) investors and ILS funds, not just in the fact more collateralised reinsurance arrangements may attach on the rising loss ratios of reinsurers, but also as the share of losses taken by those backing quota share arrangements or reinsurance sidecars are also set to increase.

In a recent piece of analysis, Fitch Ratings explained that the impact of the coronavirus outbreak will be evident in reinsurance firms 2020 results.

Fitch has a negative outlook on the reinsurance sector currently and highlights that the more thinly capitalised reinsurers are most at-risk, as “continued severe market disruptions due to coronavirus” will weigh on their performance and results.

While the underlying reinsurance sector underwriting results are expected to improve, thanks to the recent and ongoing increase in rates and pricing, Fitch warns that these will be offset by a reduction in reserve releases, as well as higher loss ratios due to the pandemic.

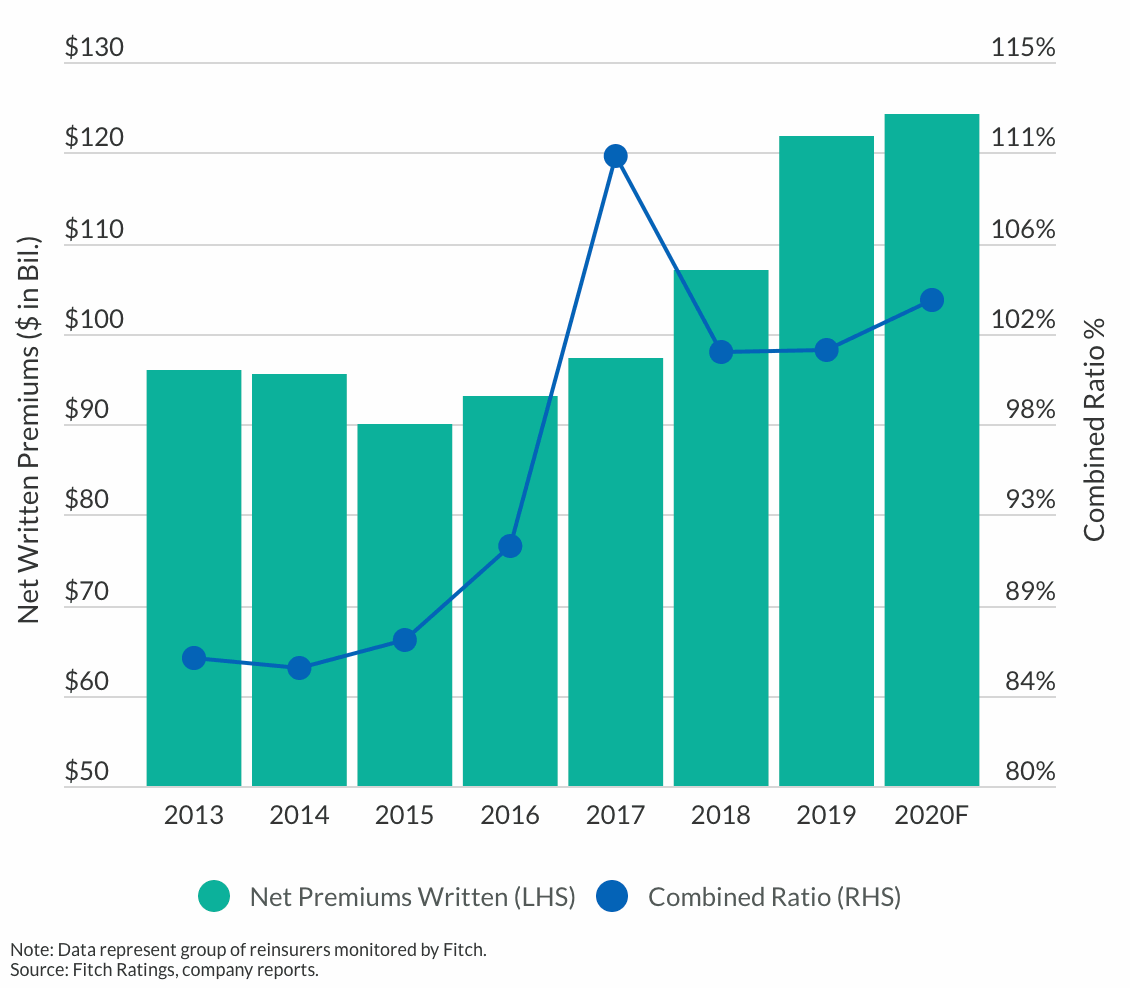

“Fitch forecasts a 2020 reinsurance combined ratio of 103.5%, up from 101.1% in 2019 with non-life reinsurers expected to suffer a fourth consecutive year of underwriting losses,” the rating agency said (shown below).

Weaker underwriting and investment results will hit reinsurance company performance through 2020 and possibly beyond, as at this time we do not know how long the tail associated with the Covid-19 pandemic loss activity will be.

While pricing of reinsurance renewal contracts are expected to improve again at June and July 1st, Fitch warns that this may not be sufficient to account for other factors embedded in the risks.

“It may not be enough to affect pricing on a risk-adjusted basis, given offsets such as global warming that have been increasing risk,” Fitch explains.

The rating agency also warned that, “The pandemic also calls into question the level of rate increases that insurers and reinsurers will be able to push through given the economic slowdown. Even robust rate rises may be insufficient for reinsurers struggling to shore up their bottom line as coronavirus claims start to accelerate.”

Reinsurance firms may find themselves in an interesting capital position as the year proceeds though and there is every chance that those with significant catastrophe exposure look to hedge some of that risk out of their portfolios.

That could provide opportunities to the ILS fund marketplace, with some of our sources suggesting there could be increased demand for instruments such as industry loss warranties (ILW’s) as the 2020 hurricane season approaches.

Fitch said that it considers pandemic related losses as one-offs for the reinsurance industry and not systemic to the industry over the longer-term.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.