The Demex Group, a climate risk focused insurtech that aims to deliver climate-resilience through financial risk solutions on a global scale, has launched a new initiative through which it aims to democratise access to climate data that is useful for risk transfer, insurance or reinsurance transactions.

The Demex Group launched last year, securing $4.2 million of seed funding from leading financial services, fintech and insurtech focused venture investment groups, Anthemis and IA Capital.

The company already has a relationship with specialist insurance-linked securities (ILS) investment manager Nephila Capital to supply specific weather risk capacity to underpin products it creates, while global reinsurance firm Munich Re is also aligned as a risk capacity provider and also provides operational support.

The Demex Climate Resilience Center was launched recently by the company, offering a free public platform through which users can analyse climate trends and variability in over 60,000 global cities.

The Climate Center provides a stunning amount of information in an easy to use interface and Demex sees this as a democratisation of the access to climate risk related data, which it hopes will stimulate risk transfer, insurance and reinsurance arrangements.

Demex explained:

The Center provides an at-a-glance, easy-to-understand representation of localized climate trends as well as year-to-year weather variability. Global coverage spans multiple weather variables including summer-heat, winter-chill, rainfall, and snowfall. The Center includes over 650,000 unique climate assessments.

Even though the globe may be getting warmer on average over time, year-to-year and day-to-day weather are very different and entirely localized. A winter may be extremely cold one year, and quite warm the next. Many locations are actually observing cooler summertime temperatures and increasing snowfall in winter. The Demex Climate Center easily summarizes recent weather conditions in context with the full historical record on a city-by-city basis.

The Climate Center leverages statistical methods from both climate and finance. Rather than simply computing the trend in regional weather, Demex compares the strength of recent changes to strength of changes over a longer history. Moving averages over shorter periods of time are compared to the average of the full underlying record. Oscillations (recent highs and lows) are also considered to determine how many seasons weather was above versus below average.

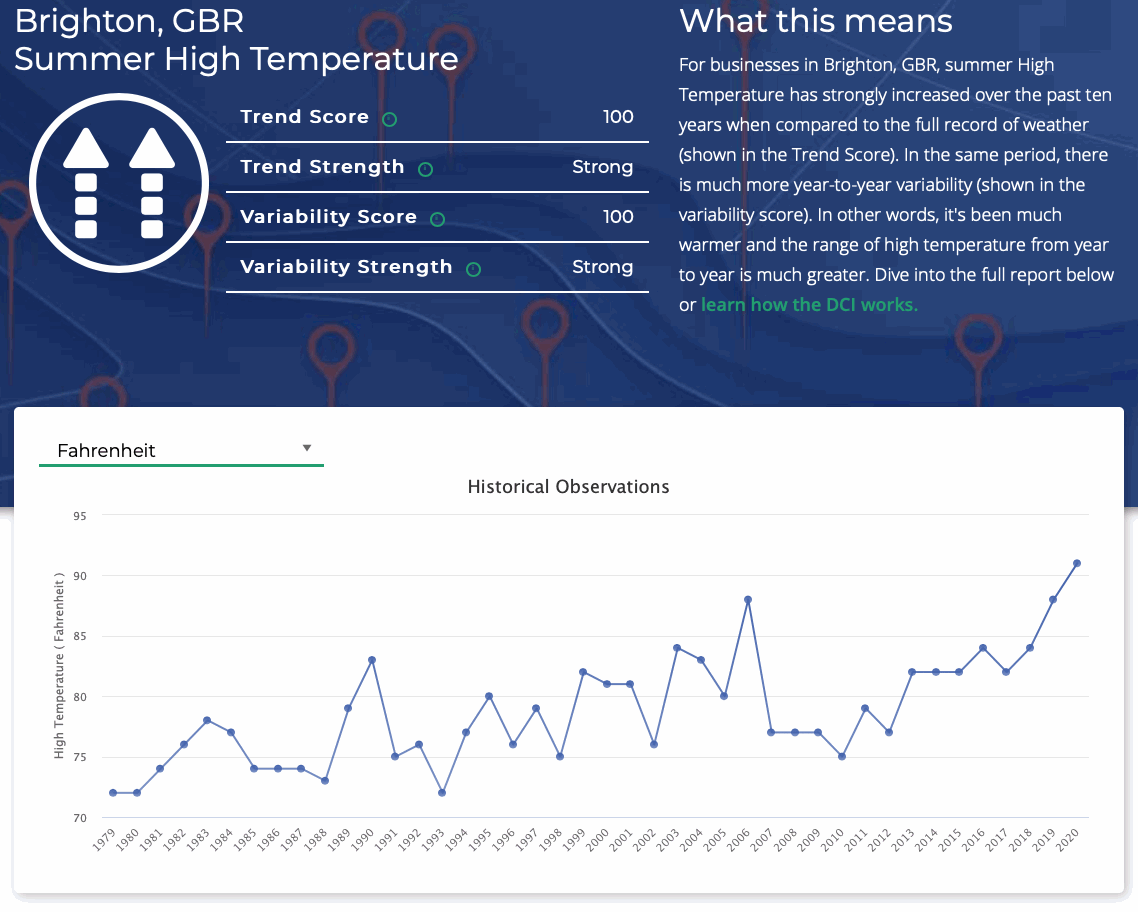

The Trend Score presents a year-over-year direction of changes in climate patterns compared with historical data. A higher or lower score means an increasing or decreasing weather variable, such as rainfall. The Variability Score presents year-over-year climate fluctuations compared with historical data. A higher or lower score means a higher or lower level of year-to-year changes in the weather. Scores are then simplified into an at-a-glance and easy-to-understand icon.

You can see climate data related to thousands of locations around the world. A quick search shows that home base for us at Artemis and Reinsurance News is experiencing steadily rising summer temperatures.

We spoke with Demex Chief Product Officer Stephen Bennett who explained the Climate Center in more detail.

“Rather than simply computing the trend in regional weather, we’re comparing the strength of recent changes to strength of changes over a longer history. Moving averages over shorter periods of time are compared to the average of the full underlying record. Oscillations (recent highs and lows) are also considered to determine how many seasons weather was above versus below average.

“The Demex Climate Indicator quantifies both trend and variability. Take Toronto for example, the indicator shows winter snowfall has strongly decreased in recent years but there is more year-to-year variability (i.e. boom and bust cycles but less snow overall). Toronto’s highest and lowest snowfall winters have both occurred since 2000. Canadian airport parking operator, Park’N Fly is particularly sensitive to snowfall and highly volatile snow removal expenses year-to-year at the seven airports they operate parking facilities for. Their snow removal costs can be more than twice as high during heavy-snow winters versus years with very low snowfall. Park’N Fly’s caps its variability on plowing and salting using a parametric cover,” Bennett explained.

Carlo Marrello, Chief Executive Officer, Park’N Fly stated, “Park’N Fly mitigates its risk associated with the variability and unpredictability of snow removal costs. This solution has positively impacted snow removal expenses while delivering fixed costs for budgets and better fiscal management.”

Bennett then added, “Demex Climate Center assessments in the Northeastern United States show many areas where increasing snowfall trends are coupled decreasing year-to-year variability. In other words, it’s getting snowier year-after-year. Risk sellers and risk buyers can freely account for the trend and variability during pricing analyses.”

Ed Byrns, Founder and CEO of Demex also told us, “We developed the Climate Center for all participants in the risk transfer transaction. We’re democratizing the ability to assess risk for events such as flooding rain, severe heat, and massive snowstorms. We are leveling the playing field between risk holders, risk intermediaries, and risk carriers.”

Thanks to the power of internet technology, data and the technology Demex uses, serious climate and weather related data is now available to everyone.

For the insurance and reinsurance market this data could be a valuable underwriting input, informing companies before they make decisions on new risks.

For the insurance-linked securities (ILS) market, this kind of climate data could also be an underwriting input, but could also lead to new types of climate related hedges, that may sit well in the capital markets and with the type of investors looking to allocate to ILS.

Risk transfer buyers, such as local governments, municipalities, investors holding portfolios of climate exposed assets (to name just a few), would also find this data valuable in their decision making, potentially even in constructing climate related risk transfer solutions to better protect themselves.

There really is a wealth of valuable climate data in Demex’s solution and it’s well worth some of your time to explore it.

As technology continues to advance at pace, the ability to access sophisticated data solutions on weather and climate related risks should enable new ways of hedging and far greater use of parametric triggered risk transfer solutions to protect against these risks.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.