Losses and IBNR reserves related to the COVID-19 coronavirus pandemic reported by major insurance and reinsurance companies have risen significantly during the first-quarter of 2021, with the total pandemic loss reported now nearing $38 billion, having risen by 21% during reporting for the final-quarter results of 2020.

Global reinsurance firms have been among those reporting significant increases in recent weeks, suggesting some attritional impacts have likely been seen through their quota shares, sidecars and other whole-account retro reinsurance arrangements.

Some new reserving and side-pocketing has been seen in the insurance-linked securities (ILS) fund market as a result of the increasing industry burden from COVID-19, although generally this has been relatively minor, with much of the ILS market’s pandemic loss booked months ago.

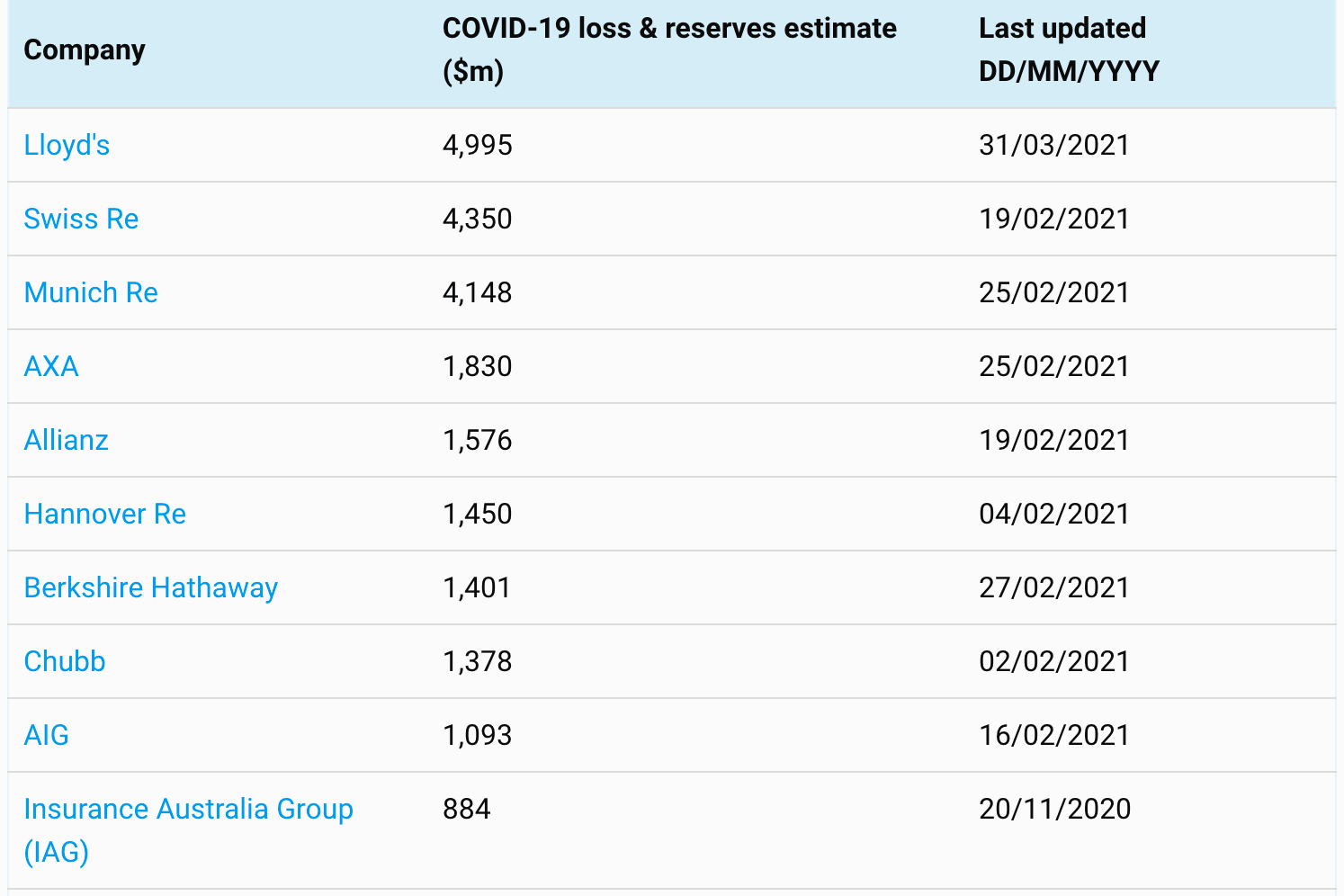

The Q4 and full-year 2020 earnings season has added around $6.3 billion to the total of disclosed COVID-19 re/insurance industry losses listed over on our sister site Reinsurance News, where you can analyse the pandemic loss data by company.

That’s a roughly 21% increase over the fourth-quarter reporting, with an upward trend widely seen, albeit some companies reduced their ultimates in their end of year reports.

There are still some numbers to come, but the COVID-19 loss data after the latest reporting period, collected by advisory PeriStrat LLC, is now finalised.

Zurich-based PeriStrat LLC, operated by Hans-Joachim Guenther, aggregates publicly available loss reports from insurance and reinsurance companies to give a picture of how the Covid-19 industry loss impact is developing. We’ve been augmenting that as well, alongside our reporting on re/insurer results and feeding that back to Guenther, giving us a picture of Covid-19 loss and reserve development for the property and casualty re/insurance market.

PeriStrat has been forecasting that the total could settle somewhere up to the US $50 billion mark, a prediction it still stands by.

However, PeriStrat’s Guenther warns that there remains some uncertainty over potential event cancellation losses through this year.

The Tokyo Olympics remain very uncertain and while Japan still plans to hold the event, a resurgence of COVID-19 in certain cities, including Osaka and Tokyo, could derail this if the country fails to get this wave of the pandemic under control rapidly.

In addition, third-party liability and D&O claims have not yet been widely notified and this could extend the tail of the pandemic losses, Guenther believes.

Business interruption cases continue in the United States, adding some further uncertainty, although still the majority continue to find in favour of the insurers so far.

So-called long COVID is another factor that needs considering, in how this could add to health insurance related claims over the coming years and drive the ultimate pandemic insurance and reinsurance market loss higher.

Uncertainty also remains over how COVID losses could cascade down through catastrophe reinsurance programs, particularly in Europe it seems.

“Event aggregation language and extension clauses will provide wake-up calls regarding how the ongoing loss event will filter through into reinsurance,” Guenther warned.

Analyse the pandemic industry loss data by company over on our sister site Reinsurance News.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.