The rapid growth of mortgage insurance-linked securities (ILS) issuance witnessed over the past five years is expected to slow as a result of uncertainty caused by the Covid-19 coronavirus pandemic, according to analysts at Credit Suisse.

Since the introduction of the first deal in 2015, the $298.89 million Bellemeade Re Ltd. (Series 2015-1) transaction from United Guaranty (AIG), mortgage ILS (often termed insurance-linked notes ILN) transactions have grown in both number and size, increasingly contributing to record levels of quarterly and annual ILS issuance.

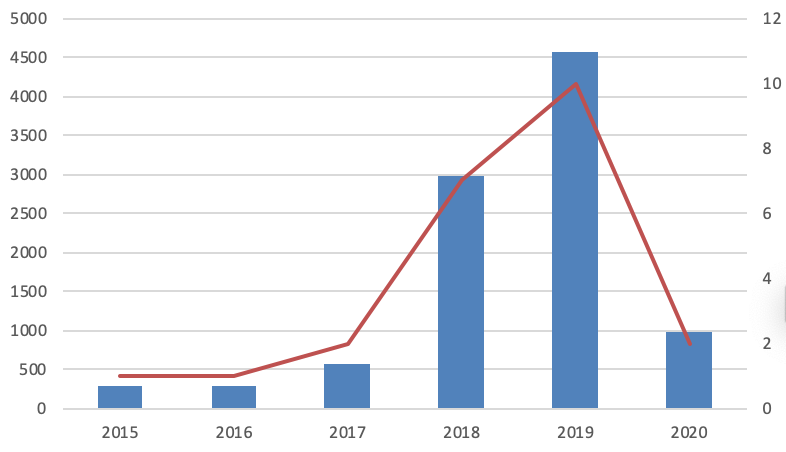

The Artemis Deal Directory shows that in both 2015 and 2016, just one deal came to market, but the following year saw mortgage insurer (MI) National Mortgage Insurance Corporation (NMIC) enter the space as well, pushing issuance towards the $600 million mark.

Then, in 2018, mortgage ILS issuance expanded vastly and a combined seven transactions from MIs United Guaranty, NMIC, Essent Guaranty, Radian Guaranty, and MGIC Investment Corporation, brought a huge $2.98 billion of mortgage insurance risks to market. In 2019 issuance reached even greater heights, with 10 transactions from repeat MIs as well as the first from Genworth Mortgage Insurance, taking annual mortgage ILS issuance to more than $4.5 billion.

So far in 2020, two mortgage ILS deals have been issued, a $496 million Radnor Re 2020-1 deal from Essent Guaranty and a $488.4 million Eagle Re 2020-1 transaction from Radian Guaranty, taking Q1 2020 mortgage issuance close to the $1 billion mark.

Clearly, and as shown by the above chart, growth in this market has been significant over the past few years and had shown little sign of slowing. However, this could all be about to change as a result of the widespread and damaging impacts of the ongoing coronavirus pandemic, which is driving significant financial market turmoil and uncertainty.

In a recent note exploring the U.S. mortgage insurance sector in light of the Covid-19 outbreak, analysts at Credit Suisse describe the increased leverage of XOL reinsurance via the capital markets as “one of the biggest changes for the MI industry since the last downturn”.

Analysts continue to explain that the diversification achieved and distribution of risk ultimately puts the sector in a stronger position to manage expected increases of losses over the coming months, with a rise in defaults anticipated.

According to Credit Suisse, both Essent Guaranty and NMIC had approximately 85% of their Q4 2019 risk-in-force (RIF) covered with ILN transactions, while Radian Guaranty had 54% and MGIC 35%.

These figures, warn analysts, will deteriorate over the coming quarters as it’s viewed as unlikely that mortgage insurers will issue new transactions until there is greater certainty around the direction of the economy and pricing for mortgage ILS notes.

As we’ve discussed previously, the uncertainty and turmoil being driven by the pandemic is also expected to slow catastrophe bond issuance too for some time, with fresh capital for new deals potentially being more limited owing to some redemption requests and a sell-off in cat bonds.

Just yesterday, global French reinsurer SCOR announced that it had suspended the marketing of its latest catastrophe bond, Atlas Capital Reinsurance 2020 DAC (Series 2020-1), over market disruption caused by the coronavirus outbreak.

While this is only expected to be a delay, with SCOR intending to restart processes in the coming weeks, it shows one way in which the Covid-19 outbreak has the potential to disrupt the ILS market.

Notable is the fact that almost $4 billion of quarterly issuance covered catastrophe risk, with mortgage risks still playing a role but less so when compared with more recent quarters.

It’s worth noting that while catastrophe bond and ILS issuance has been strong so far, Artemis’ data shows that an above-average level of new risk capital is needed in Q2 to outweigh approximately $5.5 billion of maturities.

So, with potential for both mortgage ILS and catastrophe bond issuance to slow in the coming months, it could be a challenge for the outstanding market to achieve outright growth in the second-quarter.

View details on all mortgage ILN issuance here.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.