The average return of insurance-linked securities (ILS), catastrophe bond and reinsurance linked investment funds fell to a negative -0.65% in March 2020, as the significant selling pressure experienced in the secondary cat bond market drove returns down for the month.

March’s -0.65% average ILS fund return is the second worst performance for the month on record, according to the Eurekahedge ILS Advisers Index.

March’s -0.65% average ILS fund return is the second worst performance for the month on record, according to the Eurekahedge ILS Advisers Index.

The sell-off of catastrophe bonds in the secondary market was a direct reaction to the Covid-19 pandemic and the volatility it caused across the majority of financial markets and asset classes.

With insurance-linked securities (ILS) and reinsurance linked assets proving largely uncorrelated, catastrophe bonds as the instruments with the greatest liquidity available were sold off by many more generalist investors, as well as some ILS funds.

The weight of selling pressured secondary prices, resulting in the monthly decline for the ILS Advisers Index.

ILS Advisers Founder Stefan Kräuchi explained to us, “Performance in March was mainly driven by the fund’s allocation to liquid instruments. Liquid instruments which are marked to market suffered selling pressure as global risk assets collapsed. The valuation of private contracts however was not adjusted as there was no insured loss.”

Here, Kräuchi refers to the fact private ILS contracts were not exposed to the selling pressure related pricing movements.

But in fact, some private ILS, or collateralised reinsurance, positions have been marked down by a handful of ILS fund managers in March, as a response to Covid-19 and the potential for certain specific reinsurance positions to take losses due to the pandemic.

The market presented opportunities to the more generalist investors requiring cash at the time of a global crisis, as well as those appreciating a defensive asset class at this time.

Kräuchi explained, “Overall, ILS provided the much needed decorrelation that investors are seeking.”

“The second half of the month saw heavy secondary selling of cat bonds, mainly by multi-strategy funds in need of liquidity. Those funds turned to cat bond markets as liquidity dried up and prices were severely marked down in other fixed-income segments. This selling pressure had some impact on cat bond prices, yet markets remained orderly with de- cent liquidity,” he added.

As well as presenting opportunity to the dedicated ILS funds, that specialise in the asset class, “We are seeing ILS managers take opportunity of the lower pricing in secondary markets to add exposure at very interesting levels,” Kräuchi said.

Given the weight of the selling pressure, it’s no surprise that the cat bond market performed poorly on a relative basis during the month.

However, as these are just mark-to-market declines in cat bond pricing, they are expected to be returned over the coming months.

On top of the fact cat bond fund managers picked up many bonds at below-par pricing during the sell-off, this makes the current time a very appealing entry point for investors to the catastrophe bond market, we believe.

Commenting further on March ILS fund performance, Kräuchi said, “Private ILS significantly outperformed cat bonds. Pure cat bond funds as a group lost -1.39% while the subgroup of funds whose strategies include private ILS lost just -0.10%.

“The worst fund lost 2.48% in March, whereas the best fund in the index was up 1.52%. None of the pure cat bond fund was positive for the month.”

Overall 23 out of the 33 constituent funds in the ILS Advisers Index were negative in March 2020, while the gap between best and worst performer came to 4%.

It will be interesting to see how the pricing in the catastrophe bond market reacts in April, as the selling pressure evaporated earlier during the month. Cat bond pricing had declined by some -2.36% across the market, according to Swiss Re’s index.

However, the bounce back in cat bond secondary marks may take another month or so to be fully seen, but this could buoy the Index for a while, if catastrophes remain absent.

April though may see some private ILS and collateralised reinsurance pressure though, as ILS fund managers mark their books for any potential Covid-19 claims exposure they hold.

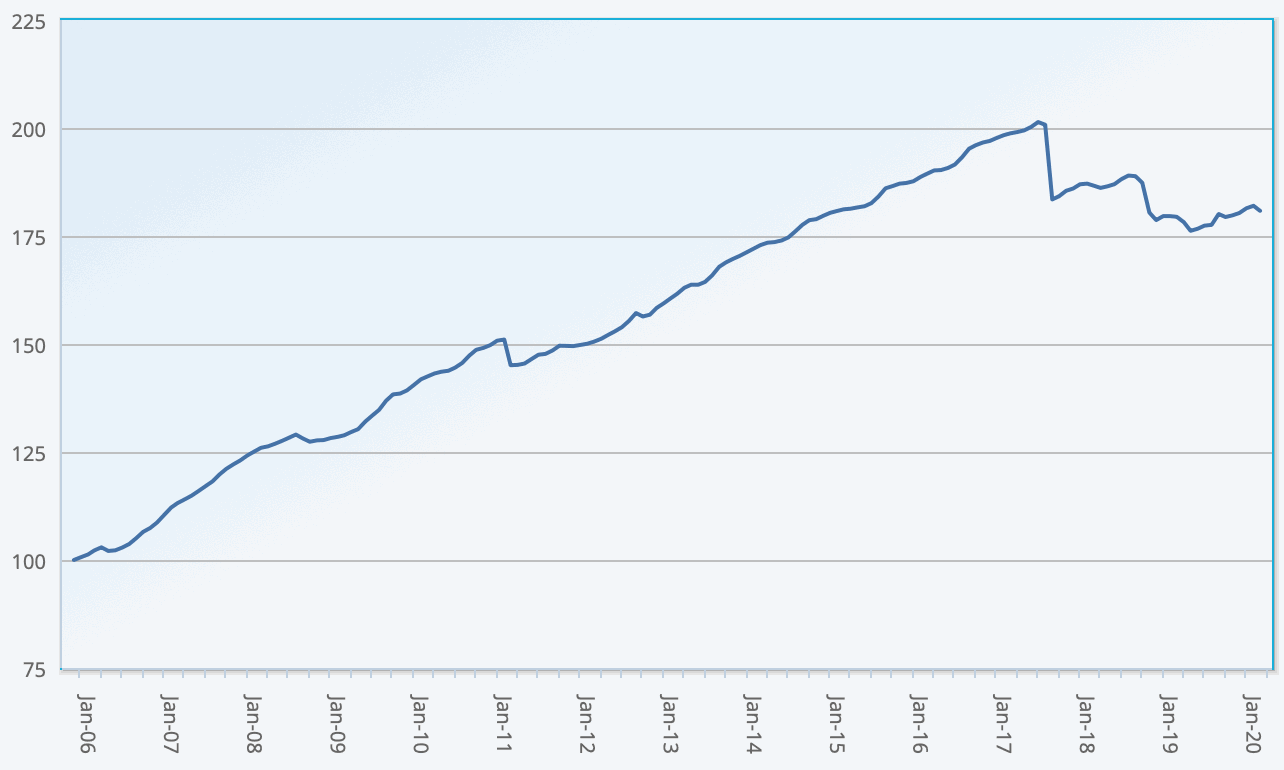

You can track the Eurekahedge ILS Advisers Index here on Artemis, including the USD hedged version of the index. It comprises an equally weighted index of 33 constituent insurance-linked investment funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond investment space.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.