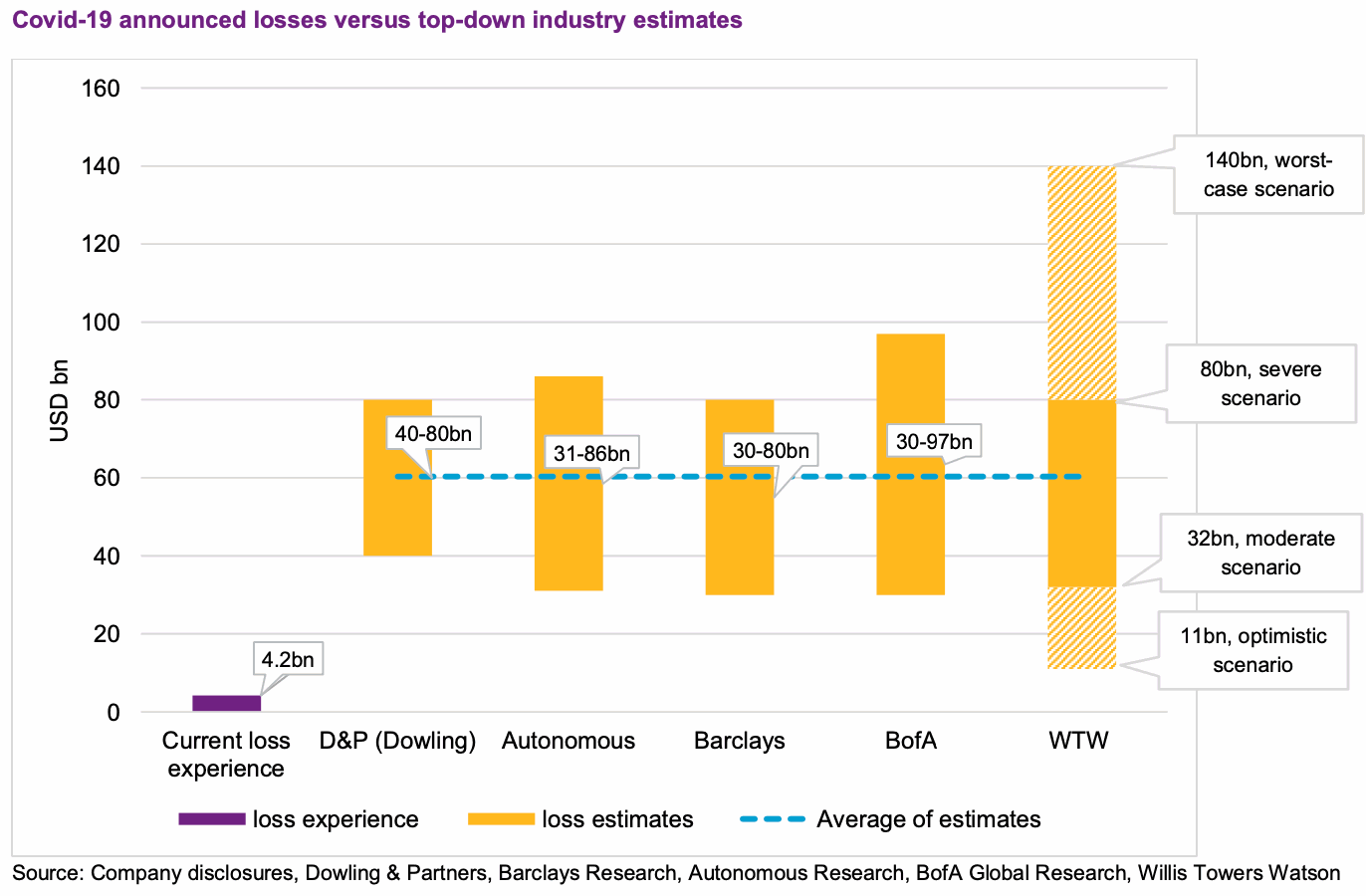

There is an early consensus emerging on the size of the insurance and reinsurance industry loss from the Covid-19 coronavirus pandemic, with the broad range now focused on being $30 billion to as much as $100 billion, according to broker Willis Re.

It’s a fairly safe bet that the ultimate industry loss falls somewhere into this range of course and these broad estimates are still filled with uncertainty, as it is very challenging for anyone to accurately forecast the eventual impact to insurance and reinsurance markets.

But Willis Re has tried to collate some of these estimates, saying that it sees a consensus emerging from market sources, despite the complexity of the loss from the pandemic.

This new range is based on a handful of analyst reports it seems and the reinsurance broker says, “We stress that it is very early, and this is reflected in the wide ranges analysts are putting forward.”

The rough consensus range is pegged as between $30 billion to as much as $100 billion, which Willis Re notes is broadly consistent with parent company Willis Towers Watson’s range from its ‘moderate’ scenario for a Covid-19 pandemic industry loss of $32 billion, up to the ‘severe’ at $80 billion.

The estimate consensus includes losses from the following lines of business categories, Willis Re says: Contingency coverage for Event Cancellation; Trade Credit, Surety, and Political Risk; Contingent Business Interruption; Directors & Officers; Employers Liability; General Liability; and Workers Compensation.

As we explained yesterday, the United States Treasury said it is opposed to legislative moves that could force retroactive business interruption claims related to the Covid-19 pandemic onto the insurance and reinsurance industry, which could reduce the expectations of contingent business interruption claims somewhat.

But at the same time, large property insurance towers are beginning to see some claims notifications against them and these could end up in the courts, which may drive further losses through BI channels and exposure.

So far, Willis Re has calculated that just $4.2 billion of Covid-19 pandemic claims have been reported by companies, which will largely have been in their first-quarter results. But with the pandemic effects only really kicking in in the second-quarter it seems likely that this figure will rise significantly over the course of this quarter and beyond.

The chart above shows the analyst estimates, including the $40 billion to $80 billion estimate made by analysts at Dowling & Partners, but not the $30 billion to $60 billion estimate from UBS.

These estimated figures remain “fingers in the air” at this time, with clarity and accuracy perhaps a long way off at this stage.

The only area of consensus truly being seen, is that many industry luminaries have said they expect that the Covid-19 pandemic will result in the largest insurance and reinsurance market loss in history.

But how high the eventual cost runs, once the full length of the pandemic tail-risk associated with Covid-19 has manifested itself, remains hugely uncertain and incredibly difficult to predict, other than to say it will be extremely costly.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.