Commercial property insurance price rises continued to accelerate higher in all regions around the globe during the third-quarter of 2020, with catastrophe exposed property seeing some of the largest rate increases, according to Marsh.

The insurance broker once again highlights the continued and accelerating hardening of property insurance rates, which is likely to turn into a driver that helps to sustain the hardening in property catastrophe reinsurance markets as well.

Marsh’s latest quarterly commercial insurance market report shows that property rates globally rose by some 21% in Q3 of 2020.

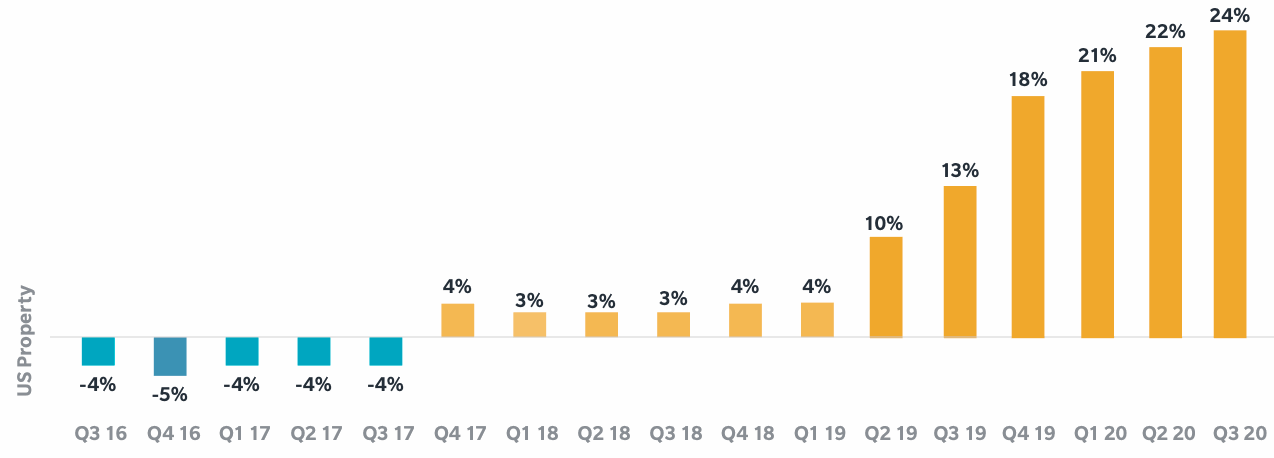

The increase for United States commercial property insurance was even higher, at 24% and with some 85% of Marsh clients experiencing increases at renewals, the broker said.

The rate increases are seen as so steep in the U.S. that some insurance clients are adjusting their programs to offset or to limit the effect of pricing increases.

This is also being seen in reinsurance, where negotiations see cedants looking for ideas on how to maintain as much cover as they can while mitigating the additional costs of higher renewal rates.

At the same time, insurers are also trying to limit unexpected impacts, seeking out higher deductibles and adjusting policy terms and conditions, as well as trying to reduce or eliminate non-physical damage coverage as well.

In the U.S., it is larger accounts that are seeing some of the highest price increases, probably because these bigger commercial clients have likely made the most frequent claims in recent years.

Which has a positive read-through for the U.S. property reinsurance market, as Marsh says that commercial insurance clients whose programs total more than US$1 million in premium saw higher price rises, with an 35% average increase.

For the UK commercial insurance market, property rates were up around 20% on average in Q3 2020.

Similar dynamics were seen in the UK market, with larger clients experiencing price increases of 25% to 30%, while insureds looked to limit the cost impact through coverage restructuring.

COVID-19 related exclusions continue to be a concern for UK insurers, Marsh’s report reveals, a trend that is likely to persist and accelerate as lockdowns continue in the country.

Latin America and the Caribbean saw property insurance pricing rise by 15%, with increases above 25% seen as common during the quarter, particularly in Brazil and Chile. In the latter, losses from rioting has driven price increases higher, Marsh noted.

In Continental Europe, commercial property pricing rose by 21%, the eighth consecutive quarter of increases. Catastrophe exposed programmes were a particular areas of increase, Marsh said.

In the Pacific region, loss activity has driven property rates some 31% higher in the quarter, the twelfth consecutive quarter of year-over-year double-digit increases.

Finally, in Asia, property rates were up 18%, with catastrophe exposed business in the region seeing double-digit increases and requiring international carrier support, Marsh said.

The continued acceleration and sustained increases in commercial property insurance rates and pricing promise to help sustain price rises for reinsurance and also for ILS strategies that look to access risk from the primary market.

ILS funds already access some primary U.S. property insurance, including commercial lines, more directly through their partnerships with MGA’s and other underwriting agencies. As rates increase globally, this strategy will become more tenable on a global basis, potentially opening up opportunities for some enterprising ILS players.

With rates accelerating further, this strategy is likely to continue presenting attractive margins where the volatility in the portfolios can be controlled and managed through reinsurance, or while major catastrophe losses are less prevalent.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.