The potential impact from climate change on natural catastrophe P&C insurance and reinsurance claims is the biggest fear of investors in the sector polled by equity analysts at Bank of America.

At their recent conference, the Bank of America (BofA) equity analyst team asked where investors thought climate change related risks would emanate for the P&C re/insurance sector.

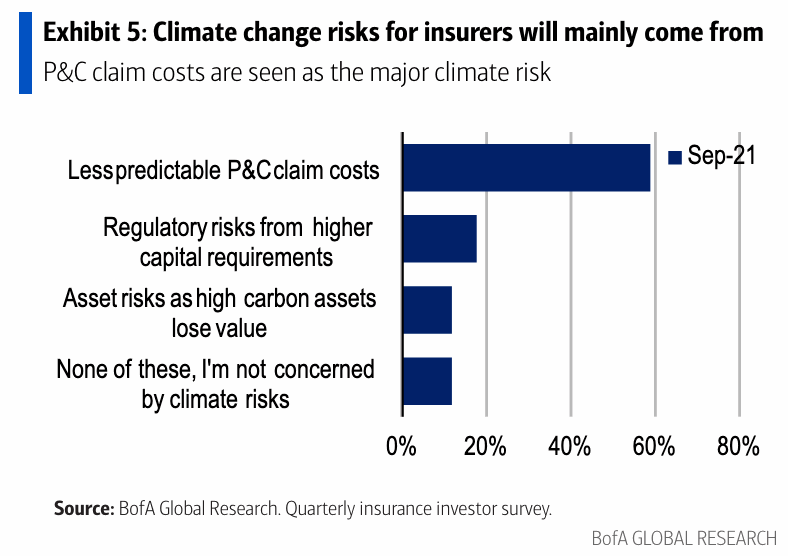

Almost 60% cited climate change and how it could make catastrophe claims less predictable as their biggest fear for the space, which mirrors the concerns of many institutional investors in insurance-linked securities (ILS) that we speak with.

As climate change becomes an increasing priority for the investor base that backs the global P&C insurance and reinsurance industry, while recent loss years have seen a heavy burden from perils that are either climate-linked, or thought to be influenced by climate change, the investor base is increasingly keen to understand how re/insurers are and intend to continue managing this risk.

The potential for claims to become increasingly uncertain and so more surprises to occur clearly has the equity investors backing major insurance and reinsurance companies worried.

With almost 60% saying this is their major fear related to climate change for the P&C sector, it far outweighs the regulatory risk or asset risk in these investors’ eyes.

The BofA analysts noted that, “Several insurers have commented that this is the 5th year of nat cat losses exceeding industry budgets, which has seen climate change becoming an increasing focus for investors.”

If the ability to predict P&C claims costs related to catastrophes and severe weather is becoming harder due to climate change effects on their predictability, it will make setting catastrophe budgets increasingly challenging for the insurance and reinsurance sector.

Whether climate related, or simply variability and cycles, it doesn’t matter. The fact is loss activity has outpaced many re/insurers expectations for a number of years in a row and investors are finding it challenging to believe some will ever get on top of this without more significant rate increases, it seems.

While there are catastrophe models available and re/insurers or ILS funds will take their own views of risk on top of those, if the models are not able to keep up with the changes occurring, or the variability in weather losses, the industry is going to have a tough time calculating its capital and protection needs.

This is an issue that the reinsurance and ILS market are acutely aware of and working hard to get on top of, through rate increases where deemed necessary, adjustments to terms, moving higher up the towers by raising attachments, and through development of new models.

But if climate change brings a level of uncertainty and unpredictability that it is impossible to stay ahead of, it suggests the industry now faces a period where their portfolio analytics need to work harder than ever and their underwriting discipline needs to remains stoic.

The BofA analysts noted that reinsurance firms remain bullish on pricing for 2022, but are also confident on their large loss budgets.

So, for now, the industry seems to believe it can stay on top of predicting a loss load for each year, but it feels like more rate is increasingly important to ensure that the economics still work.

Almost all of the investors polled by the BofA analysts at their conference believe reinsurance pricing will accelerate, rather than taper off, with a broadly even split between an expectation for rate firming across the board and those who expect only loss-affected areas to benefit from continued hardening.

The models that forecast large loss loads and catastrophe budgets are going to have to adapt to get ahead of the unpredictability, or simply be loaded more, or some will find they repeatedly exhaust them as this unpredictability in nat cat claims continues to hurt those that haven’t yet pruned or adapted their books to cope with it.

It’s also important to consider that some underwriters are increasing their focus on writing climate-linked risks, finding the opportunity appealing and the chance to label their portfolios more ESG appropriate an attractive proposition.

These companies really have to keep on top of their budgeting for weather and catastrophe losses, or their thesis could quickly be damaged and investor confidence harmed.

Technology advancement, in the world of modelling and predictive analytics seems the best way for the industry to adapt to the more unpredictable loss environment of recent years and to prepare themselves for a future where that unpredictability may continue.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.