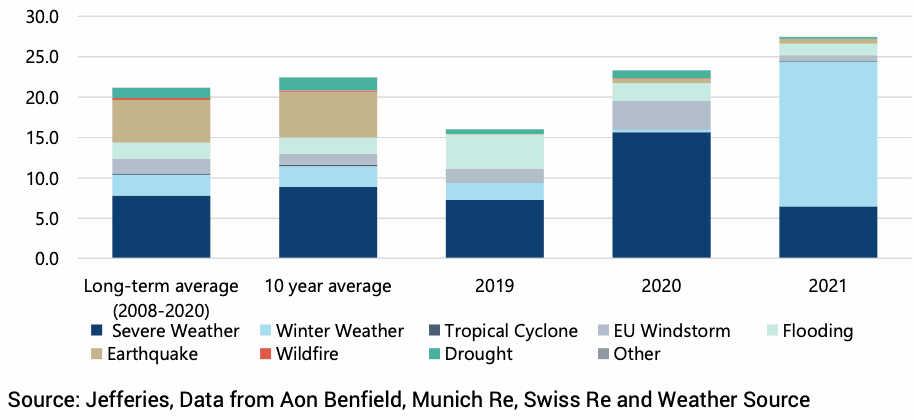

Despite April being a quieter month globally for insurance and reinsurance market losses caused by natural catastrophes and severe weather, analysts at investment bank Jefferies still estimate that claims year-to-date are running approximately 30% above average.

After the first-quarter of the year insurance and reinsurance market losses from natural catastrophes and severe weather were deemed to be running some 33% higher than the 10-year average, by thee analysts.

But the quieter month of April has lowered that to 30% above the 10-year, however severe and convective weather losses in the United States means it’s not a significant reversion towards the norm for the first four months of 2021.

The Jefferies analyst team says that the main drivers of loss for the year remain February’s US polar vortex (winter storm Uri) and US severe weather, as well as European windstorms and winter weather.

The US has taken the brunt, with some $21.4 billion of insurance and reinsurance market losses estimated to have come from the severe winter weather, with the extreme freeze event affecting Texas and the south east US estimated to make up $15.3 billion of this.

In April, Jefferies analysts estimate that European insured winter losses, largely due to cold temperatures and freezing weather, were above average at $1.6 billion, while US insured severe weather losses at $2.7 billion were actually below average.

Other regions of the world were seen to experience relatively benign conditions in April 2021.

For the year-to-date, to end of April, Jefferies analysts estimate the following as the largest sources of insurance and reinsurance market losses:

- US winter weather ($15.3bn)

- US severe weather ($6.1bn)

- Europe winter weather ($2.1bn)

- EU windstorms ($0.7bn)

- Japan earthquake ($0.6bn) – worth noting that the GIAJ said that claims paid are already near US $900 million.

- Australian floods ($0.4bn)

The US winter storms and Texas freeze remains the largest event, and “With $15.3bn incurred in February’s polar vortex alone, this peril has caused more losses than all other perils added together year-to-date,” Jefferies analysts said.

Adding, “Putting 2021 into perspective, winter weather losses this year are already higher than even the most costly full year in our model for this peril. “

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.