2026 begins with a “historically” soft market for the insurance-linked securities (ILS) sector, consultancy Lane Financial LLC said in a new analysis of market pricing and return potential, as catastrophe bond multiples have declined resulting in a forecast for the year ahead of a total return of just 6% after expected losses.

Each year Lane Financial LLC’s Morton Lane and Roger Beckwith take a look at the pricing of issuance in the primary and secondary catastrophe bond markets, to derive a forecast for what investors could expect to see returned in the event of an implied expected level of losses.

For last year, Lane Financial had initially said that the catastrophe bond market had the potential to deliver a total return of around 8.5% in 2025, even after accounting for an expected level of losses to bonds during the year.

By October though, the analysis changed as pricing dynamics indicated a chance of lower losses from the Atlantic hurricane season, so Lane Financial raised its estimate to an expected return for the cat bond market of around 10.5% in 2025.

That October update proved prescient as the hurricane season remained relatively benign to the catastrophe bond market, except for the sole named storm bond loss of the parametric cat bond that paid out to Jamaica following the devastation caused by hurricane Melissa towards the end of that month.

In fact, given the 2025 cat bond fund performance figures already seen by Artemis, a rough range appears likely to be from around the 9% mark to as high as 14% for strategies that are mainly cat bonds but might incorporate some other instruments, meaning Lane Financial’s updated forecast falls comfortably within it.

Lane Financial’s new analysis notes that investors in insurance-linked securities, by which it means catastrophe bonds but this also applies more broadly to the reinsurance-linked asset class, have enjoyed double-digit returns now three years in a row, in 2023, 2024, and 2025.

The reasons for this high performance being the hard reinsurance market that begin post-hurricane Ian, historically low losses from natural disasters and a relatively high US treasury interest rate that boosted the floating-rate component of total returns.

Of course, within that first reason, the hard reinsurance market, the reset in attachments and certain terms has also helped to make cat bond and ILS coverage a little more remote to the type of frequency and smaller insured catastrophe loss events that had impacted the market through year’s prior to the hardening.

The factors in play are different for 2026, Lane Financial explains, citing a now “historically” soft reinsurance market, an expectation that catastrophe losses while unpredictable will revert to their mean at some stage, and the fact US interest rates are seen as likely to decline further.

“In short, the most reliable forecast for 2026 is that at year-end total returns for the ILS market will NOT be in double digit annual percentages,” the consultancy states.

Lane Financial demonstrates just how soft the market has become using catastrophe bond pricing and risk metrics, firstly by looking at quarterly cat bond pricing yields. These quarterly marks are now at their lowest in three years, since the first half of 2022.

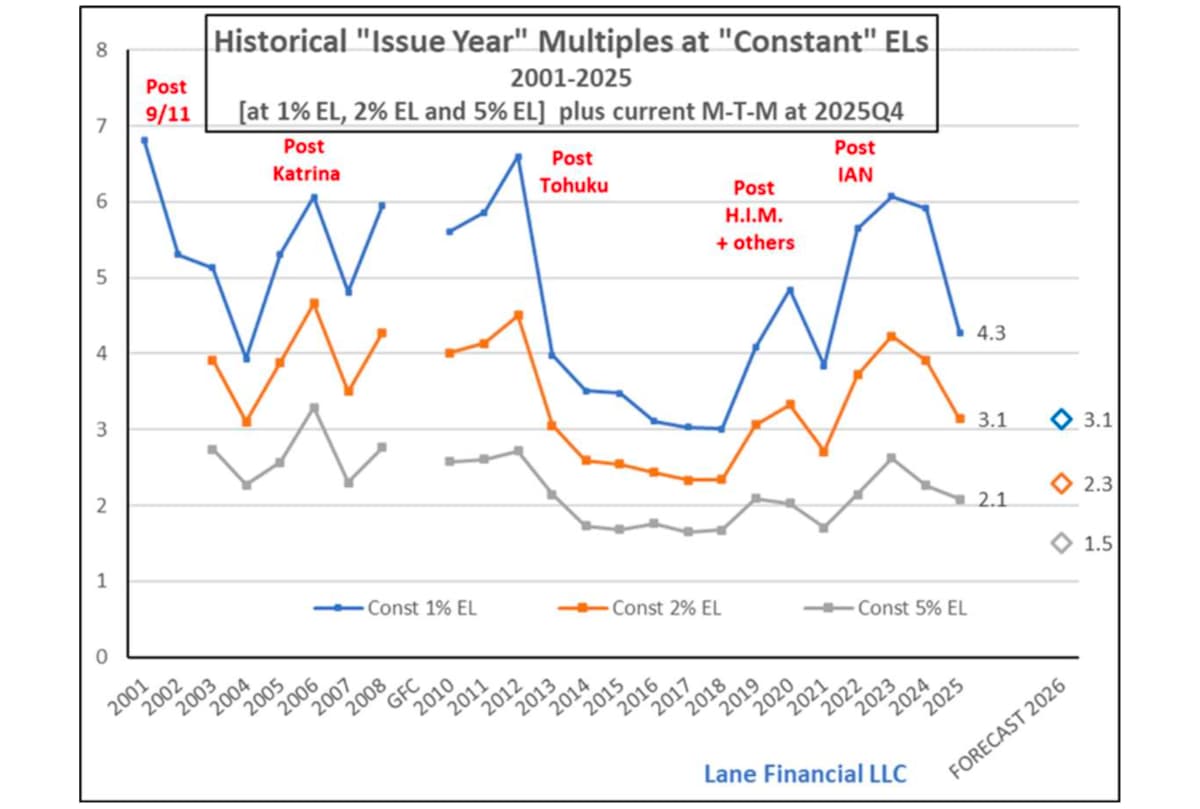

Secondly, Lane Financial shows an updated version of its chart showing issue year multiples at constant expected losses.

While the view based on quarterly marks might imply the market already at or near a bottom and that the soft market may not last too long, the consultancy cautions against being too optimistic at this stage.

“History shows that the soft market post “9/11” lasted for about four years (2002-2005) and the post Tohoku soft market also lasted about four years (2013-2017). In contrast, hard markets tend to be shorter – two to three years.

“There is no particular reason that cycles arise the way they do. Mother nature is in control of frequency and severity, Nevertheless, the historical record is interesting,” Lane Financial states.

You can see this chart of multiples at constant expected losses below, which includes a forecast for where these multiple figures are potentially headed in 2026:

Another data point from Lane Financial is particularly telling about just how the catastrophe bond market has softened, as December 2025 forward-looking multiples for 2026 are “at the lowest or lower than the cone of past experience for the last 25 years.”

Using a soft year-end multiple of 2.13 times the end of 2025 issues expected loss of 2.56%, gives a spread of 5.45% and an expected underwriting margin or return for 2026 of 2.89%, Lane Financial’s analysis suggests.

Add to that the floating-rate return, which is now below 4% and Lane Financial believes could fall further to around 3.125%, and the consultancy comes to an expected total return for the catastrophe bond market of around 6% for 2026.

But, Lane Financial also notes that this is “associated with a larger than usual standard deviation,” by which it is referring to other price dynamics and how they affect the performance of catastrophe bond portfolios and funds.

“The underwriting margin is vulnerable to wide swings,” the consultancy explains. Further stating that the pricing of outstanding bonds could make the difference.

“If in 2026, the market softens even more (beyond historic experience) there may be a premium at the end of 2026 which will push up the assumed underwriting margin. If the market lingers in its current soft market position the underwriting margin will hold. However, if the market hardens for any reason then outstanding prices will fall below par, say to $99 or $98, and the underwriting margin will be eroded or could disappear,” Lane Financial says.

There is also uncertainty around that floating-rate return component as well, so investors in and managers of catastrophe bond investment strategies may need to watch dynamics closely this year.

Finally, Lane Financial note that navigating the soft market is challenging and there are reasons neither reinsurance providers or ILS investors can easily withdraw or hold back. But they also provide some ideas for how to stay engaged while avoiding the soft market risks that can emerge and highlight that soft market’s can also provide well-priced hedging opportunities.

Bringing up the bond market mantra of “there is no such thing as a bad bond, just bad prices,” Lane Financial asks if there is anything ILS funds can do to follow that principle while staying in the game?

Answering its own question by stating, “A few things and we would expect to see them manifest in the next year or so.

“First, funds can stay invested in the soft market, but shortening their risk, by favoring the low EL and earlier maturity deals and avoiding the high ELs. Conversely, they would favor longer, high ELs when markets are hard. This is the analog of bond market traders shortening or lengthening their maturity as they become more bearish or bullish.

“A more dramatic strategy during a soft market would be to hedge the riskier parts of their existing portfolio by becoming a reinsurance buyer or, its equivalent, being an ILS issuer themselves covering their current portfolio’s tail risk. Some hedge funds have done that in the semi-public ILS market in the past, while others have also done it, but privately.

“We would expect to see more evidence of this behavior in 2026. After all, if you don’t like the soft market prices from an investment point of view – use them for protection.”

You can download a copy of the new Lane Financial paper here.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.