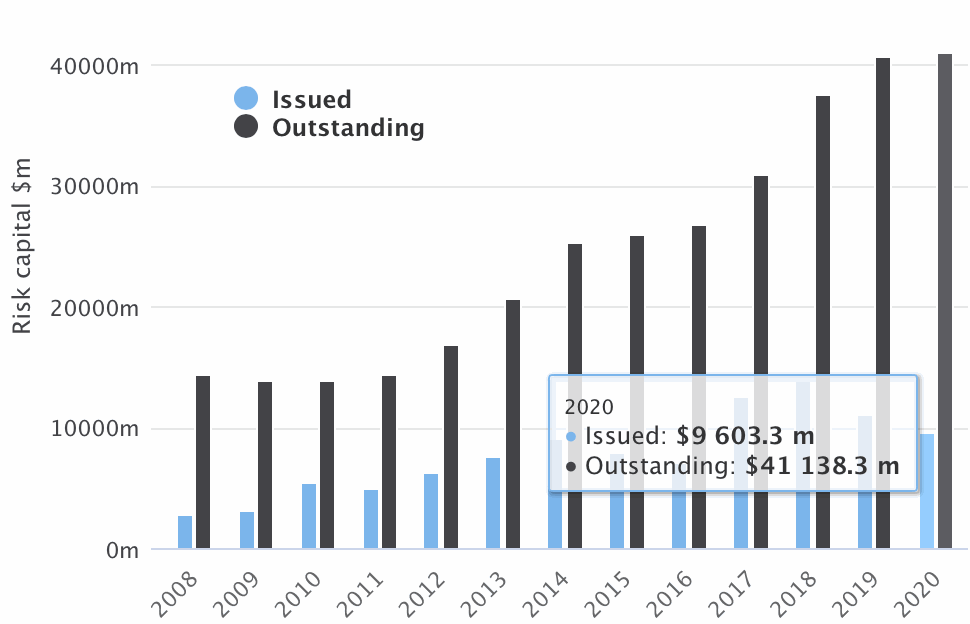

Issuance of new catastrophe bonds continued apace through early July, helping total cat bond and related ILS issuance reach $9.6 billion as of this time, according to Artemis’ Deal Directory data. While the demand from investors for higher-returns is increasingly evident, as both spreads and multiples-at-market accelerated over recent weeks.

Investor returns from the catastrophe bond market have risen as a result and those portfolios where managers have taken advantage of the recent issuance are now set to deliver a higher level of return, for a lower level of risk assumed.

In the last month the catastrophe bond and related insurance-linked securities (ILS) market has added roughly $1.35 billion of new issuance, of which $900 million or so has come from new natural peril exposed cat bonds and $450 million from the only mortgage ILS deal to come to market since the Covid-19 pandemic broke out.

Reflecting the strong pace of issuance seen, we covered cat bond market issuance back on May 29th 2020 when the figure was $7.2 billion, again on June 19th when the figure reached $8.25 billion and then at the end of the second-quarter at June 30th the year-to-date total had reached $8.81 billion.

Now, having reached $9.6 billion, including mortgage ILS issued so far this year, 2020 is on pace to potentially set records for issuance in the catastrophe bond and related ILS marketplace.

Given the large amount of maturing cat bonds that feature this year, the outstanding market has actually shrunk slightly in recent weeks, currently sitting at $41.14 billion, according to Artemis’ data, down from $41.5 billion at the end of June but still up on the $40.7 billion size of the outstanding market at the end of December 2019.

The chart above includes issuance of mortgage insurance-linked securities (ILS), as we try to reflect all insurance-linked issuance we feature in our comprehensive Deal Directory.

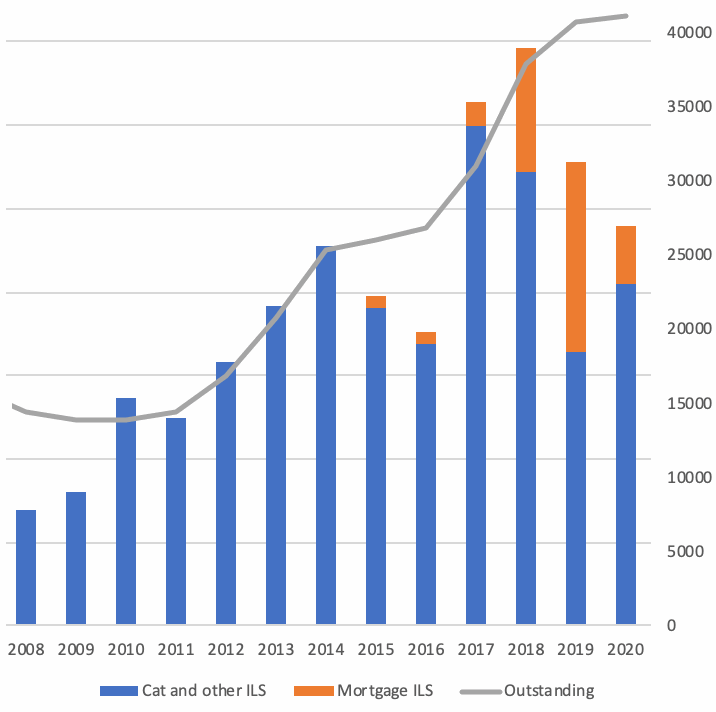

But, excluding mortgage ILS deals, so only focusing on natural catastrophe bonds, health or life ILS, plus any specialty lines catastrophe bond type transactions we have data on, issuance is now at almost $8.17 billion for the year 2020 to-date and has already far outpaced 2019, as this chart below shows.

You can also see the slowdown in mortgage ILS issuance caused by the Covid-19 pandemic and it remains to be seen whether that side of the market can catch up to 2019’s bumper issuance.

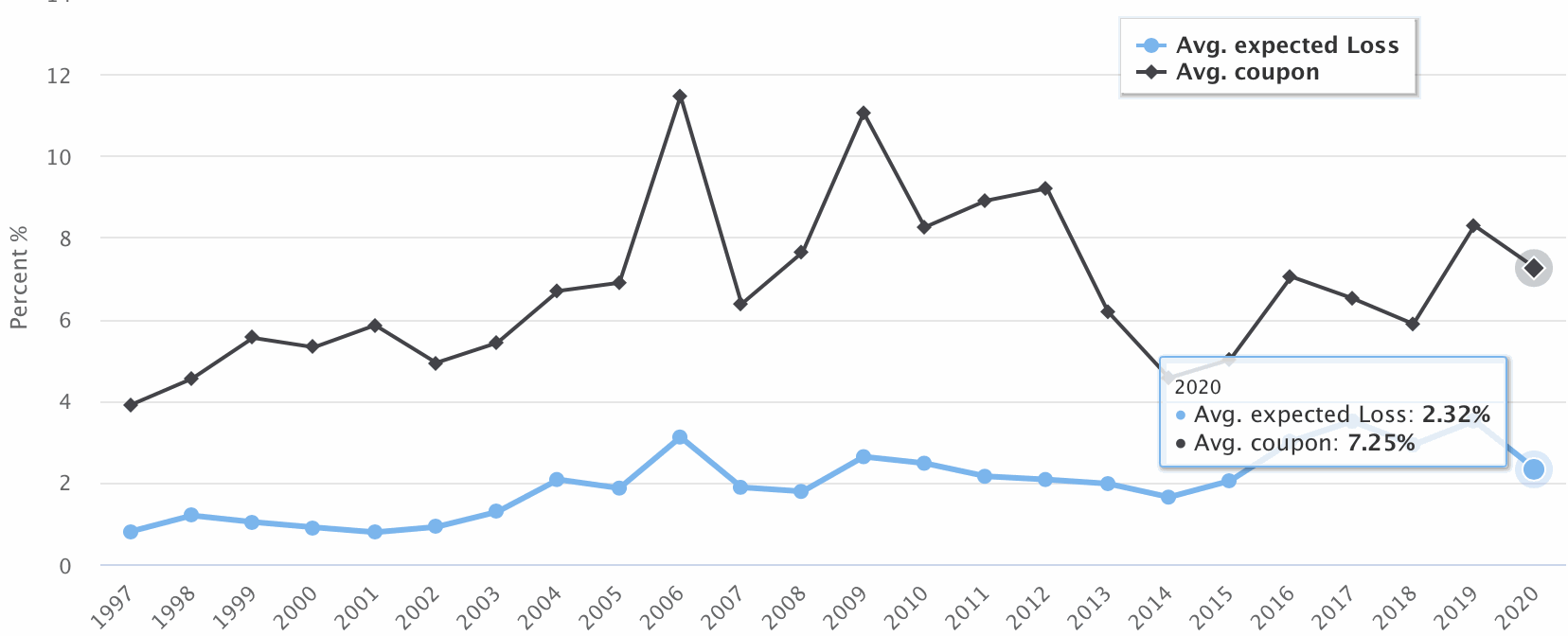

As we said, investor demand for higher cat bond returns, which goes in tandem with the hardening of the reinsurance market, is also evident in Artemis’ transaction data and charts.

The average coupon of all issuance so far in 2020 that we have this data point for has risen again in the last month to 7.25% (up from 7.09% a month ago), while the average expected loss is now 2.32% (only very slightly up on June 19th’s 2.3%).

That implies a widening spread above expected loss and as a result higher return potential from recent catastrophe bond issues.

In fact, the spread between average coupon and average expected loss has now risen to 4..93%, up from 4.79% at June 19th and 4.33% on May 29th.

As issuance continued through the end of the second-quarter and around the mid-year reinsurance renewals the increasing returns above expected loss, that cat bond funds and investors allocating to recent issuance can make, has accelerated.

The average multiple-at-market, of expected loss to coupon, for 2020 cat bond and ILS issuance has risen as a result, with the figure now back at 2013’s level, as seen below.

Back on May 29th the average multiple of 2020 catastrophe bond and related ILS issuance stood at 2.96 times, which increased to 3.08 times the expected loss as of June 19th and by now, including all the latest cat bond deals to come to market, stands even higher at 3.13 times expected loss.

These are some of the measures of return that are driving significant investor interest in the catastrophe bond market at this time, alongside the way that side of the ILS asset class has performed through the recent pandemic-affected months.

The issuance market for catastrophe bonds has now quietened somewhat, as you’d expect with the hurricane season underway.

But we understand there could be some diversifying perils coming to market over the summer months, which would be welcomed by cat bond fund managers with the ability to raise funds to support new issues.

Overall, the catastrophe bond market is reflective of the increased return potential of investments into insurance-linked securities (ILS) and reinsurance linked assets at this time.

With reinsurance rate firming forecast to continue into 2021 it seems likely cat bond rates will remain elevated through the end of this year, which should make ample capital available for any sponsors looking to come to market later in the year and we are being told that the issuance market could be particularly active as we move through the hurricane season into the end of year renewal cycle.

Analyse every catastrophe bond using the Artemis Deal Directory, the Artemis Dashboard and our statistics and charts.

For full details of second-quarter 2020 cat bond and related ILS issuance, including a breakdown of deal flow by factors such as perils, triggers, expected loss, and pricing, as well as analysis of the issuance trends by month and year.

For full details of second-quarter 2020 cat bond and related ILS issuance, including a breakdown of deal flow by factors such as perils, triggers, expected loss, and pricing, as well as analysis of the issuance trends by month and year.

Download your free copy of Artemis’ Q2 2020 Cat Bond & ILS Market Report here.

For copies of all our catastrophe bond market reports, visit our archive page and download them all.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.