While the insurance-linked securities (ILS) market is now beginning to see broader growth resuming, with some successful capital raises across private ILS and collateralized reinsurance, the catastrophe bond market is still leading the way as the main source of ILS market growth in 2023, Aon Securities’ latest data shows.

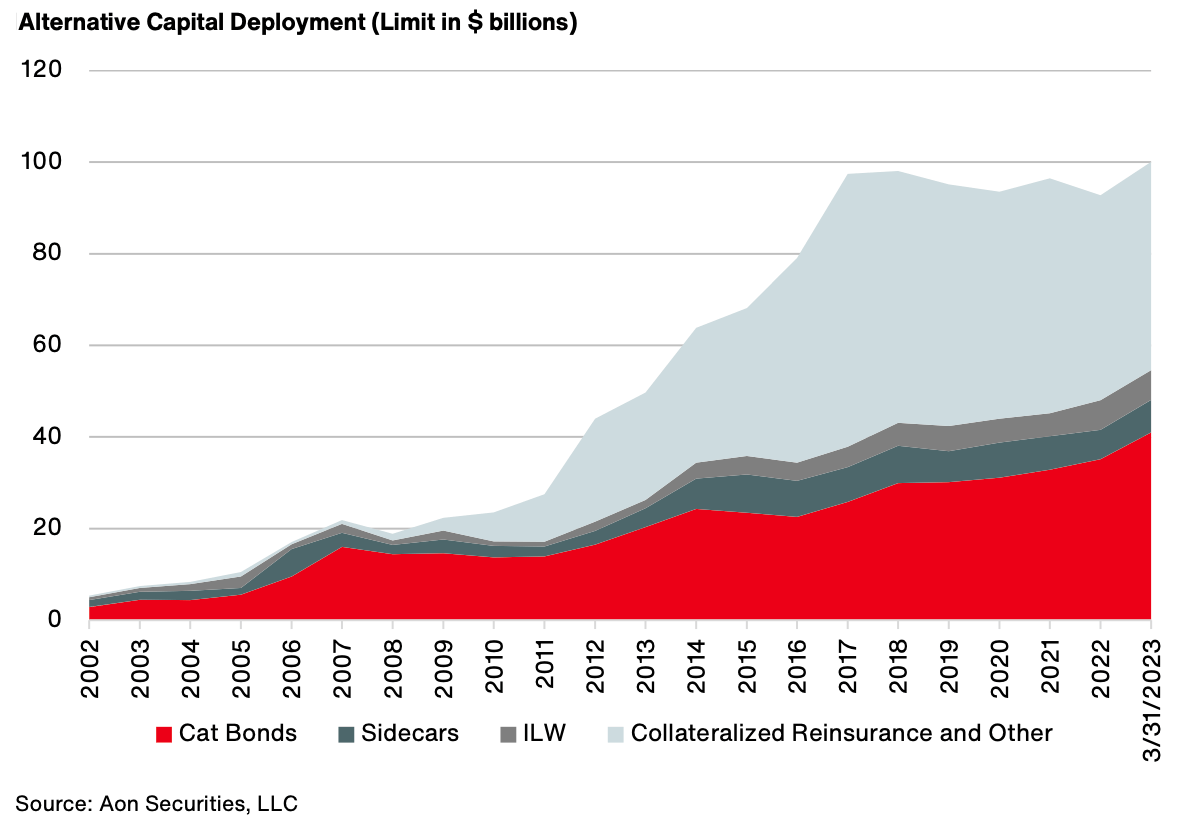

The broker issued its latest reinsurance market report recently, highlighting a return to growth for alternative reinsurance capital and that it hit a new high of $100 billion at the end of Q1 2023.

Aon highlighted the very strong catastrophe bond market as one of the key sources of inflows that have helped to drive the ILS market back to growth and to this new high.

While we are now hearing that capital is flowing positively to all of the main segments of the ILS market in recent weeks, albeit in small amounts in some cases, the cat bond market continued to take the lions share through the first-quarter of the year, it seems.

Aon noted newly raised capital at ILS funds flowing to the cat bond market, helping to drive issuance higher, but the latest data from the Aon Securities division shows the other main ILS products as relatively flat to the end of Q1 2023 (see below).

The chart shows an upturn in the growth trajectory for the catastrophe bond market, but the other ILS market segments remaining relatively flat.

The catastrophe bond market has clearly grown fastest and the most in recent months. Our latest quarterly report, that details cat bond market activity through Q2 2023, notes that outstanding cat bond and related ILS risk capital increased by an impressive 10% over the first-half of 2023, to reach almost $41.6 billion.

Increasingly we are now hearing of capital raising in private ILS funds and collateralized reinsurance or retrocession strategies, as well as some sidecar capital raises.

As a result, we do expect that Aon Securities next update for the chart above, taking it to the mid-year, could show a slight widening of the collateralized reinsurance and other ILS strategies band, as that segment is now expected to be the recipient of recent capital raising activity.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.