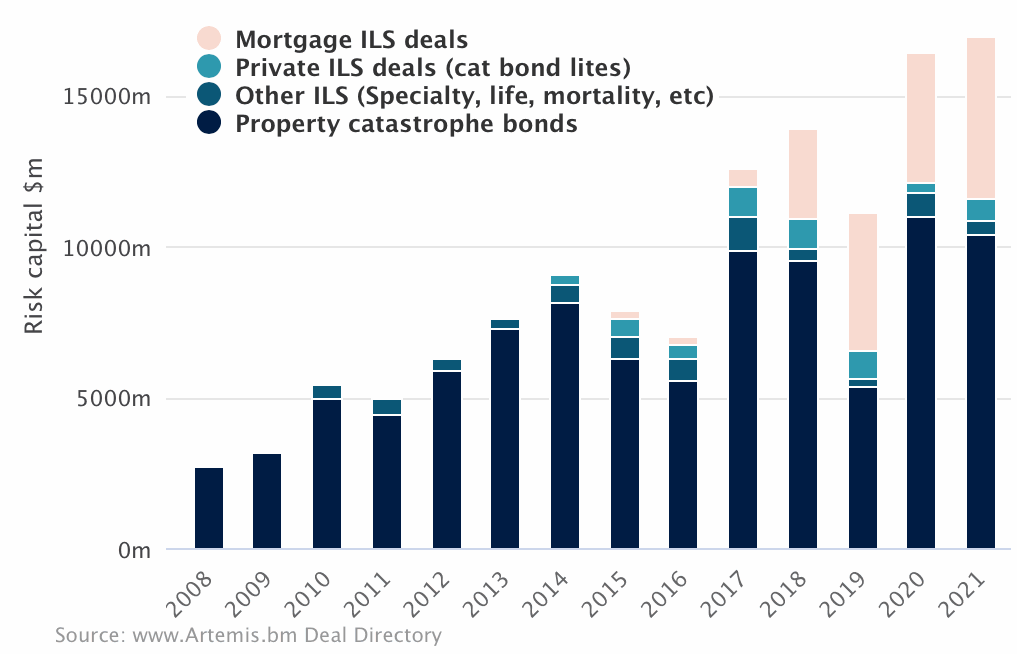

Catastrophe bond and related insurance-linked securities (ILS) new issuance has now reached $17 billion in 2021, setting a new annual record for the total tracked by our Artemis Deal Directory.

It’s also notable that issuance of new Rule 144A property catastrophe bonds has surpassed $10 billion now for the second year running and only the second time in the cat bond market’s history.

In fact, property catastrophe bond issuance has already reached almost $10.4 billion in 2021, so is now closing in fast on the annual record set a year ago, of just over $11 billion.

The new $17 billion annual issuance record includes: pure property catastrophe bonds; cat bonds covering life, health or specialty lines; private catastrophe bonds; and issuance of mortgage insurance-linked securities.

The previous record was set in 2020, when the annual issuance for those types of ILS deals reached $16.44 billion.

The market is now on-track to even reach the magic $20 billion number, for those types of ILS issues in 2021, while pure property catastrophe bond issuance is also now expected to eclipse its previous annual record.

Analyse cat bond and ILS issuance data using our interactive charts.

Another good sign for the catastrophe bond and overall ILS market, is that the number of transactions listed in our Deal Directory this year has already reached 80, which equals the record set in full-year 2020.

Meaning that we are guaranteed another new record in 2021, as activity in the ILS market continues apace and re/insurers continue to turn to catastrophe bonds and other forms of securitization for reinsurance and retrocessional protection.

On top of this, the market for mortgage insurance-linked securities (ILS) has also reached a new record high already in 2021, at more than $5 billion issued for the first time ever. That figure will also grow as there are set to be more mortgage insurers looking for reinsurance from the capital markets over the coming weeks.

In terms of the size of the outstanding marketplace, if you break it down into pure 144A property catastrophe bonds then we’re at a new record high of $32.53 billion at this time, by Artemis’ data, which is slightly up from the end of Q3 high of $32.48 billion.

That’s also positive, as issuance has managed to outpace maturities even through the wind season, as more cedents looked to the ILS market for reinsurance capacity during this period than is typically seen.

Adding in the cat bonds outstanding and covering other lines of reinsurance business, as well as private cat bonds, and risk capital outstanding sits at almost $35.5 billion, which is relatively flat with the end of Q3.

We continue to hear that issuance of new catastrophe bonds should be brisk through the end of the year, suggesting more records will fall.

We’ll update you when new records are set and you can stay tuned to Artemis for news of every catastrophe bond and related ILS transaction that comes to market, as well as details of other ILS structures including reinsurance sidecars.

You can view information on every catastrophe bond issued so far in 2021 and all prior years, totalling over 750 issues, in the Artemis Deal Directory.

Keep up-to-date with the make-up of the catastrophe bond and ILS market using the Artemis Catastrophe Bond & ILS Market Dashboard, designed to be a simple and effective tool providing key data and statistics on every transaction (there are 750+) contained in our catastrophe bond & ILS Deal Directory.

Keep up-to-date with the make-up of the catastrophe bond and ILS market using the Artemis Catastrophe Bond & ILS Market Dashboard, designed to be a simple and effective tool providing key data and statistics on every transaction (there are 750+) contained in our catastrophe bond & ILS Deal Directory.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.