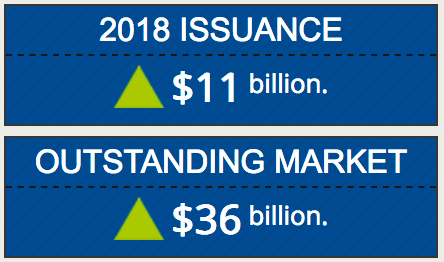

The volume of new catastrophe bonds and related insurance-linked securities (ILS) transactions tracked by Artemis in 2018 has now reached $11 billion, outpacing 2017’s issuance so far, while at the same time the outstanding market has continued to grow to reach a new high of $36 billion.

The successful completion of the two most recent catastrophe bond transactions in just the last week or so, the $500 million FEMA sponsored FloodSmart Re 2018-1 flood cat bond and the $200 million PG&E sponsored Cal Phoenix Re Ltd. first indemnity wildfire cat bond, has now propelled the market to $11 billion of issuance already in 2018.

The successful completion of the two most recent catastrophe bond transactions in just the last week or so, the $500 million FEMA sponsored FloodSmart Re 2018-1 flood cat bond and the $200 million PG&E sponsored Cal Phoenix Re Ltd. first indemnity wildfire cat bond, has now propelled the market to $11 billion of issuance already in 2018.

The run-rate of new catastrophe bond and related ILS issuance in 2018 continues to impress, with the use of securitised capital market instruments for property catastrophe reinsurance seemingly growing all the time.

In fact the level of cat bond and related ILS issuance recorded by Artemis this year so far is now outpacing the level seen a year ago (which was a record year overall if you recall), as in 2017 issuance had only reached $10.64 billion by this stage in August (according to Artemis’ data).

We’ve seen numerous firsts in the cat bond market in 2018, from the first pure flood cat bond, to the first pure wildfire deal, as well as the inclusion of third-party liability and litigation risk coverage, more operational risks, mortgage risks and the first financial guarantee risks.

In addition we’ve seen new peril regions and an expansion of covered perils, as sponsors of U.S. multi-peril cat bonds look to secure as broad as possible all natural peril reinsurance cover from their ILS issues.

The roughly $11 billion of issuance seen to date ($10.96bn to be precise) has been reached through the issuance of 48 individual cat bond or related ILS transactions, each of which we’ve tracked and covered in detail in the Artemis Deal Directory.

The overall market for catastrophe bonds and related ILS has also continued to grow, now reaching $36 billion as of this week, a new record size for the cat bond market.

Impressively, year-to-date the cat bond market has grown by 16% in terms of risk capital outstanding since the beginning of 2018, an impressive rate of growth.

More impressively the outstanding cat bond and related ILS market has grown by 10% since the end of the first-quarter of 2018 and even by 2% since the end of the second-quarter.

There is only just under $800 million of maturities still to come over the remainder of 2018, making further outright market growth of this market size almost assured.

It is also increasingly likely that cat bond and related ILS issuance in 2018 will achieve another record, as only $1.6 billion of new transaction across the rest of this year will help it to surpass last year’s record of $12.56 billion (as recorded by us at Artemis).

For full details of catastrophe bond and related insurance-linked securities (ILS) market issuance every quarter please visit our quarterly cat bond market report archive and download them all.

Don’t forget to check out our Cat Bond Market Dashboard as well, for a snapshot of the ILS market, and our range of catastrophe bond market charts and data visualisations which allow you to analyse the outstanding market in more detail.

Don’t forget to check out our Cat Bond Market Dashboard as well, for a snapshot of the ILS market, and our range of catastrophe bond market charts and data visualisations which allow you to analyse the outstanding market in more detail.

Note: Artemis’ data on catastrophe bond issuance includes every transaction we can source information on, including private deals, new diversifying insurance perils, and the usual 144A broadly marketed property catastrophe issues. Hence our figures are typically higher than those quoted by reinsurance broker reports, but we feel this offers a holistic look at market activity.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.