Catastrophe bond issuance in the first-half of 2020 has been one of the bright spots in the insurance-linked securities (ILS) and alternative reinsurance capital market, as issuance was buoyed by the assets robust performance through the Covid-19 pandemic.

In discussing the dynamics around alternative capital, insurance and reinsurance broker Aon said that investors in ILS have faced significant tests in recent years, with the Covid-19 pandemic presenting yet another.

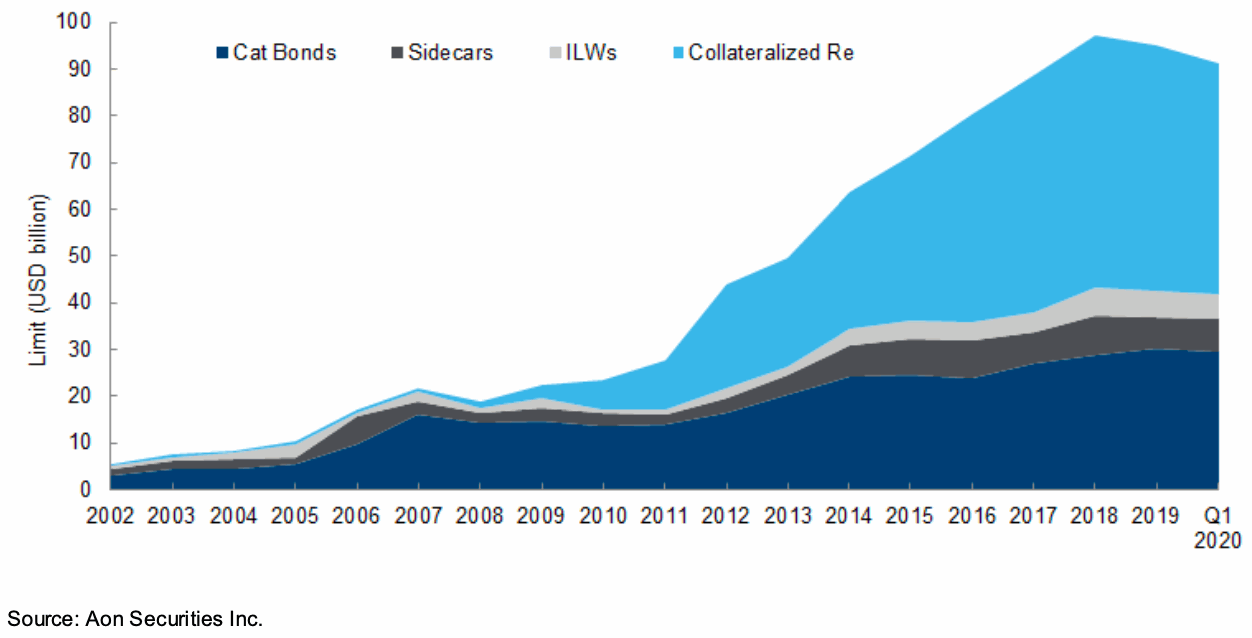

As a result, the amount of alternative capital in the market had shrunk again at the end of Q1 2020, as we explained earlier. But not every segment of ILS has suffered as investors have shown increasing interest in areas of the market where risks are more remote, or better defined and where exposure or not to the pandemic much clearer.

The chart from Aon’s latest reinsurance market report clearly shows that it is collateralised reinsurance arrangements that have taken the brunt of the trapping of collateral and losses in recent years.

The one area that seems to still be growing though is catastrophe bonds.

As we’ve documented at length and in our quarterly cat bond market reports, issuance has continued apace after just a short lull when the pandemic first went global at scale.

In addition, some cat bond funds have been able to attract new capital, although this hasn’t been particularly significant given the large amount of maturities seen and the need to reinvest that capital as well.

Explaining in its recent report, Aon said, “Some new inflows of alternative capital have been seen, but they have tended to favor established managers with strong track records. The perceived lack of correlation with broader capital markets remains the main driver, with the expectation of higher returns now added to the mix. However, this rationale may be challenged if investors see additional collateral becoming trapped as a result of COVID- 19.”

Aon went on to say, “One bright spot is the property catastrophe bond market, where the liquidity of the product and the peril- specific nature of the coverage continues to attract strong interest.”

By Aon’s measure, issuance in the first-half was seen to be “nearly matching the maturities.”

That’s a testament to the robustness of the cat bond structure, the value of liquidity that it showed in a time of stress, and also to its attractive features that keep investors coming back even through times of stress.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.