Catastrophe bond spreads are back at levels not seen for at least five years and specialist insurance-linked securities and reinsurance investment manager Twelve Capital believes they have further to go in 2020, making this a compelling year for investors to allocate to the sector.

“Cat Bond spreads reflect prevailing conditions within global (re)insurance markets. Twelve Capital believes these are moving decisively in investors’ favour,” the insurance-linked securities and reinsurance market investment manager explained.

Catastrophe bonds are largely issued to provide a source of reinsurance or retrocession capacity for ceding re/insurers, so as renewal rates rise in the traditional reinsurance market they can be expected to do so for new issuance catastrophe bonds as well.

Twelve Capital continued to explain why this is being seen right now, “The reason for this is that the last three years have witnessed an increased frequency of meaningfully sized natural catastrophe events, including North Atlantic hurricanes, typhoons in the Pacific and wildfires in California and Australia.

“To compensate for these losses, (re)insurance premiums are now rising materially, terms and conditions are tightening, both materially improving the risk adjusted pricing of (re)insurance contracts and by extension catastrophe bond spreads.”

For 2020 Twelve Capital forecasts that catastrophe bond strategies are targeting gross returns of roughly 7% and even higher, which is an impressive return in an asset that is almost uncorrelated with broader equity markets and other asset classes.

In fact, after a 2019 that saw impressively strong performance in many liquid asset classes, such as equities and fixed income and 2020 looking unlikely to repeat those strong returns, investors could do much worse than to look to the increasingly active cat bond investment universe at this time.

Asking whether, “liquid asset classes still have a potential to generate attractive returns at all in 2020?” Twelve Capital suggests that “insurance sector investing can solve this quandary for investors” adding that it is bullish on all the liquid sectors, from catastrophe bonds, to insurance credit and insurance equity investments.

Twelve Capital operates investment strategies across the insurance and reinsurance market balance-sheet, with cat bond, private ILS, private insurance debt and insurance equity strategies.

Within these, catastrophe bonds are offering the best returns for five years from what is the more liquid of the ILS fund strategies in 2020.

Cat bond funds can be particularly liquid, for an insurance-linked securities (ILS) strategy, with funds generally structured to offer weekly liquidity in a UCITS format, the manager notes.

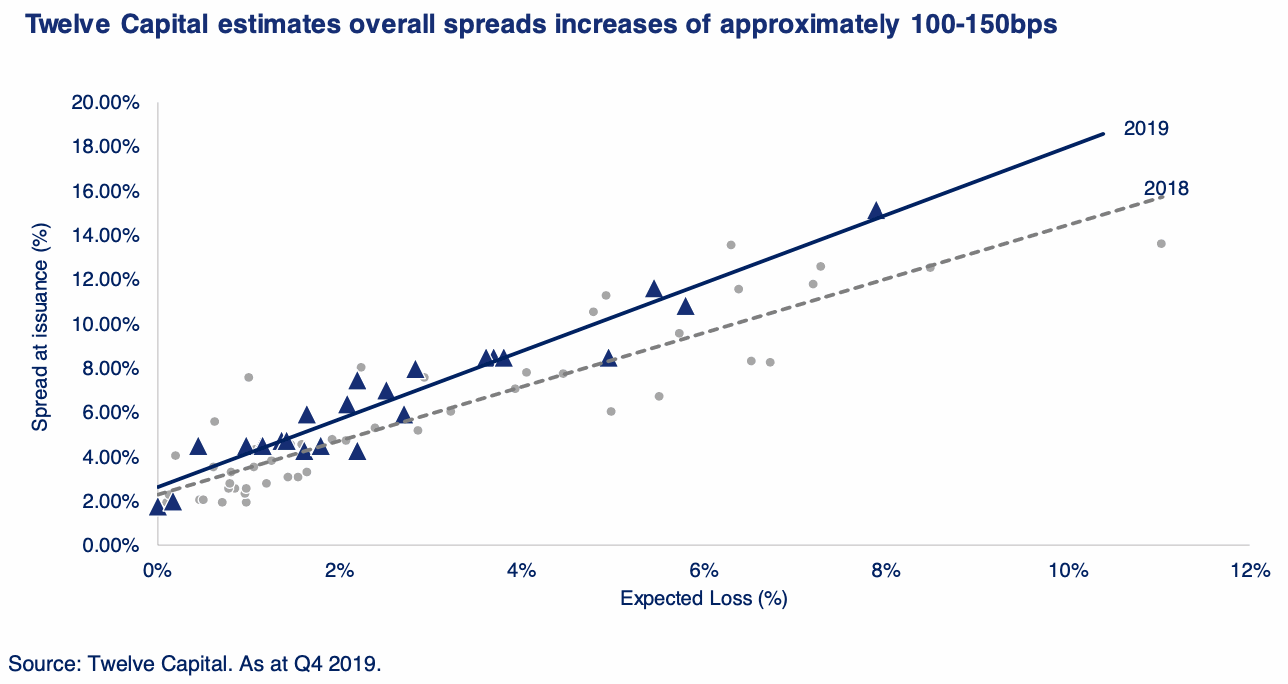

“This asset class is currently seen at levels which have not been witnessed for the last five years,” Twelve Capital explained, saying that it “Estimates that over the past 18 months bond spreads have increased by 100-150bps alone and are expected to improve further.”

“This is in stark contrast to wider Fixed Income markets that have experienced a trend of tightening spreads. As a result, the market is currently priced at USD gross of loss returns in excess of 7% for 2020,” Twelve Capital said.

While catastrophe bond spreads do tend to track upwards movements in pricing of the reinsurance and retrocession market, right now they are equally appealing to cedents as they are to investors it seems.

Issuance activity has been high through the beginning of 2020, which is partly because at certain return periods a catastrophe bond is currently very keenly priced versus traditional reinsurance protection.

Clearly there are frictional costs for new sponsors to the market, but with plenty of maturities to come this year it is expected that 2020 will be a big year for catastrophe bond issuance, meaning cat bond funds can expect to fill their portfolios with long-dated names that will deliver higher spreads over the next few years.

All of which makes 2020 a good year to enter the cat bond investment sector and that is why investor interest in the asset class is resurgent and perhaps set to reach new highs this year.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.