The catastrophe bond and related insurance-linked securities (ILS) market saw $3.3 billion of new risk capital issued in the first-quarter of 2023, but the big story of the opening period of this year was the elevated spread environment and as a result the promise of higher returns for investors, Artemis’ latest quarterly report shows.

The Artemis Q1 2023 Catastrophe Bond and related insurance-linked securities (ILS) Market Report, available to download now, examines the cat bond and related ILS risk capital issued in the quarter.

The Artemis Q1 2023 Catastrophe Bond and related insurance-linked securities (ILS) Market Report, available to download now, examines the cat bond and related ILS risk capital issued in the quarter.

Our new report examines a period in which the average spread (coupon minus expected loss) of issued cat bonds reached an all-time high of 10.5%.

While a flurry of deals in the closing weeks of March brought this down to 9.41% as at the end of Q1, Artemis’ data shows that this is still higher than the average spread for any year in the market’s history.

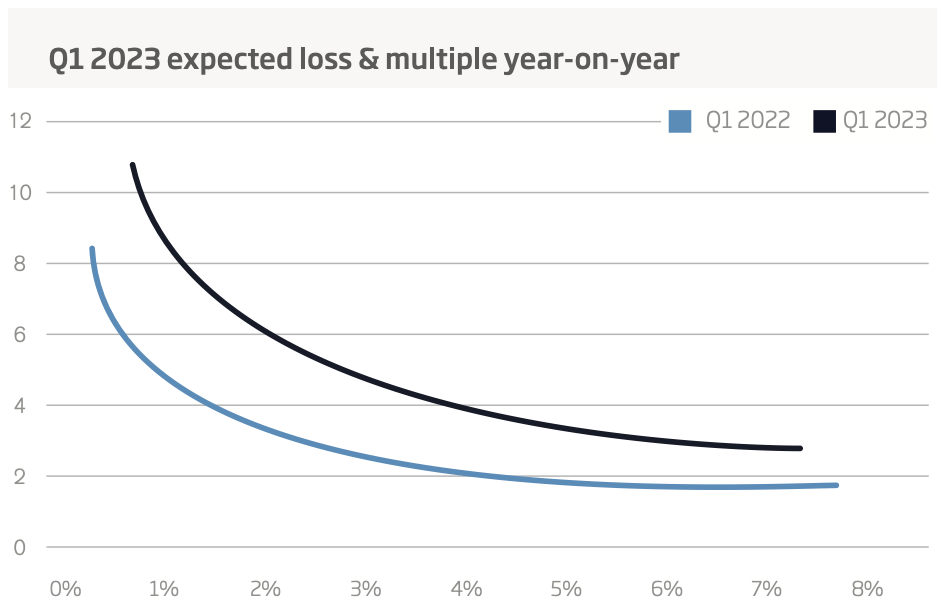

The significant rise in cat bond spreads reflect the higher reinsurance rates being paid by cedents, which, as the report shows, is also evidenced by the fact the average multiple (expected loss to coupon) of issuance so far in 2023 has risen significantly as well.

Year-on-year, this does represent a dip in issuance, but is still above the 10-year average for the quarter by more than $416 million.

Traditional 144a property catastrophe bonds once again dominated the quarter, although deals covering non-cat risks, including the very first cyber ILS deal, as well as some other private placements, also featured in the period.

The industry’s first cyber cat bond was sponsored by Beazley, who alongside The Andover Companies, were the only two new sponsors to feature in Q1.

The remainder of issuance came from repeat sponsors, although for five of these it was just their second transaction, reflecting continued traction among re/insurers in their use of securitization and capital markets sources of reinsurance or retrocession capacity.

Artemis’ data on catastrophe bond and related ILS issuance from Q1 2023 shows that, when compared with the prior year, investors are set to be paid more for the same level of risk, in expected loss terms.

The chart below, from our new report, shows a comparison of first-quarter catastrophe bond and related ILS issuance expected loss and multiples year-on-year.

The higher multiples of note issued throughout the first quarter confirms the continuation of the market firming which began in 2021. The average multiple of expected loss was volatile 2010 through 2013, before trending downwards, with a few exceptions, between 2014 and 2021. Now, it seems investors are set to enjoy a period of higher returns.

We will keep you updated on all catastrophe bond and related ILS transaction issuance as 2023 progresses, and we’ll report on the evolving trends in the cat bond, insurance-linked securities (ILS) and collateralised reinsurance market.

For full details of first-quarter 2023 cat bond and related ILS issuance, including a breakdown of deal flow by factors such as perils, triggers, expected loss, and pricing, as well as analysis of the issuance trends seen by month and year.

For full details of first-quarter 2023 cat bond and related ILS issuance, including a breakdown of deal flow by factors such as perils, triggers, expected loss, and pricing, as well as analysis of the issuance trends seen by month and year.

Download your free copy of Artemis’ Q1 2023 Cat Bond & ILS Market Report here.

For copies of all our catastrophe bond market reports, visit our archive page and download them all.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.