The attractive margins still available to investors in catastrophe bonds have the potential to drive “meaningful market growth” in 2023, broker Aon has explained.

Commenting on the conditions in global reinsurance and insurance-linked securities (ILS) this week, the broking house has highlighted that the cat bond market, in particular, appears to be one segment poised for potentially significant expansion.

Commenting on the conditions in global reinsurance and insurance-linked securities (ILS) this week, the broking house has highlighted that the cat bond market, in particular, appears to be one segment poised for potentially significant expansion.

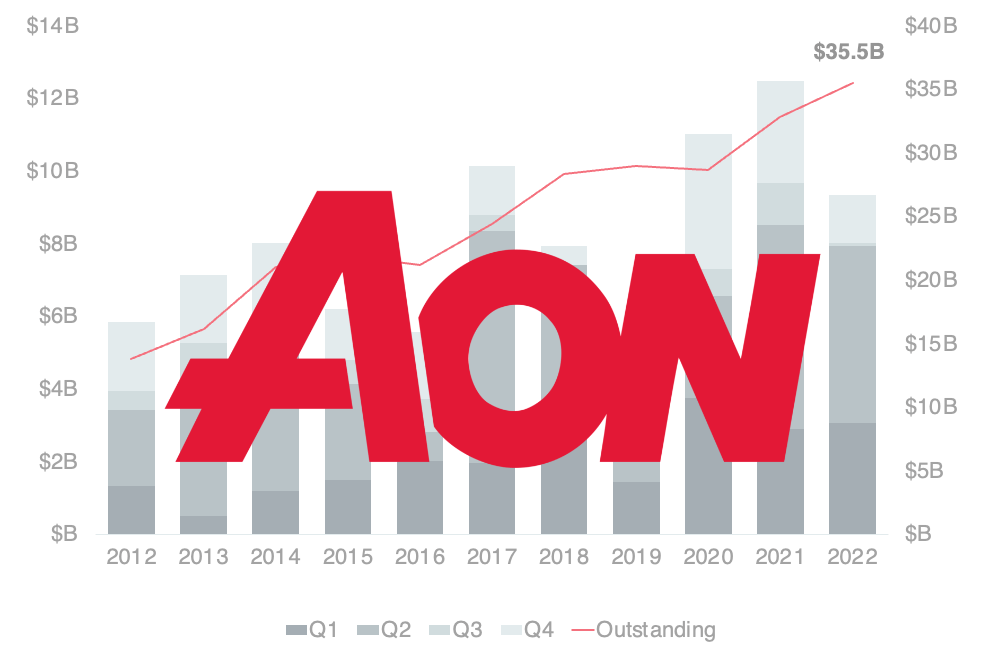

As we reported yesterday, Aon had highlighted that the cat bond market has reassumed its growth trajectory at this time.

The upwards trajectory of the market is detailed in Artemis’ own catastrophe bond market report, which was released this week and can be downloaded here.

Aon’s commentary is particularly positive on prospects for the cat bond market in 2023, albeit despite the elevated interest in the sector is seemingly starting to weigh on the high prices that had been seen.

In fact, Aon has reported that property cat bond pricing has tightening by around ~12% since the year-end peak of spreads, while at the same time individual deal sizes have rebounded and are now averaging larger again.

Driving cedent demand for coverage using catastrophe bonds, Aon said that sponsors are reacting to higher traditional reinsurance and retro pricing, choosing to tap into the capital markets instead.

But the capital markets are responding to this demand and providing the liquidity needed to satisfy the growing pipeline and elevated level of deal-flow now being seen.

After a busy first-quarter of 2023 for the catastrophe bond market, Artemis has already recorded 8 new cat bonds seeking $1.325 billion of protection for the second-quarter so far.

Aon’s commentary suggests we can expect this pipeline to expand, perhaps significantly, not least because there are around $4.4 billion of cat bonds scheduled to mature in Q2, but also as demand could remain high as cat bonds provide an increasingly attractive alternative reinsurance source, with zero counterparty credit risks attached.

“Investors are keen to see abundant issuance volume during the second quarter to ensure maturing capital is deployed,” Aon explained.

“But also to put to work newly raised capital from end investors who are seeking to capitalize on the healthy margin environment.”

Joe Monaghan, Global Growth Leader Reinsurance Solutions at Aon commented, “At projected 2023 rate levels, the property cat market should be attractive to investors.”

Adding, “The catastrophe bond market is also back in full swing after a difficult fourth quarter, 2022. Pricing has tightened since the year-end peak and deal sizes have bounced back.

“We expect ILS inflows to continue in 2023, as the case for diversification is resonating given the broader environment.”

Ultimately, Aon believes that the attractive margins still available to investors in cat bonds “could result in meaningful market growth going forward.”

While the market is increasingly primed for new inflows it appears.

As, on cat bonds, “Investors are comfortable with the structure and liquidity of the product and higher margins are attracting new inflows of capital,” Aon said.

Track catastrophe bond issuance using the Artemis Deal Directory, Dashboard and Charts.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.