The insurance-linked securities (ILS) market is slowly returning to normal, as loss creep affecting the sector has reduced substantially, according to Willis Re Securities.

The capital markets unit of the reinsurance broker noted that by the end of the second-quarter of 2019, the loss creep from prior year catastrophe events continued to affect the ILS market, but at a “substantially reduced rate.”

The broker highlights the fact that about a year ago, the catastrophe bond market was facing losses of roughly $755 million, or 3% of non-life cat bond capacity outstanding at the time that Willis Re Securities tracks, due to the impacts of the 2017 hurricanes, California wildfires, and the Chiapas earthquake.

Now, one year later at the end of Q2 2019, the loss to the catastrophe bond market from these events has risen to a little over $1 billion, or 4.2% of the same non-life cat bond risk capital outstanding figure.

That reflects almost $250 million of loss creep in one year, a year-on-year rise of around 40%.

Following the impacts of recent year’s of catastrophe losses and the following loss creep, Willis Re Securities notes that much of the ILS market has recalibrated its risk models and thinking to accommodate loss creep and is now “closely watching the commencing wind season to set the tone for the year ahead.”

William Dubinsky, Managing Director & Head of ILS at Willis Re Securities, commented, “Things are slowly returning to a more normal ILS environment, but relationships will still matter over the next six months if cedants are to get the protection they need at sensible pricing, terms, and conditions.

“The contracting ILS market required cedants to look elsewhere for capacity during the recent renewals. Those with at least some relationship-based treaties with long-established reinsurance partners on their books found it easier to plug the gaps, relative to those who buy reinsurance on a purely transactional basis.

“That is likely to be the case for the balance of the year at least. Both approaches have merits, however, and the ideal balance will be different for each reinsurance buyer.”

Catastrophe bond loss creep expectations, as shown by implied losses the market was factoring in, have been decreasing steadily over each quarter, according to Willis Re.

The brokers data shows that the growth in estimated losses from the 2017 hurricanes was slowing throughout recent quarters.

Willis Re Securities explained:

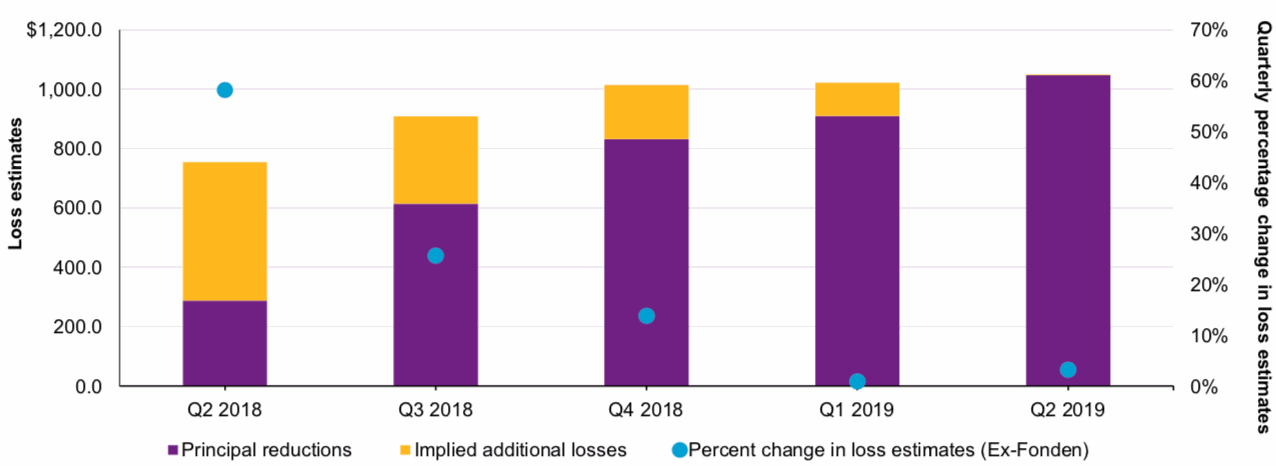

The chart below shows the development of losses by quarter as well as the sequential loss estimate growth rates for impacted cat bonds. Q1 2018 loss estimates of about $532 million (not depicted) saw a quarterly increase of about 58% followed by a 26% increase between Q2 2018 and Q3 2018. Over the past year, the difference between actual principal reductions and ceding insurer loss estimates has narrowed from implied additional losses being 63% of loss estimates to now less than 1%. Not surprisingly, loss estimates grew in tandem with underlying insurer and reinsurer estimates for these events.

The chart shows the realisation of actual loss experience for the catastrophe bond market, as implied and expected losses turn into actual notifications of loss and claims on cat bond collateral.

The cat bond market has realised its losses much more quickly than collateralized reinsurance will have though, which means that while loss creep has slowed substantially as Willis Re Securities said, it is continuing and ILS funds return to normal is still going to take some more time.

The broker also reviewed market activity in Q2, highlighting that in the second-quarter of 2019 the broker recorded just $1.7 billion of non-life catastrophe bonds in the quarter, slightly lower than the $1.78 billion we recorded in our Deal Directory including a number of private cat bond deals during the period.

It was the lowest second-quarter of catastrophe bond and related ILS issuance since 2016, as we reported in our recent Q2 2019 cat bond and related ILS market report.

There were still 11 broadly distributed non-life catastrophe bond deals, Willis Re notes, so the number of transactions did not fall as much as the transaction volume did.

U.S. wind focused cat bonds dominated issuance in Q2, as you’d expect for the time of year and with the mid-year reinsurance renewals approaching.

As well as the non-life cat bond issuance, just over $1.8 billion of mortgage insurance-linked securities (ILS) were issued in cat bond-like deals to provide mortgage reinsurance protection.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.