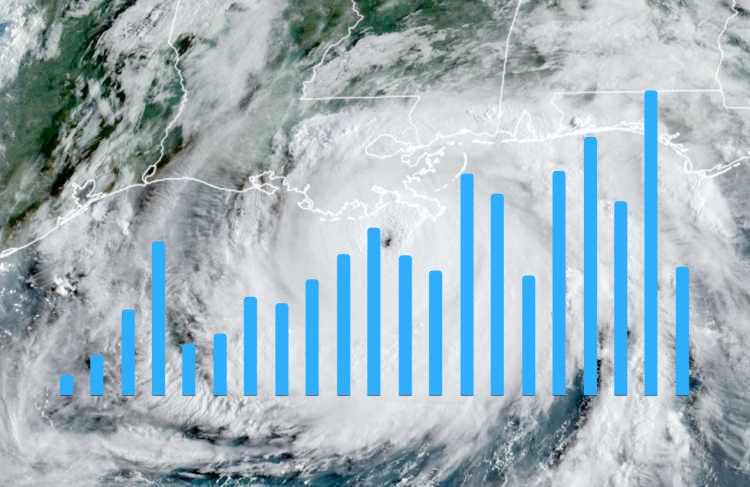

Issuance of property catastrophe bonds, bonds exposed to other lines such as health and related private cat bond deals tracked by Artemis in our Deal Directory has now reached $7 billion for 2024 so far, but of that total some 82% is exposed to Atlantic hurricane risks showing just how important the peril is to the market and how important ILS capital is to underwriters of it.

As well as showing how important that peril is to the catastrophe bond market and its returns, the data also shows just how important insurance-linked securities (ILS) investors are to those insurers and reinsurers seeking reinsurance and retrocession to protect them against named tropical storms that form in the Atlantic basin.

As well as showing how important that peril is to the catastrophe bond market and its returns, the data also shows just how important insurance-linked securities (ILS) investors are to those insurers and reinsurers seeking reinsurance and retrocession to protect them against named tropical storms that form in the Atlantic basin.

Some $5.73 billion of the catastrophe bond and related ILS deals listed in our Deal Directory and settled so far this year contain Atlantic hurricanes as a covered peril.

This year, we’re already seeing significant demand for hurricane reinsurance protection, with some large issues and a number of new cat bond sponsors that have also sought out capital markets backed cover for some of their named storm exposure.

Making up 82% of the roughly $7 billion of new deals settled as of today, that we have tracked with our Deal Directory and charts.

The cat bond market remains very active and there are already another more than $2 billion of cat bonds in the Deal pipeline that are projected to be issued in the coming weeks.

Based on every cat bond listed in our Deal Directory and including those highlighted green as yet to settle, the issuance total will reach around $9.26 billion at that time (mid to late May) depending on final deal sizes.

In fact, there is a chance that with some upsizing issuance of cat bonds tracked by the Artemis Deal Directory could reach $10 billion earlier than the prior year and could well be on a record pace so far in 2024 (H1 issuance was $10.3bn in 2023).

Atlantic hurricane risk is an even more significant component of the pipeline cat bond deals, which is perhaps no surprise given the Florida and US property catastrophe reinsurance renewal dates are nearing.

In fact, we can now report that some 84% of the cat bonds currently settled or expected to settle, so that current projection for $9.26 billion, will contain some exposure to Atlantic hurricane risk.

US hurricane risk is the largest peak peril of the insurance industry, so it is no surprise that it dominates.

Florida remains ground-zero for that risk as well and so far we see 41% of the settled catastrophe bonds and the remaining pipeline as containing exposure to hurricane risk in that state.

Again, this demonstrates the critical role of the ILS market in provision of catastrophe reinsurance to cover peak industry exposures.

Of course, the concentrated exposure to US hurricane risk is exactly what many investors want from the catastrophe bond space.

But there are also plenty of investors and allocators that prefer a more diversified and balanced approach to their peril exposure, so the lack of diversifying issuance can be disappointing to them.

It’s also worth considering how the concentration of Atlantic hurricane risk exposure has implications for larger catastrophe bond funds, that need to invest in most of the market’s issues to sustain their growth and assets. Here, it can also present some challenges, as managing the original diversification promises some funds launched with can become more of a challenge over time.

Find all of Artemis’ catastrophe bond market charts and data here, or via the Artemis Dashboard.

All of our charts are updated as new catastrophe bond issues complete, and as older issuances mature, based on the data in Artemis’ extensive catastrophe bond Deal Directory.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.