The insurance-linked securities (ILS) fund sector finished 2025 on strong footing with December seeing the third-highest returns for that month on record, as both catastrophe bond funds and strategies allocating to private ILS finished the full-year with averaged double-digit returns, the ILS Advisers Fund Index shows.

December 2025 saw the strategies in the ILS fund sector tracked by ILS Advisers reporting an average return of 0.73% for the month, the third best December since the Index began back in 2006.

December 2025 saw the strategies in the ILS fund sector tracked by ILS Advisers reporting an average return of 0.73% for the month, the third best December since the Index began back in 2006.

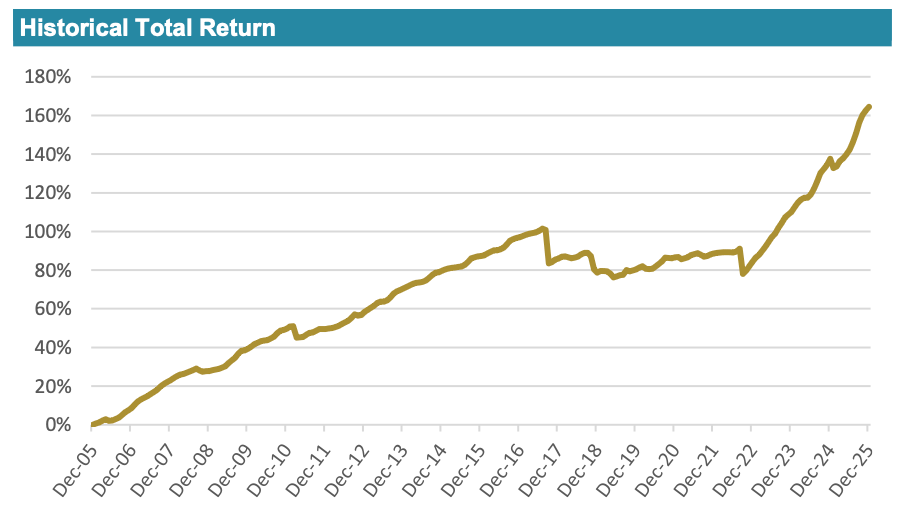

It topped off the third consecutive year of double-digit performance for the Index, leading to an average full-year return for 2025 of 11.32%.

That figure could rise a little higher, as there are still some private ILS fund managers that have not reported full-year figures at this time.

But, with 86% of ILS managers now having reported their December returns to ILS Advisers, it’s clear 2025 was another very strong year for the insurance-linked securities marketplace and its investors, in fact the fourth-highest annual return for this Index since its inception.

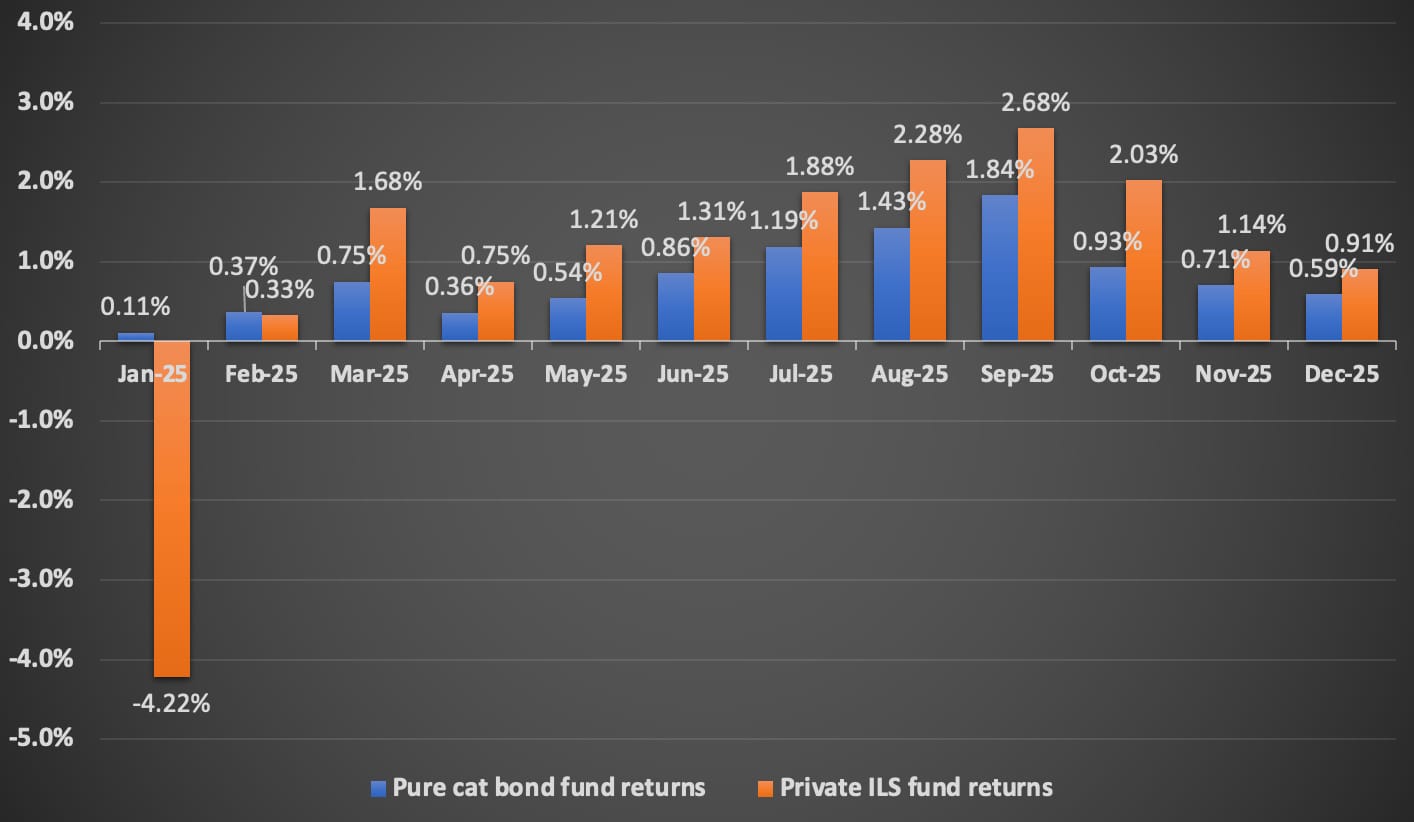

To end the year, pure catastrophe bond funds averaged 0.59% for December 2025, while the private ILS funds averaged 0.91%.

That private ILS figure is the one likely to rise, as the managers yet to report all have strategies that fall within that category.

2025 began with a particularly challenging month, given the catastrophic wildfires that affected Los Angeles, California.

The negative effects of these wildfires was most severely felt in the cohort of ILS funds that allocate to private collateralized reinsurance and retrocession, so the grouping known as private ILS funds.

Pure cat bond funds scraped through January still delivering a positive return and for every month following, both categories of ILS funds delivered positive performance, as the chart below shows.

Were it not for the negative effects of those California wildfires in January, the full-year average return across the cohort of funds tracked by the ILS Advisers Index could have been very close to the prior year.

There were, of course, other catastrophe and severe weather related losses throughout 2025, principally to aggregate contracts from the US severe convective storm season and of course hurricane Melissa in the Caribbean causing a total loss of one parametric catastrophe bond.

But losses fell well-below spread and premium accruals through every month of the year except January, while seasonality drove particularly strong catastrophe bond and private ILS returns through the peak hurricane season months, all helping to propel returns for the ILS fund sector into double-digits again.

As a result, while the average return across all the constituent funds in the ILS Advisers Index reached 11.32% for full-year 2025, there was a dispersion in particular across private ILS fund strategies.

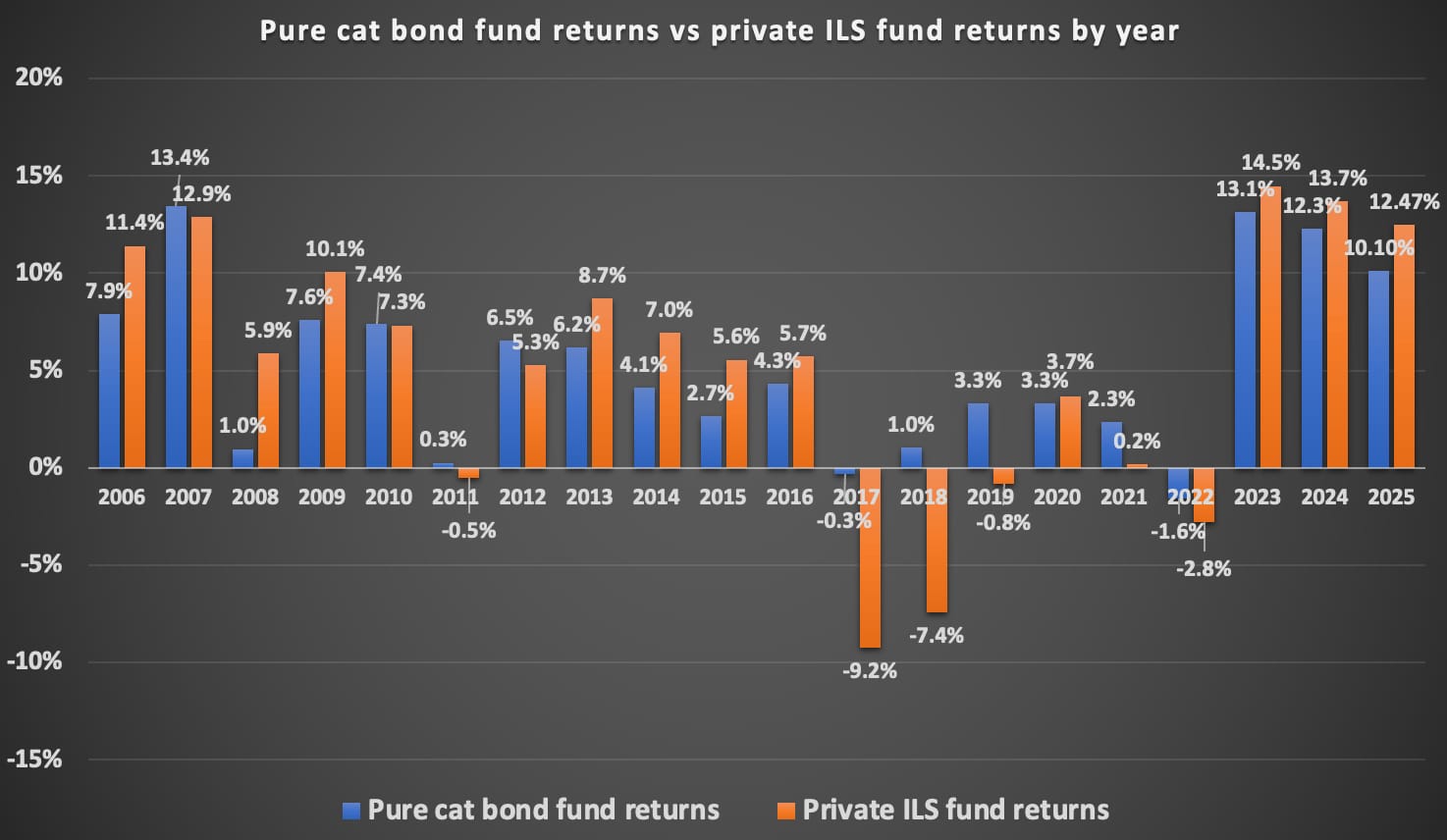

For full-year 2025 the pure catastrophe bond funds averaged a 10.1% return, while private ILS funds gained by 12.47%.

All 36 constituent funds were positive for the year, reflecting another strong year for the end-investors to the ILS asset class.

For both the pure cat bond fund and private ILS fund cohorts 2025 was the fourth best year of performance since this Index began tracking market data back in 2006.

You can see the annual performance of each cohort of ILS funds tracked by the ILS Advisers Index in the chart below.

While the average performance was strong again and every ILS fund delivered positive returns, there was a meaningful dispersion among strategies, especially on the private ILS side.

ILS Advisers reports that within the private ILS fund cohort, where private collateralized reinsurance, retrocession and instruments such as industry-loss warranties (ILW) are invested in alongside cat bonds, the full-year range of returns spanned from 4.4% to as high as 25.6%.

Once again, this demonstrates the significant range of strategies within the private ILS fund sector, with differing risk-return targets and allocation strategies resulting in a broad set of returns over the cohort of funds.

On the pure catastrophe bond side, as you might expect the dispersion of returns was far narrower, with the worst performing pure cat bond fund delivering 8.6% and the best performing 11.9%.

That range is also helpful though, as it shows the range of strategies in the pure cat bond fund sector is also relatively broad and that some cat bond fund strategies can beat the market average and even the main benchmarks (Swiss Re Index at 11.4%, Aon Index at 11.6%) for the sector due to their allocation decisions and investment strategies.

With ILS funds averaging an 11.32% return for 2025, it is no surprise the capital in the sector rose meaningfully and naturally pressured reinsurance and cat bond pricing.

While 2026 suggests lower returns ahead for pure catastrophe bond fund strategies, although still at historically attractive levels should the year prove to deliver minor losses, on the private ILS fund side the availability of more bespoke, privately negotiated deals and layers may help to reduce the effect of market softening somewhat.

It will be interesting to watch how the performance of this Index develops over the course of the year and how wide the gap between the two fund cohorts is for 2026.

Track the ILS Advisers Fund Index here on Artemis.

You can track the ILS Advisers Fund Index here on Artemis. It comprises an equally weighted index of 36 constituent insurance-linked investment funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond investment space.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.