Cessions of premiums to capital markets investors and specialist insurance-linked securities (ILS) funds rose among the Aon Reinsurance Aggregate group of companies tracked by the broker.

Greater use of capital markets backed collateralised reinsurance has helped the 23 major reinsurers tracked by Aon to offset the impact of the record level of catastrophe losses experienced in 2017 and 2018.

Greater use of capital markets backed collateralised reinsurance has helped the 23 major reinsurers tracked by Aon to offset the impact of the record level of catastrophe losses experienced in 2017 and 2018.

In fact, insurance and reinsurance broker Aon notes that the reinsurers it tracks absorbed around $32 billion of the roughly $220 billion of private market catastrophe losses experienced in 2017 and 2018, which is a relatively small proportion given the scale of these companies and reflects higher cessions and the rising role of alternative capital in absorbing losses from major global catastrophe events.

Aon explains that its data helps to demonstrate just why, “The reinsurance sector has proved to be so resilient. Net catastrophe losses of ‘only’ USD32 billion for the ARA (derived in part from insurance operations) demonstrate the extent to which peak risk is now being shared with the capital markets.”

“At sector level, Aon estimates the reinsured portion of the total losses incurred in 2017 and 2018 at no more than 30%,” the broker explains.

While this is still a significant figure, at $32 billion of loss for the group of 23 major reinsurers that consists of, Alleghany, Arch, Argo, Aspen, AXIS, Beazley, Everest Re, Fairfax, Hannover Re, Hiscox, Lancashire, Mapfre, Markel, Munich Re, Partner Re, QBE, Qatar Insurance, RenRe, SCOR, Sirius, Swiss Re, Third Point Re and W.R. Berkley.

It hurt the earnings of these traditional reinsurance carriers, “but was not sufficient to materially erode the excess capital that had built-up prior to these events,” Aon said.

Because of this, “continuity of supply has been maintained,” in the reinsurance market, with financial strength ratings generally unchanged and flattening of the pricing cycle demonstrated, the broker notes, which it adds is “clearly to the benefit of reinsurance buyers.”

The defining factor in helping reinsurers maintain their credit worthiness after major natural catastrophe loss events does now seem to be the use of the capital markets and the role of the ILS market as a place of the peak catastrophe risks to be ceded to.

Mike Van Slooten, Head of Business Intelligence, Aon Reinsurance Solutions, commented “The natural catastrophe losses absorbed by the private market in 2017 and 2018 are estimated at USD220 billion – an unprecedented total for any two-year period. The impact to the ARA exceeded USD32 billion and yet overall earnings have remained positive in both years. We believe this is testament to the resilience of the sector.”

That resilience has been significantly boosted by the increasing use of alternative capital, it seems.

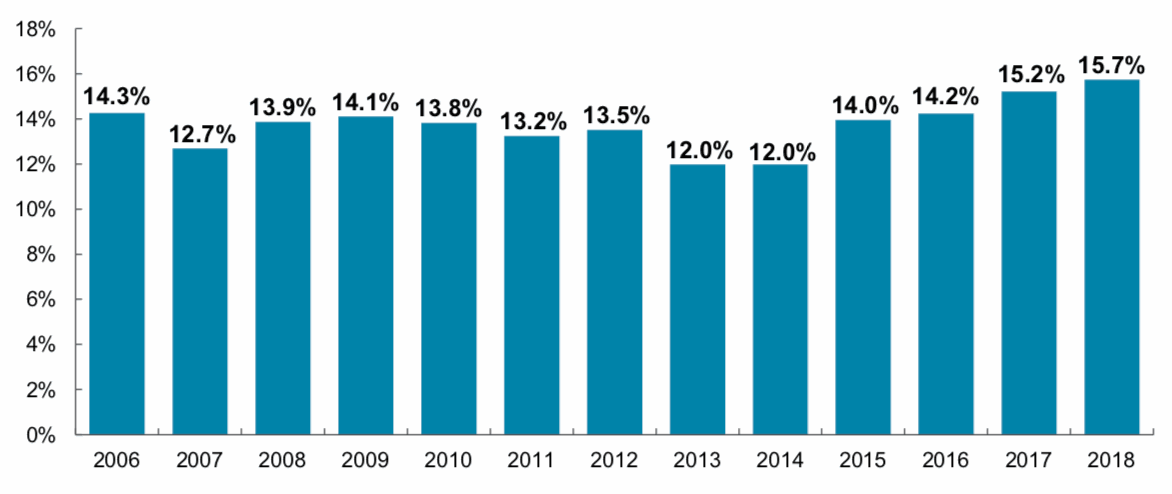

The overall reinsurance cession ratio of the reinsurers’ Aon tracks rose to 15.7% in 2018, up from 15.2% in 2017.

Aon explains that one of the factors driving the upward trend of recent years “is the increasing amount of peak risk being transferred to the capital markets.”

The chart below, created by Aon using data from company reports, shows that cessions have risen by almost 4% since the explosion of ILS market growth took off in 2014.

The increasing cession of underwritten premiums to third-party capital and ILS investors or funds does mean that less is retained and once again raises the question over how much new business needs to be written on the front-end to allow the fee income received to compensate for premium directly earned that is now passed on.

It’s a difficult juggling act for these reinsurers, as they work out how to use the capital markets to drive higher growth, while leveraging the fees earned to improve their income at the same time.

Gradually these companies are adding roles as servicers of risk, rather than holders, to their operations.

This is of course positive for the investors seeking to access quality sources of insurance linked investment returns, although conflict of interest questions do always raise their heads, but overall this strategy could be potentially dilutionary for the reinsurer itself, unless they can get the mix of fees and earned underwriting profits just right.

Aon recently also said that it believes alternative capital growth will resume shortly, once the impact of the recent catastrophes is dealt with. That bodes well for reinsurers looking to double-down on their gross to net strategies, with the use of the capital markets.

———–

Register today to attend our next ILS conference in Singapore, ILS Asia 2019.

Register today to attend our next ILS conference in Singapore, ILS Asia 2019.

We’re returning to Singapore for our fourth annual ILS market conference for the Asia region. Please register today to secure the best prices. Early bird tickets are still on sale.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.