As the market for insurance-linked securities (ILS) and catastrophe bonds enters a new year that is expected to be busy, Aon Securities explained that the breadth of the investor base has now helped to reduce pressure on any single market for capacity, as well as expanded syndication of risk.

The catastrophe bond market has now passed $100 billion of cumulative issuance on Aon Securities numbers, a significant milestone for the marketplace.

Aon’s number is based on 144A catastrophe bonds and some life or specialty cat bond issuances we believe, but does not include private cat bond activity or the emerging mortgage ILS transactions.

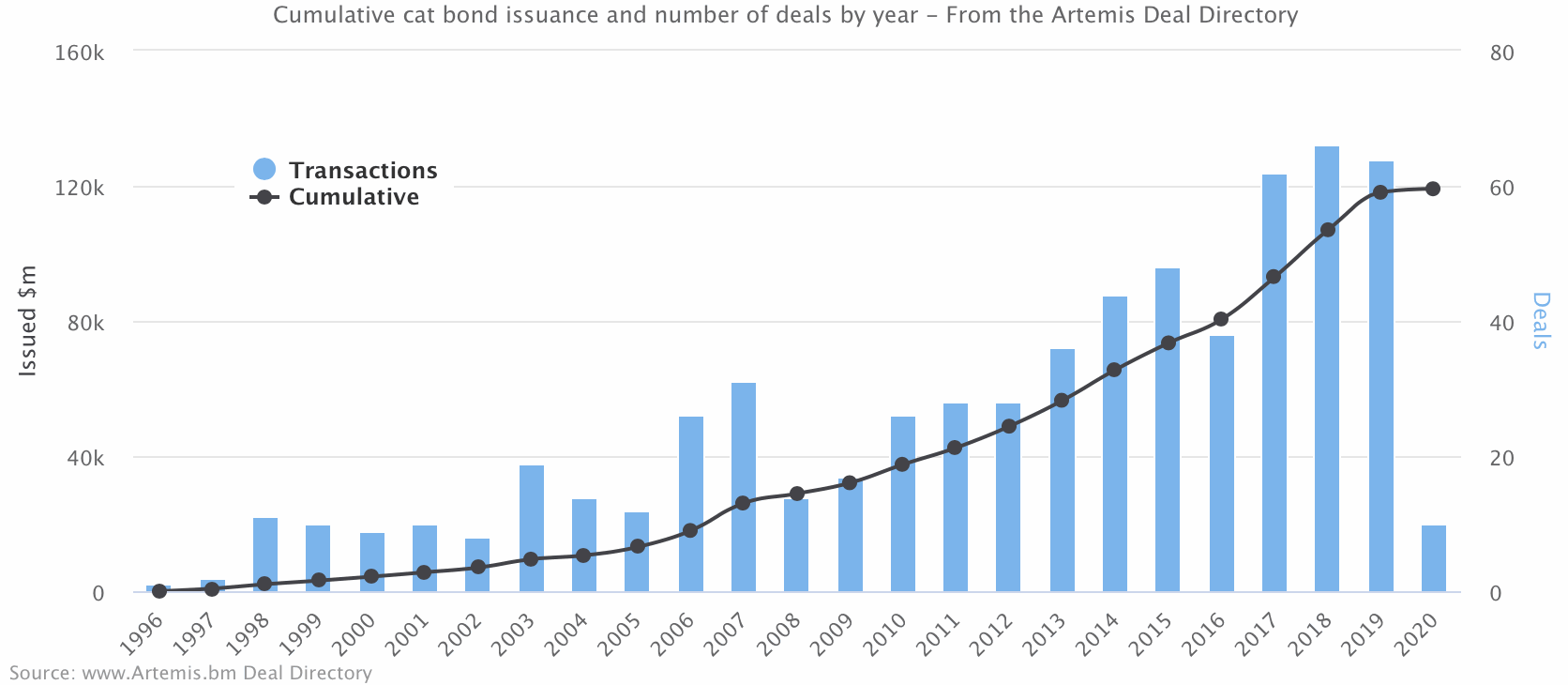

Artemis’ figure for cumulative cat bond and related ILS issuance is now at more than $119 billion, based on the transactions we include in our extensive Deal Directory. If we exclude the mortgage ILS transactions the figure falls to $110 billion.

Differences in tracking aside, Aon Securities highlights one of the key factors that suggests more brisk issuance of catastrophe bonds is ahead, the continued growth and diversification within the catastrophe bond investor base.

ILS and catastrophe bonds has provided “a robust non-correlating asset class for investors, producing an average annual return of 6.38 percent, and 7.48 percent for 2019,” Aon Securities highlights.

Very attractive figures for any investor, but when you really value the diversification and lack of correlation with broader financial asset classes the benefits to major investors really add up.

This has helped to attract more investors to the cat bond market in recent years.

“Sector investor numbers have grown significantly, with orderbooks in 2019 inclusive of 23 percent more investors, on average, than orderbooks in 2015,” Aon Securities explains.

This has enabled the average order size for a catastrophe bond issuance to actually fall, from $13 million down to $9 million, meaning pressure is less for the really important markets backing any issuance.

That’s a good thing, as this cat bond investor base expansion means deals can be supported more readily without having to rely on one big ILS fund taking a significant chunk of any new issue.

At the same time the investor base has become increasingly sophisticated and professional, with more dedicated ILS fund managers and a plethora of major global institutional investors.

In addition asset managers looking after funds capitalised by sophisticated investors are also a growing component of this market.

This has helped the catastrophe bond market to expand its remit and horizons, taking on more and different risks, while offering an increasing range of coverage options to protection buyers as well.

“As markets increased their level of sophistication and resources devoted to the space, ILS transitioned from being commonly perceived as an exotic alternative investment offering a large premium to a mainstay of many portfolios, supporting the expansion from simple parametric or industry loss structures to coverages more closely resembling those found in the traditional market,” Aon said.

Paul Schultz, CEO of Aon Securities, commented on the ongoing evolution of the catastrophe bond market, “From its beginnings in 1996, the insurance-linked securities sector has shown remarkable growth, reaching a point today where it is an integral component of the way in which re/insurers approach risk transfer.

“Having endured significant tests in recent times, the sector has shown strength in adversity, proving that re/insurers and investors view ILS as being an enduring and important part of the industry.

“Reaching this $100bn milestone is a fantastic achievement, and we anticipate many further successes for ILS in the years to come as it expands into a greater number of geographies and perils.”

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.