Through 2021, Bermuda headquartered insurance and reinsurance firm AXIS Capital managed down its catastrophe probable maximum losses (PML’s) through portfolio pruning and use of third-party capital.

AXIS has been through an overhaul of its property catastrophe reinsurance exposures in recent times and this accelerated at the recent January 1 2022 renewal season.

The re/insurer reported that it cut its property cat book of business by a significant 45% at the 1/1 renewals.

On top of this, AXIS said that it achieved an average rate increase of 7% on property cat business, but also noted that pricing remains mixed and that because of this, the company believes underwriting discipline is paramount at this time.

AXIS is expecting rates to continue increasing in reinsurance at the April and June/July renewal seasons in 2022, so these could present additional opportunities to hone the catastrophe book further.

The rationale behind the pruning has been to reduce volatility in the results of the reinsurance business, while maintaining a global catastrophe market foothold and also working closely with third-party investors to develop access to the cat book for institutional investors that might appreciate its returns.

AXIS has driven down the ex-cat combined and loss ratios considerably in recent years, which it puts down to its portfolio management approach, as well as selectively deploying lower limits into some areas of the market.

The re/insurer believes it can further optimise the underlying loss ratio of the reinsurance business with the use of third-party capital relationships and so this is anticipated to be an area of growth for the company over the coming years.

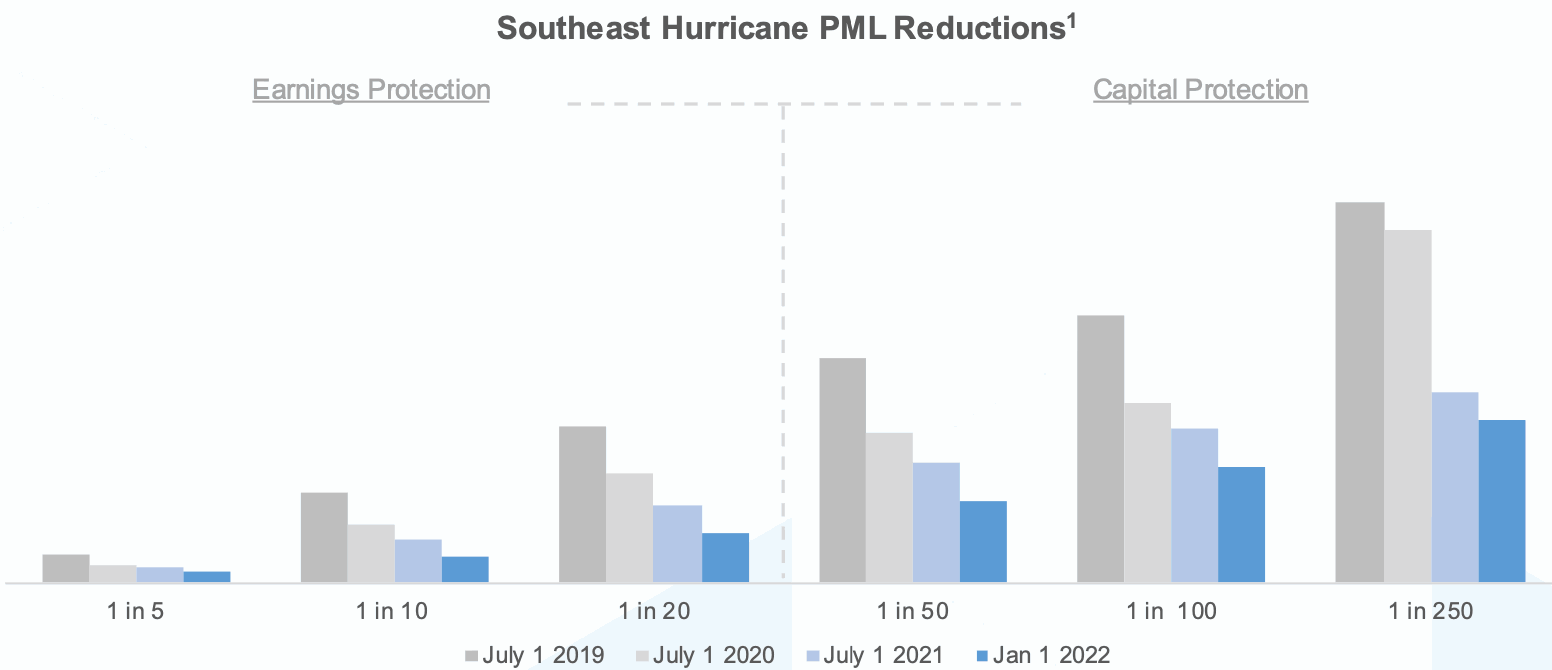

So far, AXIS has lowered its probable maximum losses (PML’s) from catastrophe events across the risk curve, with significant reductions at the higher return period levels, but also steady declines in PML’s at the earnings protection level.

The chart below shows AXIS’ southeast hurricane PML development over the last few years:

Strategic use of third-party capital partnerships has been one driver of these changes, alongside the portfolio pruning and management decisions such as moving away from lower-layers and aggregates, AXIS explained.

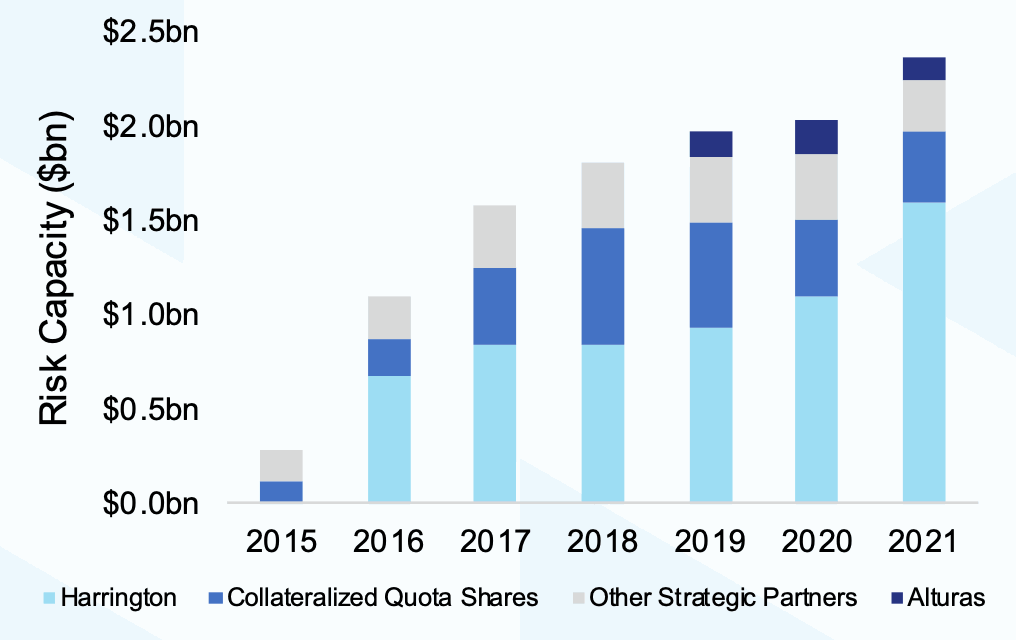

These PML reductions have come at a time when AXIS Capital’s third-party capital under management has actually reduced in recent years.

Part of this has been a refocusing of that part of its business, as well as the loss of some large capital partnerships with investors that have adjusted their strategies in recent years, such as Stone Ridge.

But, the use of collateralized quota share reinsurance arrangements with private investors and funds, as well as AXIS’ Alturas Re sidecar structure, both continue for the company and are core to these efforts to remodel the catastrophe book and resultant PML’s.

Thanks to the Harrington Re reinsurance venture, which is largely third-party capitalised but more of a total-return play than ILS, AXIS’ strategic capital partners activities continued to expand in 2021, in terms of capacity.

It’s also important to note though, that AXIS’ fee income from its strategic capital partner activities has continued to build and is providing a significant additional source of earnings for the company.

Now that the catastrophe PML’s are so reduced and with reinsurance market conditions and pricing continuing to improve, we suspect that AXIS may find opportunities to build again on the quota share capacity it enjoys from third-party investors, as well as to launch new ILS products through which investors can participate in its underwriting returns.

Watch our recent video interview with AXIS Capital executives here.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.