Global insurance and reinsurance giant AXA has expanded its quota share reinsurance protection across its property book, which compensates for a reduction in excess-of-loss reinsurance protection as the firm saw its retentions and the attachment points rising across multiple perils at the renewals.

Overall AXA continues to push to reduce its natural catastrophe exposure, with a further ~35% reduction in the AXA XL Re reinsurance division now targeted for 2023.

That follows a ~40% reduction in the nat cat exposures the AXA XL reinsurance portfolio held a year ago.

However, there is a balancing of cat exposure across the AXA business, given more challenging reinsurance renewals and adjustments to the way the company is set to cede risk going forwards.

AXA has a higher retention in its primary business for 2023, as attachment points have risen across multiple of its reinsurance peak peril scenarios.

Offsetting this though, is the planned reduction in catastrophe exposure at AXA XL Re, as well as increased cessions across AXA XL insurance quota share arrangements.

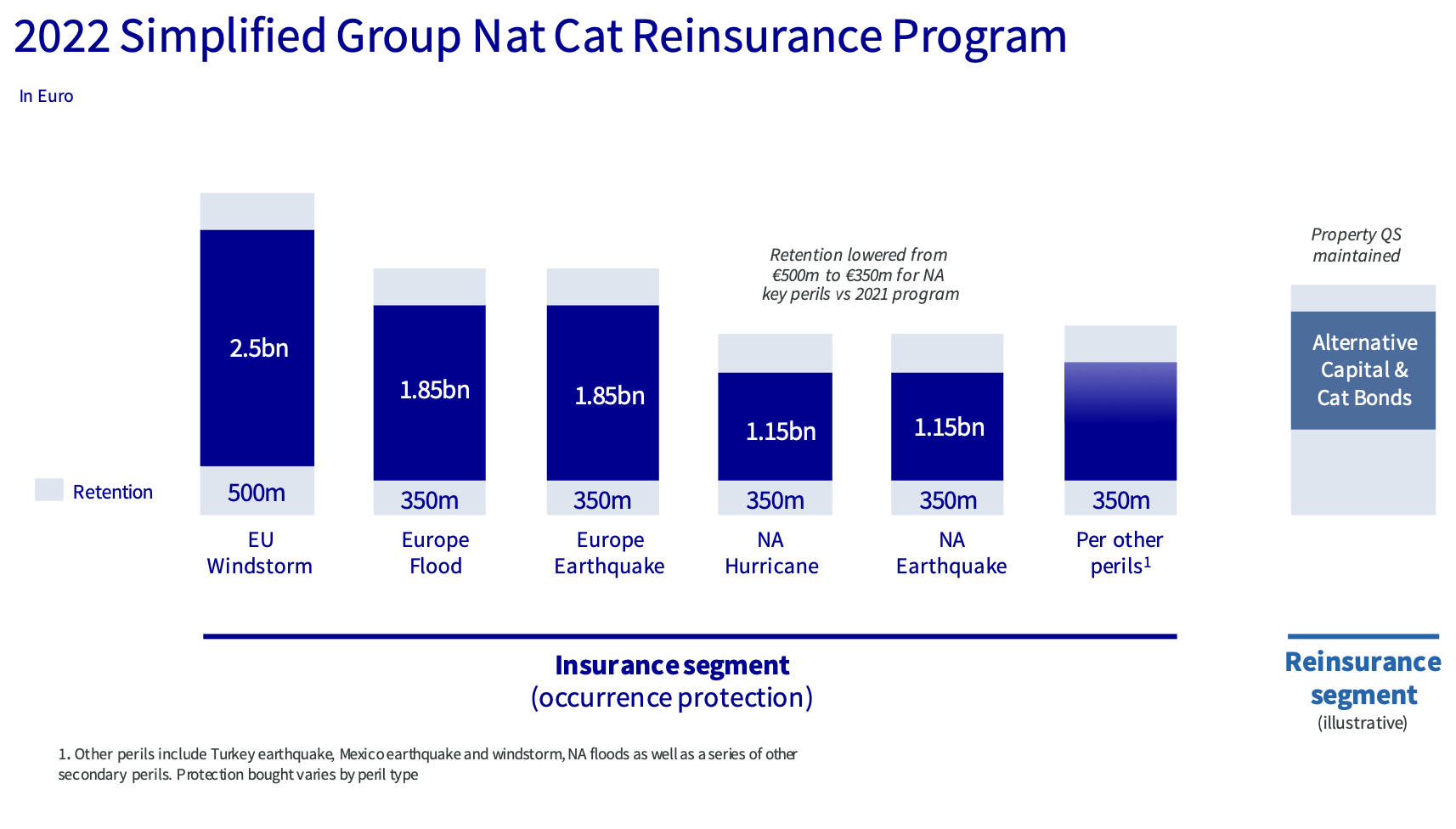

You can see AXA’s 2022 reinsurance arrangements below and the renewed reinsurance program for 2023 underneath that, allowing you to compare and contrast the changes.

The retention and so attachment for AXA’s main reinsurance nat cat perils have risen across the board, some significantly so.

In particular, the North America hurricane and earthquake excess-of-loss reinsurance cover will now not kick-in until EUR 600 million of losses and the coverage has declined from EUR 1.15bn to EUR 1bn across each.

Retentions have also risen across European windstorm, European flood, European earthquake and other perils as well, while the amount of coverage has also shrunk in all cases except for EU windstorm, the only peril AXA has increased its reinsurance limit for.

On the right side, alternative capital and catastrophe bonds continue to play an important role for AXA, while its third-party capital partnerships managed under the AXA XL ILS Capital Management division, with that division managing roughly $1.05 billion of ILS assets at this time.

On the quota share side of AXA’s reinsurance, the cession has been increased for AXA XL’s property lines to 31% for North America and 28% for International risks.

On top of this, AXA has added a new 14% quota share reinsurance arrangement for the AXA XL London market property business.

The quota share reinsurance expansions and addition to cover AXA XL’s London property business, are the elements that AXA believes offset the higher retention across its excess-of-loss reinsurance program.

They have also helped the company manage the costs of its reinsurance renewal, although AXA has noted that higher reinsurance costs in 2023 are planned to be fully offset by pricing actions across its primary property lines and at AXA XL Re.

AXA XL Re’s revenues decreased 27% for 2022 as a result of its nat cat exposure reduction efforts, but the company continues to benefit from the earnings of the AXA XL ILS Capital Management division, that will go some way to offsetting this, although are not disclosed.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.