It’s clear that reinsurance sector returns are now much closer to the levels of return offered by ILS funds to their investors, once again raising the importance of keeping the cost-of-capital low and maximising efficiency in order to make a profitable return and remain competitive in re/insurance.

Reinsurance returns have declined to the point where many are barely able to cover their cost-of-capital, with rating agency Standard & Poor’s saying that the sector only generated returns that were 1.2% above its cost-of-capital in the first-half of 2017.

That’s lowered the return on equity of the reinsurance space to a level where its returns appear to be converging with the insurance-linked securities (ILS) funds space, and in fact there are ILS funds where you could generate a higher return on your investment than investing in reinsurer stocks these days.

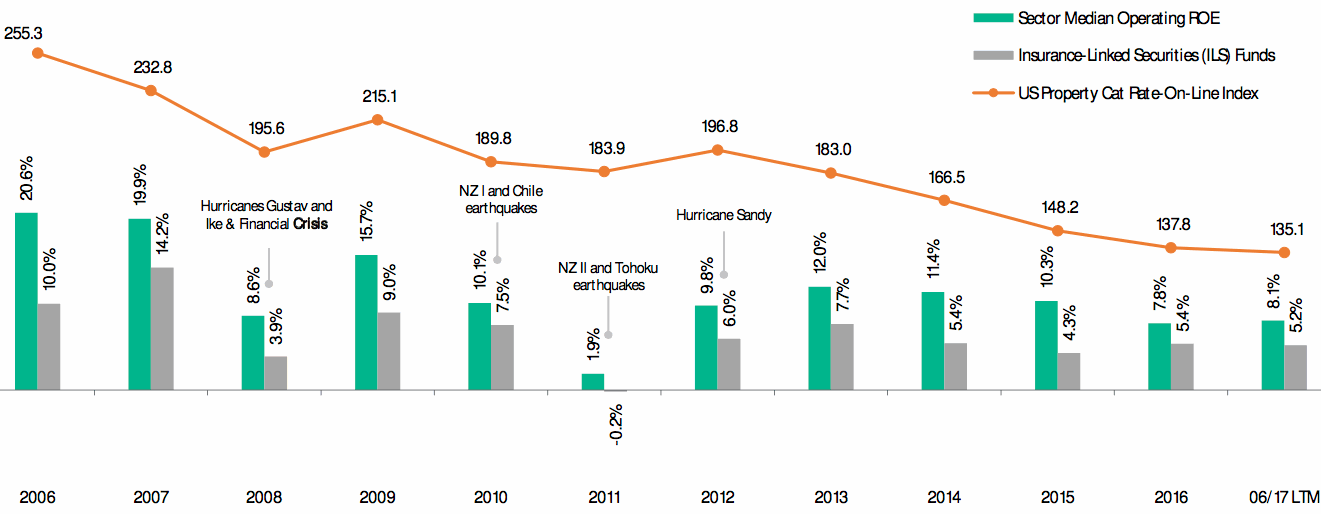

The chart above from rating agency Moody’s shows the steady decline in reinsurance pricing and the equally steady decline in reinsurer median operating return on equity (RoE), against the average return of ILS funds.

While the average return of the ILS fund sector remains 2.9% below the median reinsurer RoE, in the data above, there are numerous ILS funds which generate 6% to 8% annual returns and that have the added benefits of low correlation to financial markets and economic indicators, which makes the investment case for shares in a reinsurer versus allocating to an ILS fund seem less tenable.

The ILS fund sector has been a lesson in efficiency for reinsurance, showing how a different business model can achieve much the same end-result (an underwritten portfolio of risk) but without a lot of the overheads, the correlation with broader financial markets and the challenges of operating much larger, global companies.

As reinsurer returns have declined the importance of efficiency is raised once again, now becoming vital.

But reinsurers are in the main not reducing their costs and in fact the average cost-of-capital of the reinsurance sector is expected to rise through 2017 and 2018, according to S&P, possibly as reinsurers try to spend their way out of the challenging market, while at the same time investing in technology and digitalisation.

Avoiding becoming disrupted is not always easy and reinsurers have shown a tendency to try to spend their way out of trouble, when all the signs in the last five years or more have pointed to the need for a more efficient business model.

Efficiency might be gained through reinsurers embracing of Insurtech and Reinsurtech, along with their increasing use of third-party capital, forays into more risky investment alternatives and of course cost-cutting, but the results will take time to actually lower their costs and in fact costs are likely to rise first before reducing.

There are also risks attached to the strategies being taken to enhance efficiency, particularly in tech where reinsurers are playing the role of venture capitalists in some cases, but with investment teams that often have very little technical experience.

Also on the asset side the shifting of investment portfolios to add yield does not come without risks of getting it wrong and lowering returns as a result.

Finally, those reinsurers embracing third-party capital have to juggle the placing of risks on their own balance-sheet paper and third-party capital, with the potential for reputation damage high, should poor portfolio decisions be taken. There’s also the chance that if the third-party capital is so much more efficient than their own paper, for certain risks, there could be no way back and reinsurers could risk finding themselves as over-staffed, higher cost ILS fund managers.

If returns do truly converge, there would seem little to compel investors to allocate capital to reinsurer stocks over ILS funds and with the diversification and low correlation factor many investors could find ILS far more compelling than reinsurer equity.

The coming months could give reinsurers a chance to stretch their return advantage once again, but early data shows that the reinsurance sector was heading for a break-even year before the hurricanes even struck, suggesting this convergence of returns is likely to become more permanent.

Join us in New York in February 2018 for our next ILS conference

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.