With catastrophe bond market activity having accelerated to record highs in 2025, our extensive Artemis Deal Directory has reached a new milestone, with now over $200 billion in catastrophe bonds and related insurance-linked securities tracked and analysed since its inception.

The Artemis Deal Directory has existed in some form since late 1996 when we began keeping records of the very first 144A catastrophe bonds that came to market.

The Artemis Deal Directory has existed in some form since late 1996 when we began keeping records of the very first 144A catastrophe bonds that came to market.

With the launch of Artemis in 1999 we formalised the Deal Directory as a valuable research tool for those interested in the catastrophe bond asset class and the transfer of reinsurance risks to the capital markets, providing it for free as a data and research service to the market, reflecting our interest in the nascent ILS asset class at the time and belief that transparency could help it grow.

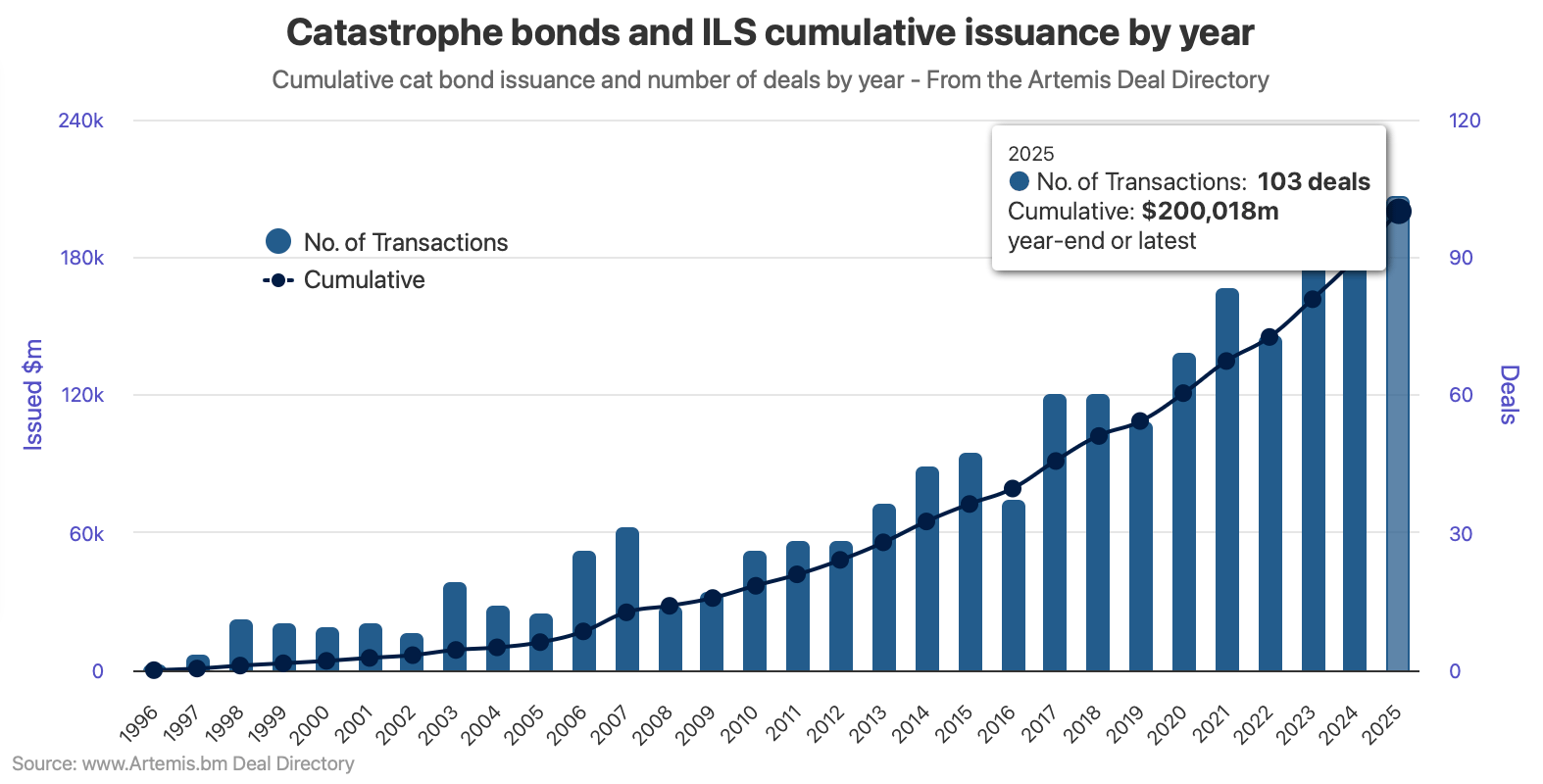

Grow it has, perhaps slowly at first as our Deal Directory had only recorded its first $10 billion of cat bonds and related ILS deals by the end of 2004.

But the pace increased and the Artemis Deal Directory reached $25 billion of catastrophe bond and similar ILS deals tracked in 2007, then reached $50 billion in 2013.

The $100 billion milestone of catastrophe bonds and related ILS deals analysed and tracked in our Deal Directory was reached in 2018, with $125 billion then surpassed in 2021 and $150 billion in 2023.

Thanks to continuing record-breaking levels of catastrophe bond issuance in the last two years, the $200 billion milestone has now been surpassed.

That figure is based on currently settled (so only deals where their issuance is completed) catastrophe bonds, private catastrophe bonds and a handful of ILS structures from “back in the day” that look cat bond-like and found their way into the Artemis Deal Directory as a result.

103 deals have already settled in 2025, across 144A cat bonds and private cat bond arrangements tracked by Artemis, which is a record number and currently could reach 118 deals at least for the full-year if everything in the current market pipeline settles in December.

We don’t include mortgage insurance-linked securities in this cumulative issuance figure, or in our chart where you can analyse this cumulative catastrophe bond issuance data by year.

This $200 billion milestone is reached thanks to the now more than 1,200 individual transaction entries in the Deal Directory.

But the $200 billion is far from every transaction we’ve tracked and analysed for our readers.

We’ve also tracked somewhere around $100 billion in reinsurance sidecar arrangements across P&C, life and other arrangements over the years. It’s hard to be exact as a lot of the sidecar transactions lack detail on their exact capitalisation or size, but we know of close to $80 billion of volumes since 2005.

Plus the mortgage ILS deals we’ve tracked now add up to over $23 billion of issuance as well. While in another area we’ve always been interested in given the suitability of certain risks to capital markets, the longevity risk transfer and reinsurance market, we’ve analysed and tracked over the years add up to 10’s of billions more in transactions we’ve seen.

We do this because we’re still passionate about the potential for capital from institutional investors to add efficiency to reinsurance and risk transfer markets. While the use of capital market securitization plumbing and infrastructure provides an innovative way to structure insurance risks into investable formats, resulting in the convergence of re/insurance and financial markets we’ve written about for so many years.

At the current pace of issuance, the $250 billion mark, for cumulative catastrophe bond and related ILS issuance tracked by Artemis, may only be two to three years away (if the recent issuance pace can persist).

There is every chance the pace picks up further, given the evident need for growing levels of risk transfer capacity to support catastrophe insurance and other reinsurance market demand.

We could well end up reporting the next major milestone even more quickly than we think.

2025 has seen numerous records fall in the catastrophe bond market and with over $20 billion of 144A deals already issued the market is on-course to set a very high bar for the coming years.

Download our free quarterly catastrophe bond market reports.

We track catastrophe bond and related ILS issuance data, the most prolific sponsors in the market, most active structuring and bookrunning banks and brokers, which risk modellers feature in cat bonds most frequently, plus much more.

Find all of our charts and data here, or via the Artemis Dashboard which provides a handy one-page view of cat bond market metrics.

All of these charts and visualisations are updated as soon as a new cat bond issuance is completed, or as older issuances mature.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.