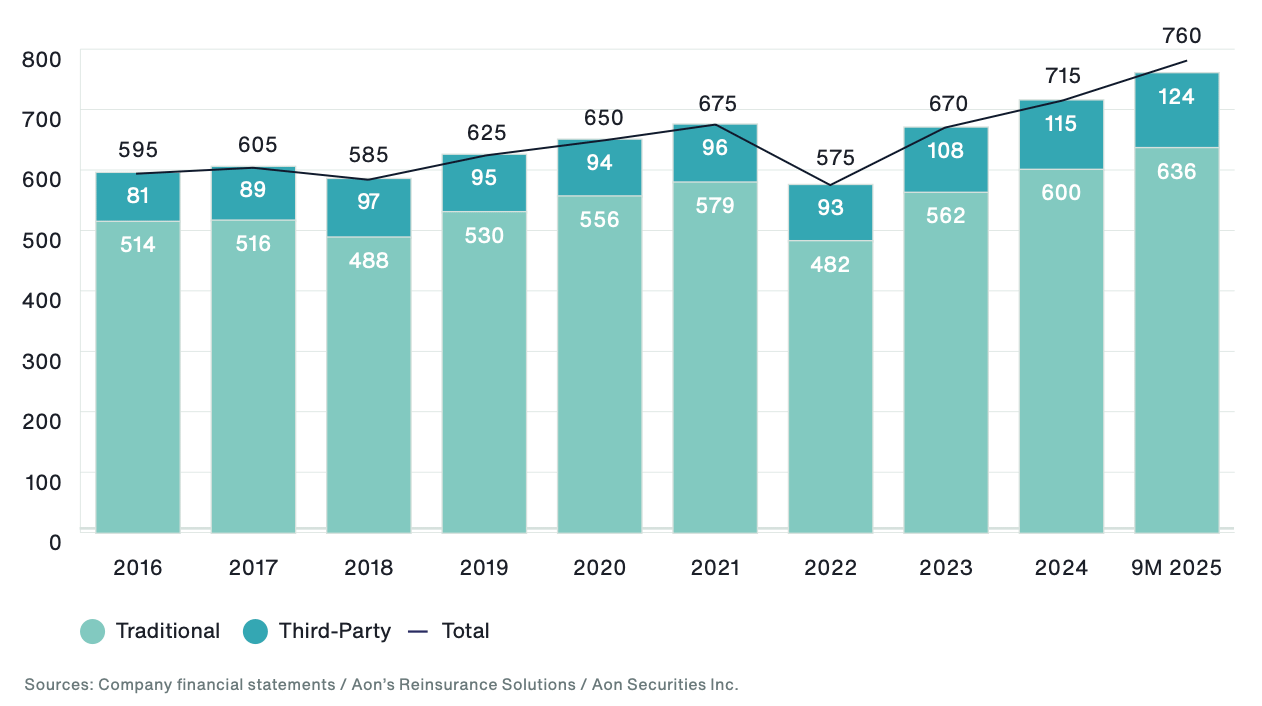

Alternative reinsurance capital, so that deployed through insurance-linked securities and related collateralized structures, reached a new high of $124 billion as of September 30th 2025, according to Aon and the broker expects the growth trend to persist as third-party investors show “consistent” appetite for returns from the sector.

In a just released new report from Aon’s Reinsurance Solutions, the broker explains that global reinsurance capital reached new heights by the end of the third-quarter of 2025.

The core drivers were reinsurer’s own retained earnings, as they experienced another strong year of underwriting and investment returns, as well as the growth of third-party reinsurance capital deployed in insurance-linked securities (ILS) structures.

Traditional reinsurance capital grew 6% through the first nine months of 2025 to reach a new high of $636 billion.

But, alternative or ILS capital grew faster, recording 9% growth through the first nine-months of the year to reach the new $124 billion high, largely driven by elevated catastrophe bond and sidecar activity.

Aon explains that the global reinsurance capital pool continues to widen, with ILS and alternative capital slightly growing its share over the last nine months.

“With each year, the relevance of alternative sources of capital continues to grow. Third-party capital reached a new high of $124 billion at the end of the third quarter, an increase of $9 billion relative to the end of 2024,” the broker stated.

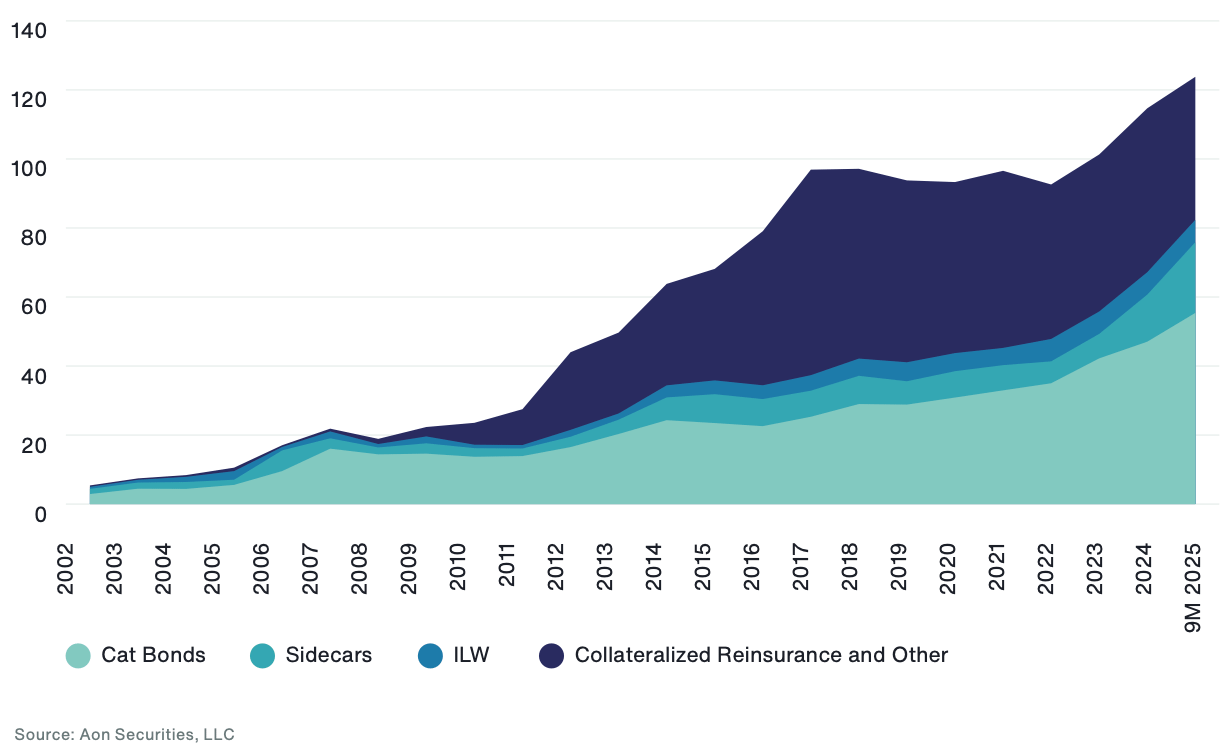

Catastrophe bonds and sidecar activity were the main drivers of the growing ILS capital base, with both these structures anticipated to continue seeing investor inflows.

Aon further said that, “Increased investor appetite is lowering retrocession costs and allowing many traditional reinsurers to expand their sidecar and/or catastrophe bond programs.”

You can see the expansion in the catastrophe bond and sidecar segments of alternative reinsurance capital in the chart from Aon Securities below:

Going into more detail, the broker explained, “Throughout 2025, third-party capital has become increasingly mainstream. The overall ILS market grew nearly $10 billion from January through September, with strong gains in both catastrophe bonds and sidecar structures which are increasingly spanning both property and casualty lines of business. For the third year in a row, investors benefited from relatively benign catastrophe conditions and strong margins, resulting in 2025 double digit returns for the overall market.

“These strong gains, particularly in the summer months, resulted in an abundance of third-party capital. With investors looking to reallocate funds for 2026, clients saw meaningful pricing reductions during the fourth quarter which were commensurate with how the traditional reinsurance and retrocession markets fared.

“Aon approaches 2026 with anticipation for growth and the increasing importance of ILS as the largest single source of catastrophe capacity in the global insurance market today, is unmistakable.”

Aon is anticipating more strong growth for the ILS and alternative reinsurance capital sector in 2026.

“We believe that the growing value of new reinsurance capacity, enhanced ceding commissions and partnerships with skilled asset managers will encourage more clients to pursue sidecars in 2026,” Aon explained. “With more than $10.3 billion of maturing catastrophe bond capacity anticipated in the first half of 2026 and investors consistent appetite to put capital to work with both catastrophe bonds and sidecars, we expect another year of growth for third-party capital.”

Aon further said in its report, “New capital sources continue to enter the market, with large alternative asset managers, such as Blackstone and Brookfield, having recently emerged as active participants in the property and casualty industry. Such firms increasingly see reinsurance as a source of non-correlating insurance product that, coupled with investment returns, can support fast-growing private debt strategies, often with lower return hurdles than private equity.

“An increasingly diverse range of capital providers, supporting an expanding range of insurance risks through a variety of structures, is positive news for clients. Aon continues to facilitate innovative capital solutions for our clients, including notable sidecar and Lloyd’s deals in 2025, with more in the pipeline.”

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.