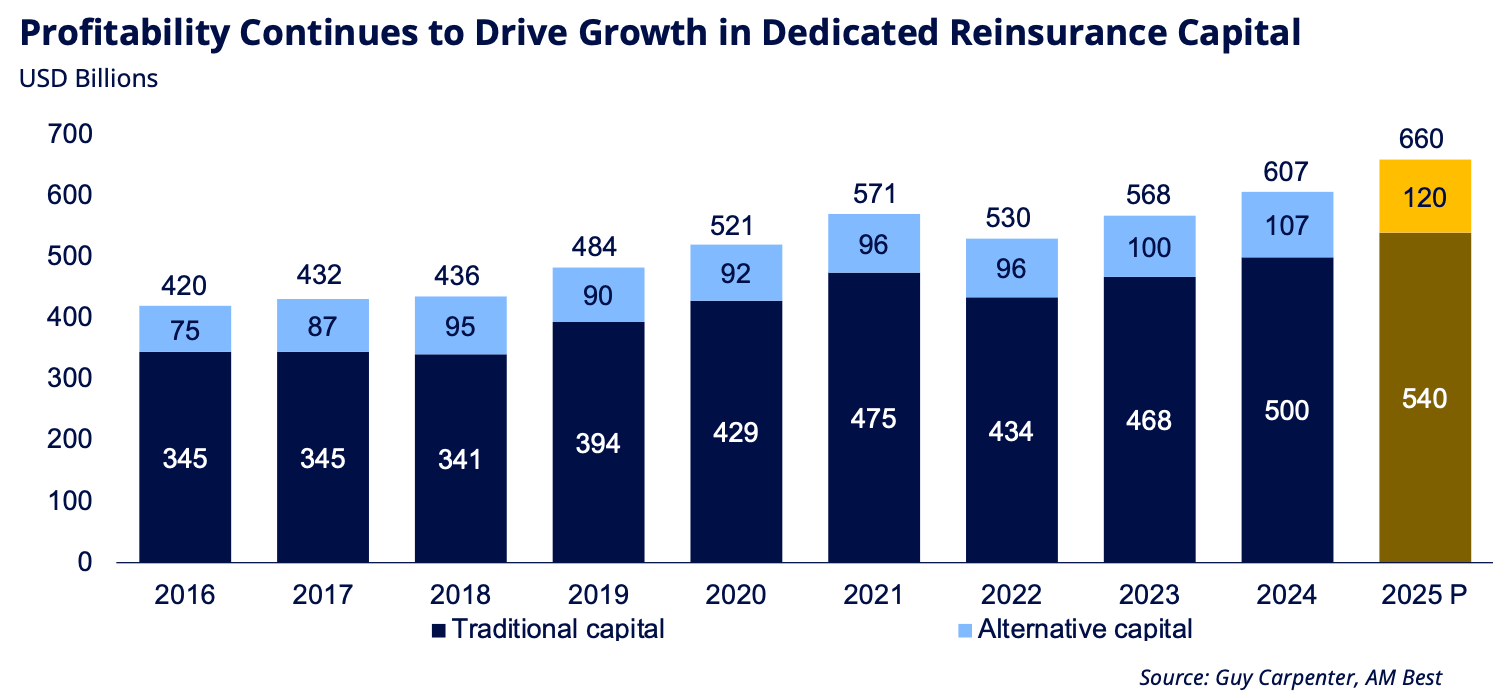

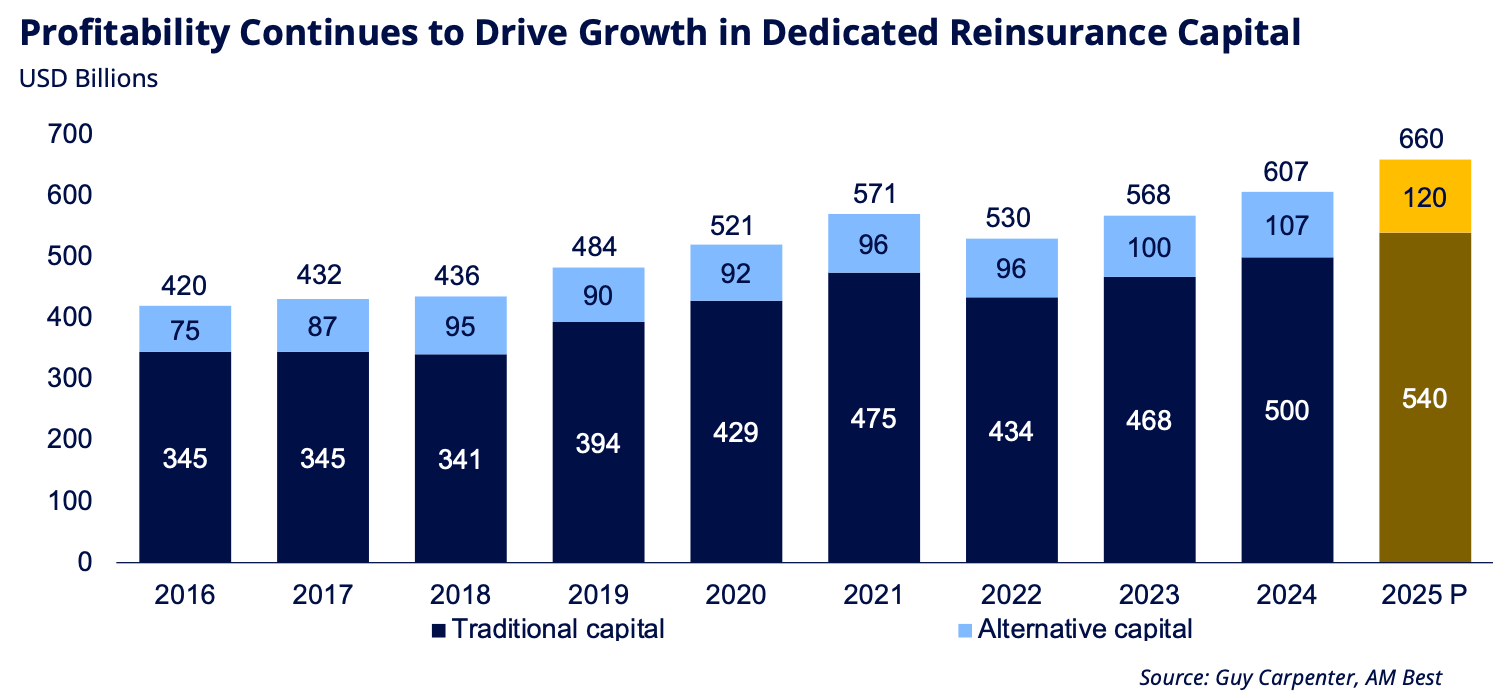

Third-party capital deployed in reinsurance through insurance-linked securities and other alternative structures is now forecast to have grown over 12% during the course of 2025 to a record $120 billion, as broker Guy Carpenter and AM Best lift their projection from the 7% expansion anticipated earlier this year.

Back in August, the mid-year projection at the time from rating agency AM Best and reinsurance broker Guy Carpenter was for third-party capital to expand by almost 7% in 2025, being projected then to end the year at a new high of $114 billion.

Back in August, the mid-year projection at the time from rating agency AM Best and reinsurance broker Guy Carpenter was for third-party capital to expand by almost 7% in 2025, being projected then to end the year at a new high of $114 billion.

But, with the accelerated levels of activity in catastrophe bond issuance and other insurance-linked securities (ILS) structures, the pair have now updated their projection.

The latest data indicates alternative capital expansion of more than 12% for 2025, to reach the new $120 billion high, up from $107 billion at the end of 2024.

At the same time, traditional reinsurance capital is now projected to have grown by 8% to reach $540 billion, up from the previous projection made in August of 7% growth to reach $535 billion.

Overall, global reinsurance capital is now expected to end the year at $660 billion, growing almost 9% this year, again higher than the previous projection for 7% growth to $649 billion.

Of course, as the chart indicates, it is not just accelerated uptake and issuance of third-party capital, or raised traditional capital, that are the only sources of reinsurance capital growth.

Earnings are a key driver for the build-up of reinsurance capital, which has been a significant factor in the softening of rates at the January 2026 reinsurance renewals.

Catastrophe bond and ILS retained returns have been boosting capital levels, while for traditional reinsurers there strong ROE’s have also served to boost reinsurance capital levels higher.

Guy Carpenter stated, “Capital growth arising from underwriting profits, retained earnings, recovering asset values and robust investor interest, particularly in alternative capital and catastrophe bonds. Trade tensions have not affected capital flows, with a well-functioning reinsurance market.”

Guy Carpenter is anticipating reinsurance capital will keep growing as well, both through ILS structures and reinsurers.

The broker said, “A further estimated USD 50 billion in capital is forecast to be added in 2025-2027. When interest rates and bond yields fall, this could stimulate additional growth in alternative capital, as its relative uncorrelated return potential improves.”

This strong growth of alternative capital in reinsurance is driving new protection buying opportunities across the range of ILS structures for cedents.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.