The average return of the insurance-linked securities (ILS) fund market was dented in October 2020 by some selling pressure on certain aggregate catastrophe bond positions and reserve setting for potential losses to catastrophe reinsurance programs due to the COVID-19 pandemic.

According to the Eurekahedge ILS Advisers Index the average return of catastrophe bond and insurance-linked securities (ILS) funds was -0.03% in October 2020.

According to the Eurekahedge ILS Advisers Index the average return of catastrophe bond and insurance-linked securities (ILS) funds was -0.03% in October 2020.

Catastrophe bond funds suffered due to a number cat bonds that provide annual multi-peril aggregate reinsurance protection covering North America were sharply marked down in the secondary market, as they saw qualifying losses from catastrophe and severe weather events moving closer to their attachment points, ILS Advisers explained.

During the month of October, ILS Advisers reports that cat bond prices lost 0.76%, which drove a -0.25% total return for the Swiss Re Global Cat Bond Index.

On top of this, the subgroup of ILS funds that invest in collateralised reinsurance and private deals also saw their returns dented during October.

As we had previously reported, some ILS funds had set reserves for potential exposure to business interruption losses due to the COVID-19 pandemic that could emanate from certain European catastrophe reinsurance programs.

It’s also possible there has been some erosion of certain private ILS positions by the hurricane activity seen during the month.

The result was that, of the funds tracked by ILS Advisors for the Eurekahedge ILS Advisers Index, pure catastrophe bond fund returns as a group were were down -0.24% in October 2020.

The subgroup of funds investing in private ILS arrangements were positive for the month, with an average return of 0.12%.

The upshot was the average decline of -0.03% for October, but ILS fund performance covered a wide range, as is often seen.

The difference between the best and the worst performing ILS fund was 3.7% in October, with 19 ILS funds tracked in the Index reporting positive performance and 14 reporting negative returns for the month.

That means a good number of ILS funds were actually positive, some particularly so, for the month. So as ever the range of strategies available in the ILS fund market means October was another good month for some market participants.

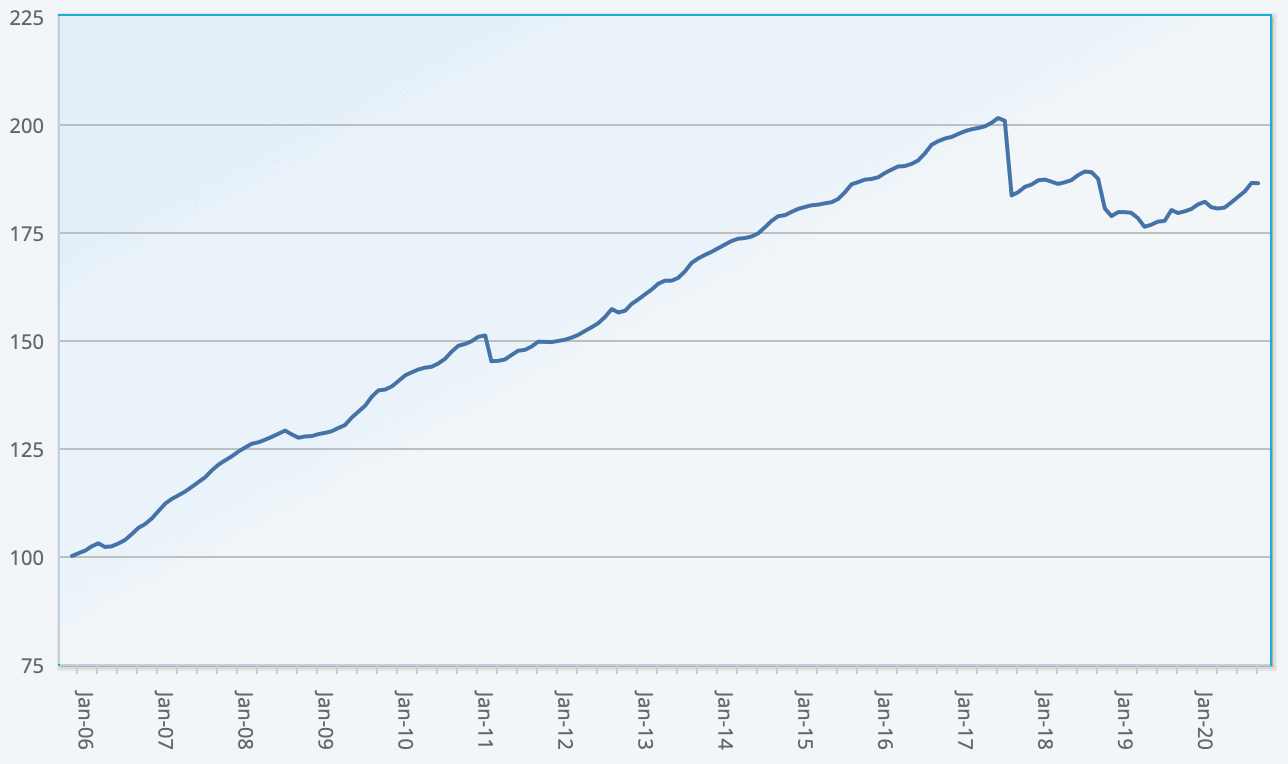

You can track the Eurekahedge ILS Advisers Index here on Artemis, including the USD hedged version of the index. It comprises an equally weighted index of 33 constituent insurance-linked investment funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond investment space.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.