Insured catastrophe losses around the globe continue to run ahead of average for 2020 after September, analyst firm Jefferies said, explaining that because frequency appears to be the main driver of losses this year it is likely primary carriers will retain a significant proportion of the costs so far.

However the pressure on aggregate reinsurance contracts persists and could intensify.

It’s expected that further losses may fall to reinsurance capital if the trend towards more frequent loss events continues, even if they aren’t as severe in terms of overall industry-wide impact.

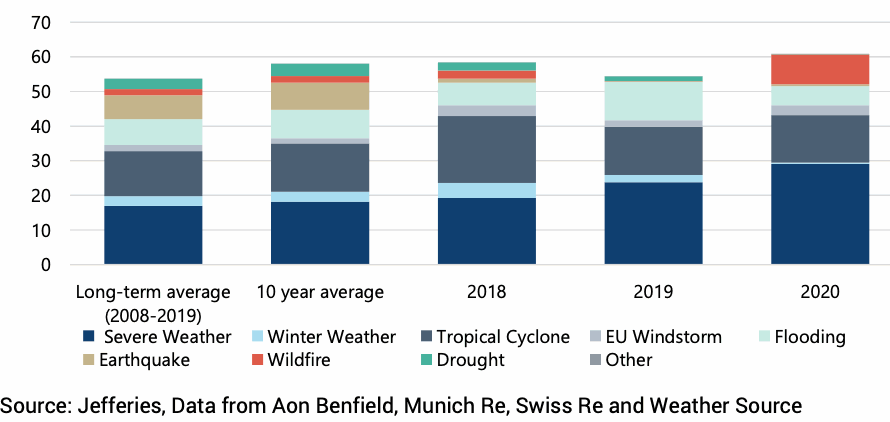

At this point in the year, at the end of the third-quarter, Jefferies analysts estimate that insured catastrophe losses are currently running some 13% higher than the long-term average (2008-2019) and 5% higher than the 10 year average.

Wildfires have now become a significant contributor to catastrophe losses for the insurance and reinsurance industry, after September, with Jefferies estimating that U.S. wildfire insured losses amount to around US $8.6 billion by the end of last month.

Explaining how the catastrophe losses breakdown, the analysts said, “Historically, the majority of insured losses over the same period year-to-date (January to September) have come from the severe weather and tropical cyclone perils, with wildfire only becoming a material contributor in more recent years. In this regard, 2020 year-to-date shows in line tropical cyclone losses, but more severe weather and considerably higher wildfire losses.”

Adding that, “For 2020 our reading of the data year-to-date is that the frequency of insured events is higher than average, while the severity of events is in line or below. For the insurance industry, we would therefore expect an outsized proportion of insured losses to remain on insurer’s balance sheets, leading to a high catastrophe loss ratio, while reinsurers experience catastrophe losses nearer to a level that’s in line with average (and probably therefore in line with their budgets).”

The suggestion that insurers retain more losses holds good year-to-date, but as the year continues we are likely to see increasing flow of losses through aggregate reinsurance arrangements that are triggered, particularly if we have any more landfalling tropical cyclones or wildfire activity picks up again as that season continues.

The frequency of smaller loss events has been an increasing driver of losses to the insurance, reinsurance and ILS market in recent years, with so-called secondary perils also driving more and more losses it seems.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.