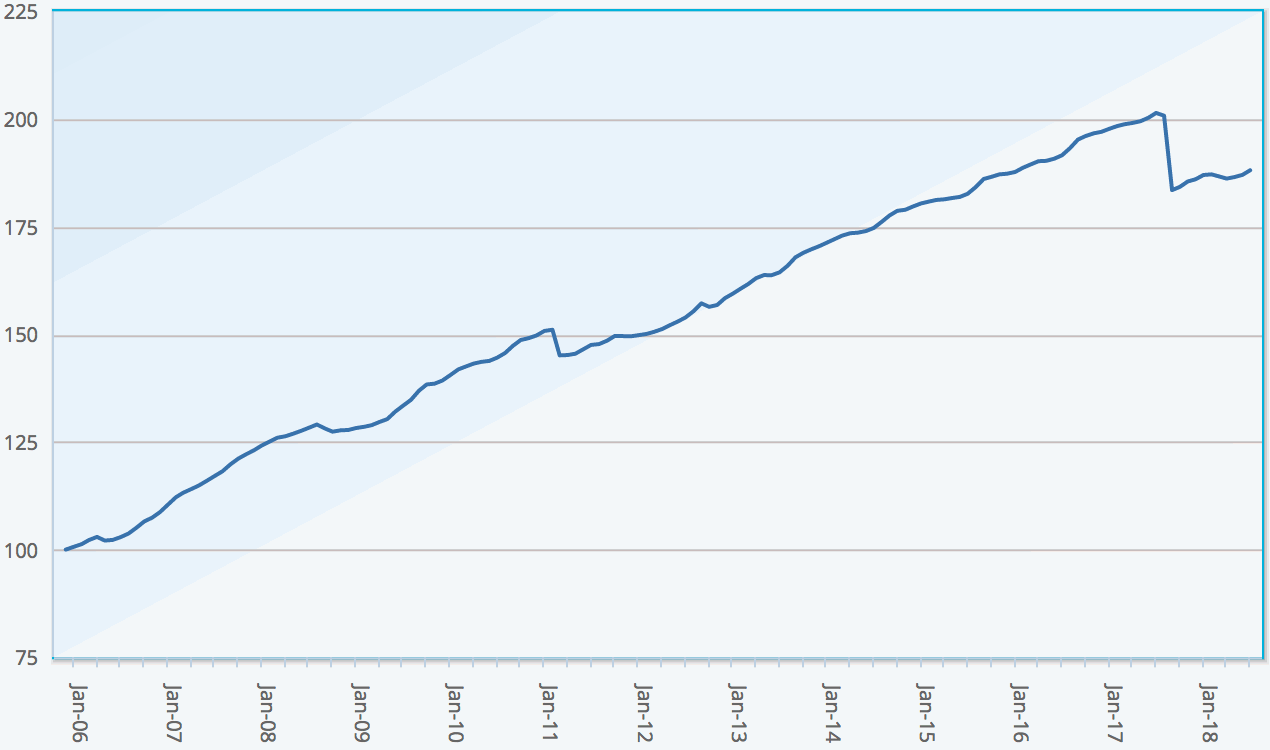

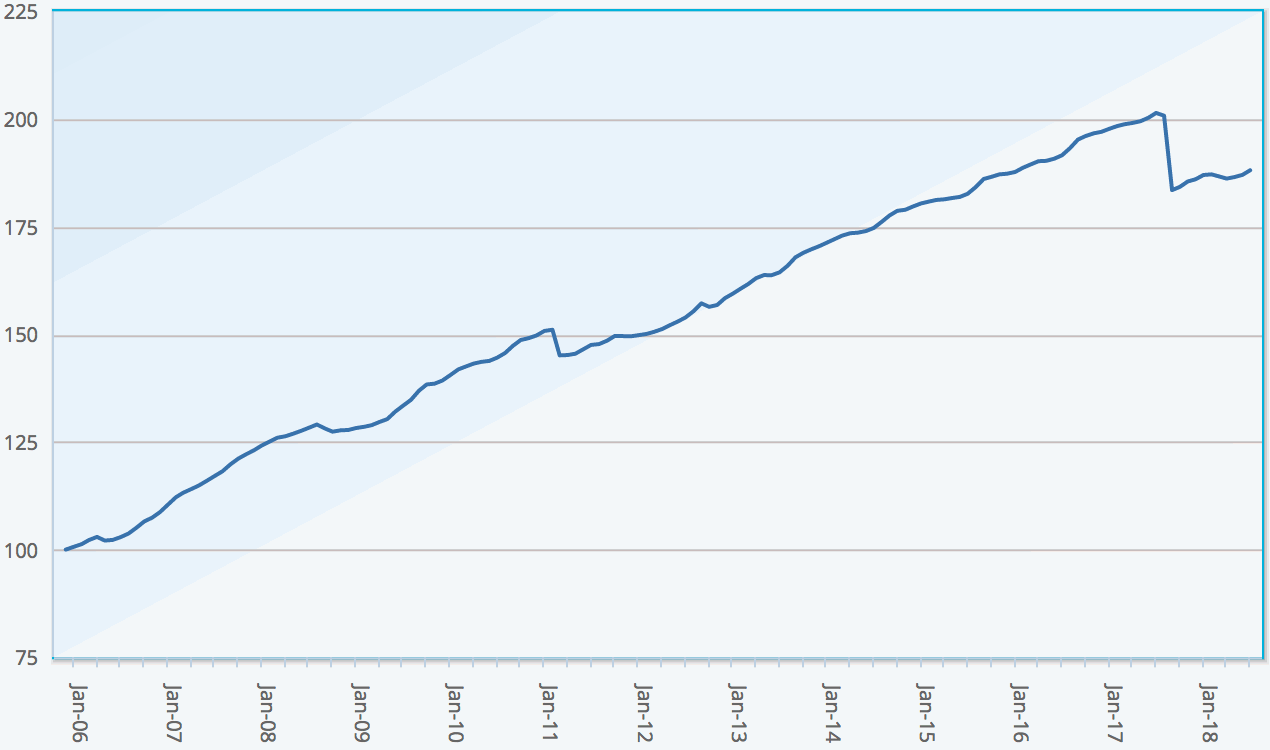

The performance of insurance-linked securities (ILS) funds in August 2018 was hit by a number of factors, leading to an average return for the market of 0.45% for the month, which is below the long-term average.

The month of August saw impacts to both the catastrophe bond and private ILS, or collateralised reinsurance, focused funds in the marketplace, with catastrophe bond loss creep due to increasing estimates for hurricane Irma one factor, and the erosion of aggregate retention and deductibles on certain private ILS another feature of the market.

The month of August saw impacts to both the catastrophe bond and private ILS, or collateralised reinsurance, focused funds in the marketplace, with catastrophe bond loss creep due to increasing estimates for hurricane Irma one factor, and the erosion of aggregate retention and deductibles on certain private ILS another feature of the market.

The 0.45% average ILS fund return in August 2018 is below the 13 year average of 0.68% and takes the year-to-date return to 1.62%, which remains the second lowest in the thirteen year history of the Eurekahedge ILS Advisers Index.

Overall, 26 of the ILS funds tracked the Index made positive returns for the month, while 7 were negative. The gap between best and worst performing was again stark, reflecting the wide array of strategies on offer in ILS funds, at 2.72%.

Stefan Kräuchi, Founder of ILS Advisers explained the performance differences to Artemis, “Out of the 7 negative funds, 5 are pure cat bond funds and 2 are private ILS funds. Pure cat bond funds as a group were up by 0.16% while the subgroup of funds whose strategies include private ILS increased by 0.67%. Private ILS funds on average continued to underperform pure cat bond funds YTD.”

The performance gap between private ILS and pure catastrophe bond funds is now 1.67% on an annualised basis year-to-date.

For August 2018, the biggest gainer in the Index is a private ILS fund that increased by 1.95%, while the biggest loser was a pure cat bond fund that lost 0.77% for the month.

The increased loss estimates from Florida headquartered primary insurer Heritage and the resulting impact on its at-risk Citrus Re catastrophe bonds was the driver of negativity in the catastrophe bond market during the month.

“Citrus Re’s middle layers were the main factors dragging the cat bond fund performance. After Heritage uplifted their losses regarding Hurricane Irma, the 2017-1 A tranche of Citrus Re fell almost 28% while the 2016-1 D-50 lost 24%, according to the average bids from major brokers. And the same data source shows the prices of 2017-2 A, 2016-1 E-50 and 2015-1 C tranches already fell to only several cents to zero,” Kräuchi explained.

Other tranches of Citrus Re have also faced additional price pressure due to the increase in loss estimates from Heritage, resulting in a sometimes wide gap between highest and lowest bids in secondary pricing.

As a result some catastrophe bond funds have struggled with valuations for these assets and depending on where you take your pricing data from and whether average or best bid approaches were taken.

Kräuchi commented, “The situation will be magnified especially during major events when a number of bonds are considered to be affected and different brokers receive and process information differently. Investors should be aware of such variables when making investment decisions.”

On the private ILS side of the market there was evidence of aggregate erosion, as events during the months eroded some of the cushion for a number of private ILS or collateralised reinsurance contracts.

It’s expected that September’s hurricane Florence and Japanese typhoons may erode some aggregates even further.

Eurekahedge ILS Advisers Index, showing average return of ILS and cat bond fund market - Click the image for more data on ILS fund performance

You can track the Eurekahedge ILS Advisers Index on Artemis here, including the new USD hedged version of the index. It comprises an equally weighted index of 34 constituent insurance-linked investment funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond investment space.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.