Mortgage insurance specialist MGIC, is watching the development of the mortgage insurance-linked notes (or insurance-linked securities) market closely and the success of transactions so far is likely to encourage new sponsors like MGIC to come forward.

MGIC Investment Corporation, the parent of Mortgage Guaranty Insurance Corporation (MGIC), underwrote roughly $500 million of premium in the first-half of the year and has roughly $200 billion of primary mortgage insurance in force, with a portfolio that covers more than one million mortgages.

That makes the firm a strong candidate to be looking for new and diversified sources of mortgage reinsurance protection, which makes the growing mortgage ILS market a likely route to source efficient risk capital.

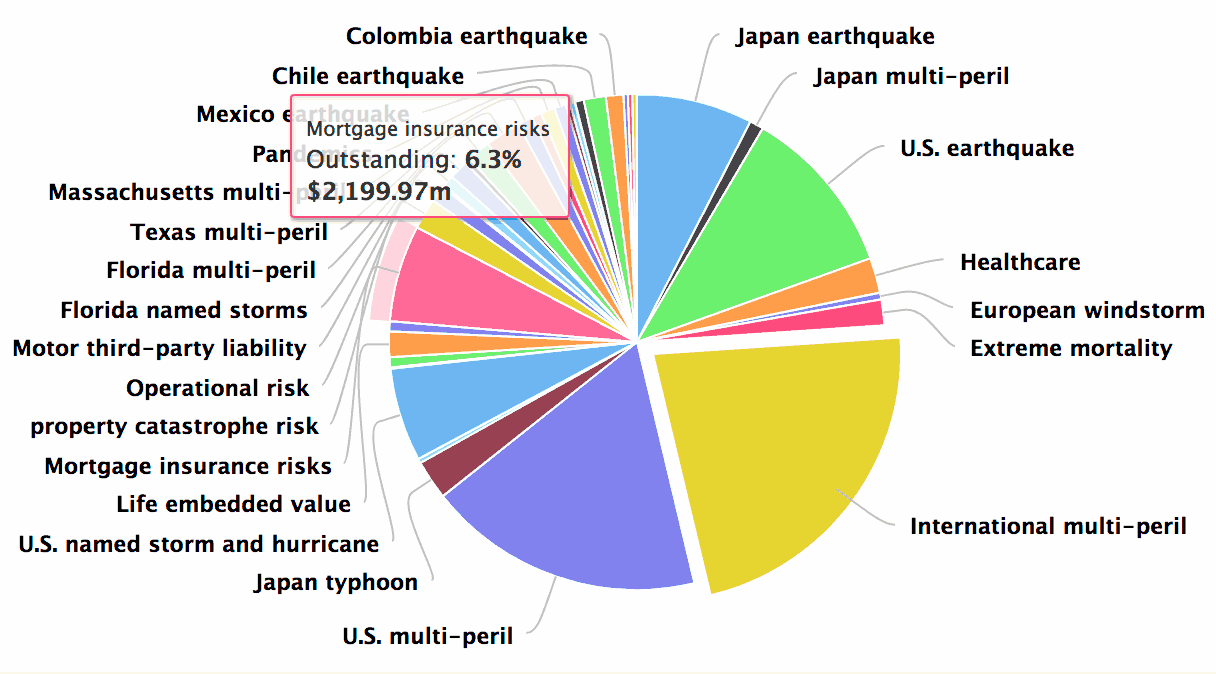

According to Artemis’ data from the extensive catastrophe bond and related ILS Deal Directory, the mortgage insurance-linked note and ILS market has now reached an outstanding size of $2.2 billion, the largest it has ever been.

The completion of NMI Holdings, Inc’s second mortgage ILS deal, a $264.55 million Oaktown Re II Ltd. transaction, has helped the burgeoning mortgage insurance-linked note market reach a size where it now makes up over 6% of the outstanding market, as tracked by Artemis’ data (click the image below for an interactive version of the chart).

Still, only three mortgage insurers have already entered the ILS market, issuing insurance-linked note (ILN) transactions to take advantage of the capital market investor appetite for insurance risk linked investments.

As well as NMI with the most recent transaction, Arch Capital Group Ltd. has tapped the ILS market repeatedly with its Bellemeade Re series of mortgage ILS deals (come of which it inherited through the United Guaranty acquisition and Essent Guaranty recently debuted with the Radnor Re mortgage ILS transaction.

Given MGIC’s position as the largest mortgage insurer in the United States it would be no surprise to see the firm follow suit, and the ILS market as a source of reinsurance is clearly on the firms radar.

In fact, the subject was raised during the MGIC Investment Corporation earnings call recently, with CEO Patrick Sinks commenting on the ILS market development in mortgage risk.

“It’s something that we’ve looked at overtime and we’ll continue to look at potential execution there,” Sinks commented.

He explained that, “We have a traditional reinsurance program in place and we think about their potential use.”

He said that the insurance-linked notes can act both as capital management and risk management tools, which perhaps could increase the attraction for MGIC to look closely at the ILS opportunity.

But he noted that its important that any mortgage ILS issuance would be able to co-exist with MGIC’s existing reinsurance tower.

“I guess, it’s positive for the industry that people are going to layoff in various forms, risks that we have to more traditional reinsurance markets or through the capital market. So that’s something we’ll continue to keep an eye on,” Sinks closed on the subject.

During a previous earnings call MGIC’s CFO Timothy Mattke had also expressed an interest in the insurance-linked mortgage opportunity, saying that, “We pay very close attention to what people are doing in the industry and we obviously have conversations about how we execute our current reinsurance structure with traditional reinsurers, versus doing something from an insurance linked note perspective.”

“It’s something we will continue to look at whether it’s for capital release or whether it’s for thinking about risk management sort of purposes,” Mattke said.

It will be encouraging for the investors that allocate to the mortgage insurance-linked securities to see that the largest mortgage insurer is aware of the development of this expansion of the ILS market and watching closely.

The mortgage insurance linked notes are not for everyone in the ILS investor base, having some correlated factors involved, but they are another sign of the expanding remit of the insurance-linked asset class and another effective way that insurers can tap the capital markets for reinsurance coverage, with the help of securitization.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.