The Philippines government is still planning to sponsor a sovereign catastrophe bond, in order to further enhance its national level disaster risk financing, and the recently announced parametric disaster insurance pilot is expected to be expanded to cover the entire country.

The recently arranged parametric disaster insurance pilot was launched with World Bank support and global reinsurance and ILS market backing covering just 25 of the Philippines 81 provinces.

The recently arranged parametric disaster insurance pilot was launched with World Bank support and global reinsurance and ILS market backing covering just 25 of the Philippines 81 provinces.

The parametric insurance pilot is underpinned by reinsurance capital through a catastrophe swap arrangement, which has been backed by some of the world’s largest reinsurers and also the largest catastrophe and weather insurance linked investment manager Nephila Capital.

According to reinsurer Swiss Re, which supported the set up and reinsurance of the parametric disaster insurance scheme, the Philippines will aim to expand this out to cover the entire country, a move which could see the amount of capacity required to back the scheme multiplied by more than three times (based on the $200m+ of risk transferred for 25 provinces today).

Thomas Kessler, Head of Swiss Re’s Global Partnerships team for the South East and East Asia region, explained; “It is the country’s stated ambition to scale up the subnational coverage to all 81 provinces in the coming years, helping Philippines to transition from a highly risk exposed country to one with a comprehensive disaster risk financing strategy that few others can match.”

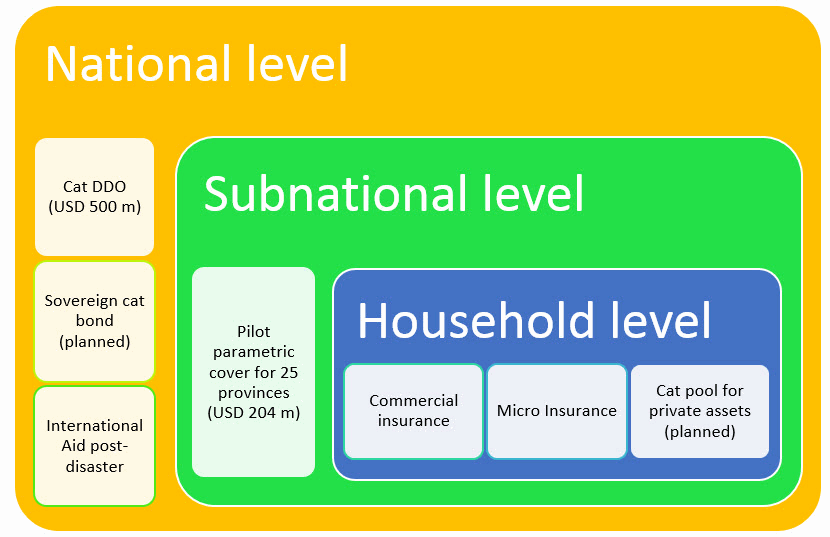

The Philippines is gradually putting in place a tiered approach to managing, financing and transferring disaster risks, with the goal being to help the national and local government players to better respond to disasters, while helping asset owners to protect themselves and ultimately to cover more lives and livelihoods.

At the national level the Philippines already has its $500 million catastrophe contingent credit line from the World Bank and access to sources of international aid, but the government has been working towards plans to put in place a sovereign catastrophe bond for some years now (we first began writing about its cat bond ambitions back in 2010).

We understand that the work got very close to a catastrophe bond being issued for the Philippines in 2015, but that political changes in the country delayed the process at the time.

It’s encouraging to learn then that the Philippines catastrophe bond remains firmly on the agenda, with a number of market sources suggesting that work is ongoing regarding this and a Philippine government source saying that a late 2017 issuance is possible, although not guaranteed as the country looks to augment its sovereign disaster risk protection using the capital markets.

A diagram published by Swiss Re also confirms that the catastrophe bond remains on the table, as part of the national level disaster risk financing strategy for the Philippines.

The diagram above also shows the long-discussed catastrophe risk pool for households, which would enable individuals and homeowners to acquire coverage for specific perils, such as typhoons and earthquakes. This pool was also expected to have launched some time ago with backing from global reinsurance markets, but has seemingly been delayed as well.

This tiered approach to disaster risk transfer and financing could, in the future, garner significant support from the capital markets and ILS investors.

The ILS market is already participating in the mid-tier subnational parametric insurance facility cat swap, through Nephila’s involvement. As this pilot gets rolled out to all 81 provinces the need for capacity to back the facility will grow dramatically, likely attracting more ILS fund managers to participate in reinsuring it.

The household level catastrophe pool for private assets could also benefit from a cat swap like structure to underpin the policies, which could again be suited to ILS market participation.

Finally, the top-tier national level catastrophe bond, which seems still to be on the cards, would also bring ILS capacity into the Philippines disaster risk financing arrangements.

Being a tiered structure, featuring parametric disaster insurance in the lower two levels (the cat pool and pilot), perhaps as these scale the benefits of additional capital market support may also be required, and a catastrophe bond become preferable to the cat swap arrangement.

If the parametric disaster insurance backing can be structured as a multi-year reinsurance arrangement the benefits of a catastrophe bond may become more apparent, as ILS investors would be more eager to support this. Then the Philippines could benefit from much broader syndication of its disaster risks.

It would also be interesting to see whether the Philippines can leverage the appetite of ILS investors and funds to support its disaster risk financing needs in order to grow the coverage provided by the lower two tiers.

Sovereign catastrophe bonds could be structured using triggers that closely match to the subnational and household level initiatives, meaning that cat bonds could provide the reinsurance required to back these efforts and also be utilised as an efficient source of capacity to help them scale up.

The work of the World Bank and firms such as Swiss Re, GC Securities and the support of ILS market actors such as Nephila Capital, has been instrumental in getting the Philippines disaster risk financing strategy to this stage. It’s not been an easy task over the seven years or more that this work has been ongoing.

But the end-result, of a tiered disaster risk financing strategy that leverages the wealth of reinsurance and ILS capacity to provide responsive disaster risk insurance that protects assets at all levels and benefits the population as well, is worth the significant effort.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.