Arch Capital Group has quietly increased the amount of third-party capital under its management in insurance-linked securities (ILS) related assets to $500 million, as the re/insurer continues to leverage its Arch Re underwriting platform to provide investors with access to reinsurance-linked returns.

Arch has been managing third-party capital through its Arch Underwriters Ltd. (AUL) unit, which it formed in 2013 as a separate arm to manage third-party reinsurance capital within its underwriting business.

The majority of the assets under management in ILS structures are deployed within private reinsurance facilities, so specific trades that are typically bilateral in nature, such as quota shares and other private arrangements. Largely the capacity is deployed into catastrophe underwriting, although market sources suggest that Arch has worked on a few private specialty reinsurance trades with ILS investors.

At the last count, according to data held in the Artemis Insurance-Linked Securities Investment Managers & Funds Directory, Arch Underwriters commanded $240 million of ILS assets.

That figure has now more than doubled, with the re/insurer disclosing assets of $500 million under its management in a recent investor presentation.

Alongside Arch’s use of third-party reinsurance capital within its Watford Re total-return reinsurer, and the use of ILS capacity through the mortgage ILS series Bellemeade Re which the company said it would continue to utilise, the $500 million of ILS capacity provides another lever that Arch can use to earn fee and profit related income from its underwriting, while sharing risk with third-party investors.

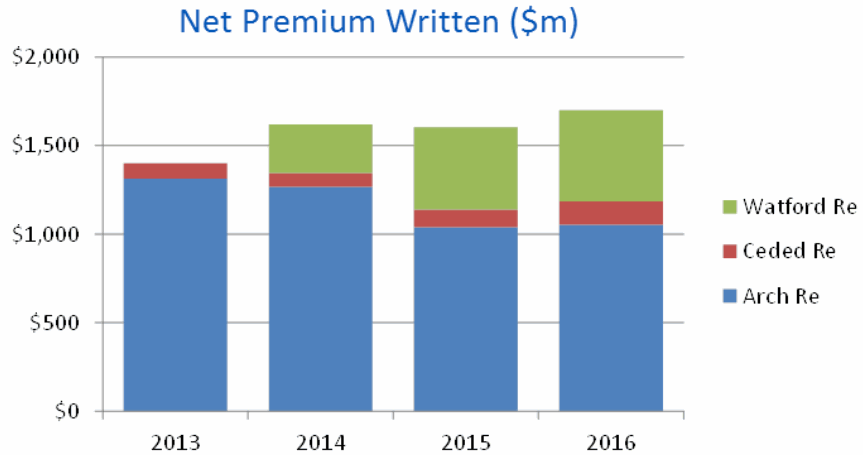

With the help of the Watford Re platform and the reinsurance business ceded to third-party capital and managed in ILS structures, Arch has grown its reinsurance underwriting business in recent years.

Arch said that the advantages of this multiple balance-sheet reinsurance platform are the bigger footprint the company has, its enhanced relevance in the reinsurance market and the greater flexibility that multiple pools of capital, with differing risk/return requirements, provides to it.

Utilising the Arch reinsurance underwriting platform alongside third-party reinsurance capital is seen as a key lever for remaining resilient throughout the reinsurance cycle, Arch said. The company also utilises ILS capacity as a way to manage and reduce its net realistic disaster scenario loss potential to a reasonable level.

It is this realisation, that third-party capital can help reinsurers to better manage and sustain the soft cycle, that is resulting in a growing pool of third-party assets being commanded by reinsurers with equity balance-sheets in recent years.

It’s a trend that’s only going to continue and accelerate, as the third-party capitalised balance-sheet becomes an increasingly important complement to the equity-backed side of the re/insurance business.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.