Despite major catastrophe events that struck around the globe in April 2016, the average return across the group of insurance-linked securities (ILS) and reinsurance linked investment funds tracked by ILS Advisers was 0.39% for the month, as losses appear limited from these events.

According to the Eurekahedge ILS Advisers Index ILS and reinsurance linked investment funds have continued their trend of doing better in 2016 than in the prior year, with the return after the first four months for the group of ILS funds tracked now reaching 1.53%, compared to just 0.92% by this time in 2015.

Despite major catastrophic events including the Kumamoto, Kyushu earthquakes, the Ecuador earthquake, severe convective weather in the U.S. and storm Fantala hitting the Seychelles, resulting in the highest level of insured catastrophe losses in April since 2011, the impact to ILS funds is expected to be limited.

Stefan Kräuchi, founder of ILS Advisers, explained that there would be limited impact to ILS and reinsurance linked investment funds from these global events, saying “losses to ILS funds should be very limited, based on our preliminary estimation.”

However, there has been some noticeable erosion to some private ILS deductibles, on aggregate or quota share reinsurance contracts, according to ILS Advisers. But this erosion of deductibles has not been sufficient to cause much in the way of direct losses so far.

“Still no direct and meaningful losses were reported. However, still early in the year, such erosions will increase the chance for losses to accumulate and reach attachment points for these private contracts, especially aggregate and worldwide covers,” Kräuchi continued.

With ILS fund managers and other ILS investors or structures such as sidecars, regularly investing in annual aggregate reinsurance contracts the chances of these contracts suffering losses by the end of the year will have risen through the first four months of 2016.

As erosion of deductibles continues to be seen from frequency type catastrophe or weather events, some ILS fund managers have been setting aside small reserves, or creating small side-pockets, in order to ensure they have the capital secured for any potentially affected contracts.

Kräuchi commented; “Such erosion will finally have an impact on the performance of private ILS funds. We will keep monitoring the loss development across the year.”

Depending on how ILS fund managers approach their reserving and net asset value (NAV) calculation, some may have already reflected potential losses in their NAV’s, which if on aggregate contracts which in the end do not get triggered could also result in some return of value to investors later in the year.

But for now, the majority of ILS funds continue to report positive performance, suggesting that impacts to the sector are really limited right now. It will be interesting to see how the expected impacts to reinsurance contracts from the Fort McMurray wildfires in Canada play into this.

During April the catastrophe bond market and its investors saw solid price support, as issuance failed to live up to expectations or meet investor demand for new cat bond paper. Once again, it seems factors are converging to provide potential cat bond sponsors with an opportunity to take advantage of this pent up demand for new issuance.

And this need for more issuance to meet investor demand continues to result in greater support for cat bond prices in the secondary market, with pure catastrophe bond funds seeing impressive performance during April 2016.

In fact, April was the first month in two years that pure cat bond funds as a group have outperformed the group of ILS funds that also invest in collateralised reinsurance and private ILS contracts. Cat bond funds as a group averaged a return of 0.5% for the month, while the funds invested in private ILS only managed 0.28%.

Kräuchi explained; “The reason is not that private ILS funds performed poorly but rather the unusual price support to the cat bonds which can be explained by increased buying power in April in absence of new supply to meet the strong demand. The performance gap between private ILS funds and pure cat bond funds was 1.12 percentage points on an annualized basis.”

Some funds did not do so well in April though, likely due to reserving affecting their NAV’s as the ILS fund managers seek to ensure investors capital is not adversely affected by any development or subsequent aggregation of losses.

The worst performing ILS fund for April reported a negative -0.11% return, while the best performing fund achieved 2.15% for the month, again providing a demonstration of the range of returns available in the ILS fund market today. As a result the monthly performance difference was 2.26% from best to worst performer.

29 of the 31 ILS funds tracked by the Eurekahedge ILS Advisers Index were positive for the month of April 2016.

It will be interesting to see what impact there is to May returns from the wildfires in Canada as well as any late reported NAV adjustments made due to earlier catastrophes and severe weather.

Often the impacts can take some time to be factored into valuations, as for the more minor, frequency type events, greater certainty of reinsurance loss estimates can be required before ILS fund managers can make accurate reserving decisions.

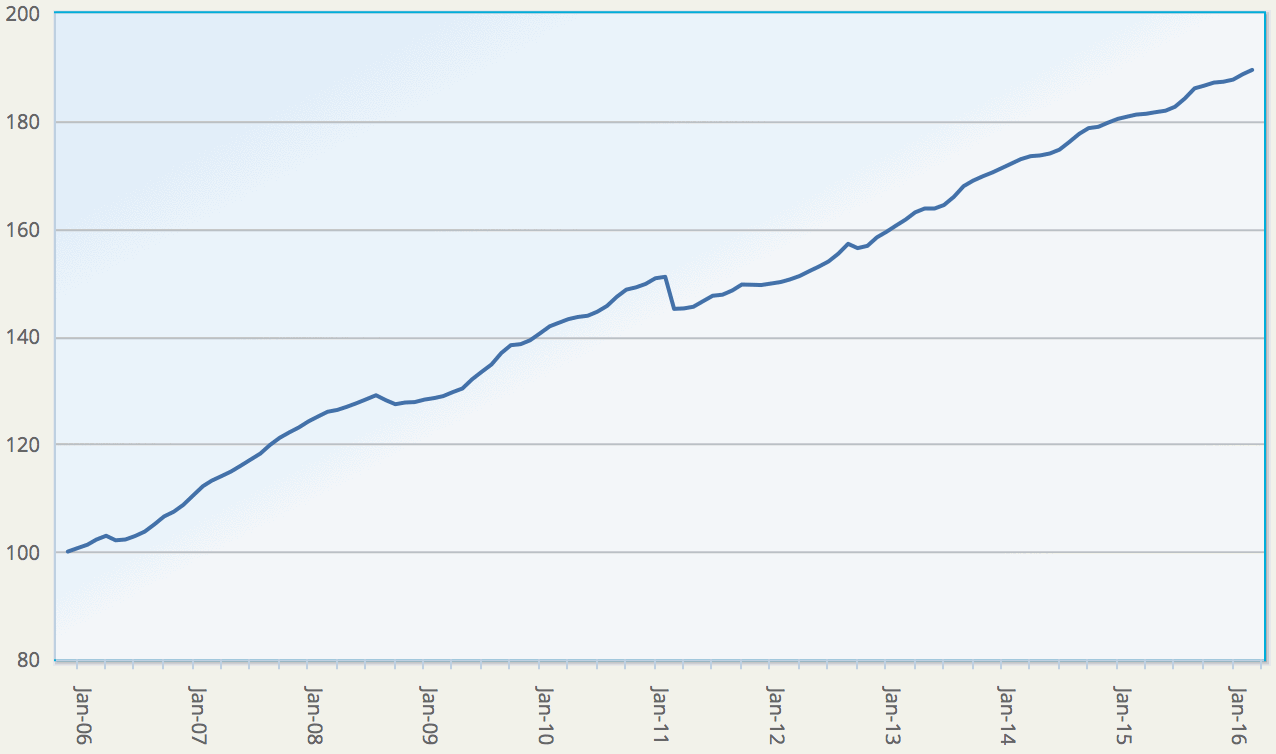

Eurekahedge ILS Advisers Index, showing average return of ILS and cat bond fund market - Click the image for more data on ILS fund performance

You can track the Eurekahedge ILS Advisers Index here on Artemis, including the new USD hedged version of the index. It comprises an equally weighted index of 31 constituent ILS funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond investment space.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.