Artemis is 20 years old this week. On the 12th of May 1999 Artemis was launched to an audience of reinsurance and capital market investment executives in Bermuda.

The goal, to provide an online home for the emerging catastrophe bond and insurance-linked securities (ILS) sector and to foster the development of the capital market’s participation in reinsurance.

The goal, to provide an online home for the emerging catastrophe bond and insurance-linked securities (ILS) sector and to foster the development of the capital market’s participation in reinsurance.

Facilitating relevant, accurate information flow for ILS and reinsurance professionals and explaining insurance-linked securities (ILS) to risk transfer users or potential investors was our aim.

20 years later our goal hasn’t changed. But the market, as well as the level of interest in it, has and now our ILS news and information attracts tens of thousands of readers from across the globe every single month.

Artemis continues to facilitate education, information provision and transparency, regarding the use of capital market techniques and risk financing within insurance and reinsurance, as well as other alternative methods of risk transfer.

Furthermore, we facilitate a conversation about how capital drives innovation or disruption and is a game-changer that has changed the reinsurance market paradigm for good.

The growing interest in accessing the capital markets as an efficient or complementary source of re/insurance underwriting capacity, as well as interest in accessing insurance market returns as an asset class, has helped us to reach as many as 60,000 people in a single month.

We average 50,000 or more readers every single month now and continue to grow this readership. While over 10,000 people receive our email newsletters and a growing number get our email alerts that let them know immediately we publish new articles.

We’ve strived to grow the largest, most targeted and relevant audience in ILS, something we’ve achieved by a significant margin and we continue to grow to this day as global interest in the sector expands.

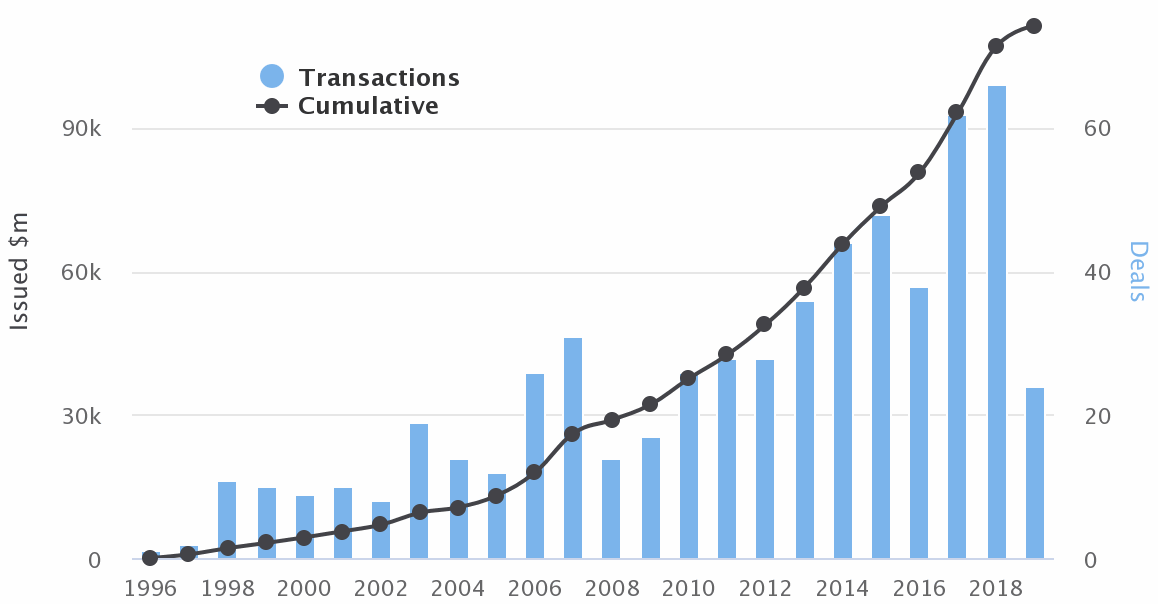

It’s interesting to look at how the ILS market has grown since our launch.

Artemis emerged as a website concept a few years after we began tracking early catastrophe bonds, catastrophe options and other capital market linked reinsurance instruments in the mid-90’s.

It was clear this sector was going to grow and become an important piece of the insurance risk transfer market, so we decided to build it a home.

In May 1999, at its launch, the Artemis Catastrophe Bond Deal Directory contained just 18 entries, amounting to approximately $2.35 billion of risk capital issued across these pioneering transaction.

At that time we delighted with were pleased with 200 or so readers a month, given the niche focus. There were only a handful of ILS investment opportunities available, dedicated ILS fund managers were a rarity at that stage in the development of this market.

Now we try to average 50,000 individual readers every single month, demonstrating the greatly increased interest in catastrophe bonds, ILS and reinsurance as an asset class, as well as the change it has generated across the reinsurance market.

There are numerous was and means to access the returns of the market now, not just catastrophe insurance risks, but a wider cross-section of re/insurance is now much more readily accessible to capital market investors.

20 years on, the Artemis Deal Directory now features information on almost 600 individual catastrophe bond and related ILS transactions, while the total cumulative issuance recorded in it has reached a huge $111.3 billion. A number set to rise even further as we also have another 6 transactions listed that are still to complete.

Since our launch we’ve published more than 11,000 articles on ILS, catastrophe bonds, alternative reinsurance capital and related risk transfer topics of interest.

In the last 12 months readers of Artemis have between them viewed our website pages over 2.5 million times. That’s up around a million page-views in just four years, a growth rate we’re very happy with for a 20-year-old online media platform.

This year we’ve also held what will be one of the largest insurance-linked securities (ILS) conferences of the year in New York with over 350 attendees and our next event in Singapore is shaping up to be our best yet (tickets still on sale here).

As Artemis has grown its reach, our coverage has expanded too, as we’ve tried to also focus on topics of relevance to the ILS market and the trends of efficiency in reinsurance risk transfer.

But to ensure we keep our coverage focused, we launched a new broader reinsurance publication to give us a platform to cover everything else interesting in reinsurance, while keeping Artemis true to its roots. Reinsurance News now has over 100,000 readers every single month and the largest, most targeted and organically grown audience of its kind.

Artemis will remain focused on ILS, the capital markets interest in reinsurance, insurance risk as an asset class, other alternative forms of risk and risk transfer for which the capital market has an appetite, and the trends that drive greater capital and transactional efficiency (so enhancing opportunities for the investor base).

Insurance-linked securities (ILS) and the reinsurance market in general continue to evolve, while catastrophe bonds, capital markets backed collateralised capacity, as well as the use of derivatives, swaps and other novel risk transfer tools grow in importance and prevalence within the broader risk transfer marketplace.

The blurring of the lines between the alternative and traditional sides of the market continues apace, but Artemis maintains its focus on the capital markets, ILS, cat bonds, weather and catastrophe risk transfer, as well as the trends that this competition from third-party reinsurance capital is creating.

Artemis remains the largest audience, on any medium, focused specifically on these topics. Artemis is also among the largest re/insurance focused audiences anywhere.

As a result it’s a great place to get your product, services and investment offerings known, to an organically grown and highly relevant audience. Please contact us to discuss advertising and sponsorship opportunities.

I’d personally like to thank all of our readers, contributors, sponsors, advertisers, partners and good friends we’ve made, without whom our continued coverage of this market would not be possible.

I truly value the relationships we’ve built with the market, the friends we’ve made over the year’s and your support is greatly appreciated!

Best wishes and I hope you continue to enjoy Artemis!

Steve Evans

Owner & Editor, Artemis.bm.

Here are a few reminders of the evolution of Artemis since its launch in 1999, for those who’ve been with us since the start.

This image shows how Artemis looked on the day it launched, 12th May 1999, taken from the original press release. I particularly enjoy the fact that the top headline discussed the potential growth of corporate cat bonds, a topic that continues to be discussed today.

This image shows Artemis in late 2000, around 18 months after its launch. Not much had changed, but deal-flow was accelerating and things were starting to get interesting in the emerging ILS world.

This image shows how Artemis looked in 2004.

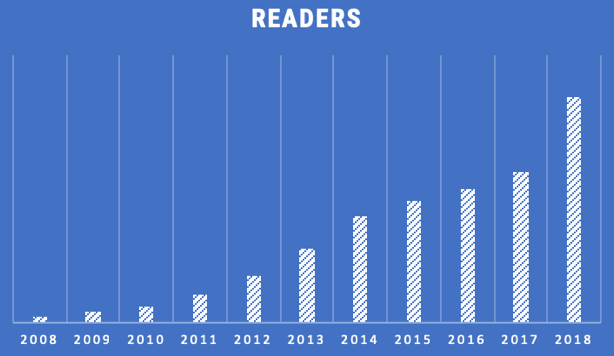

From 2008 to 2018 Artemis looked similar to this, but our readership grew from 1,000 readers per month to over 50,000 over that decade.

Artemis’ readership growth in that period of time.

———–

Register today to attend our next ILS conference in Singapore, ILS Asia 2019.

Register today to attend our next ILS conference in Singapore, ILS Asia 2019.

We’re returning to Singapore for our fourth annual ILS market conference for the Asia region. Please register today to secure the best prices. Early bird tickets are still on sale.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.