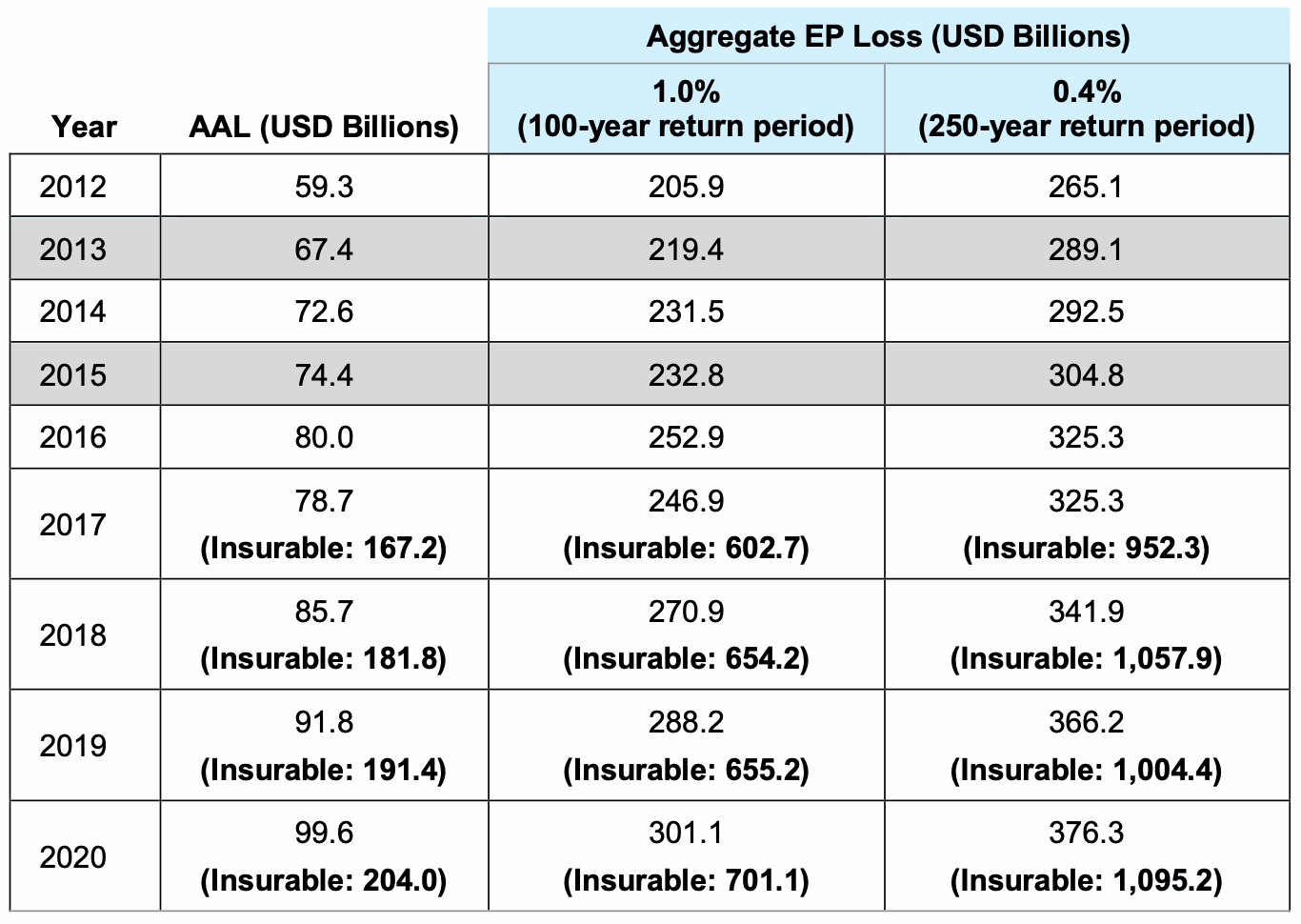

The 1% aggregate exceedance probability insured loss (also the 100-year return period loss) from catastrophe events around the globe has risen to more than US $300 billion, according to risk modeller AIR Worldwide.

This figure has been rising steadily in recent years and now reaching almost $301 billion it is at the highest level ever.

The 1-in-250 year average loss, a 0.4% aggregate exceedance probability, has now risen to over $376 billion.

The data points represent loss metrics based on outputs of AIR’s most current suite of global property and crop models from AIR, including new models and updates released during 2020 as well as databases of property values for more than 110 countries.

“For regions and perils covered by catastrophe models, the protection gap represents not only potential business growth opportunities for the insurance industry to offer essential protection to vulnerable home- and business-owners, but a responsibility to act,” explained Bill Churney, president at AIR Worldwide.

“Understanding the protection gap can also help governments assess the risks to their citizens and critical infrastructure, and develop risk-informed emergency management, hazard mitigation, and public risk financing strategies to enhance global resilience and reduce the ultimate costs from catastrophic events.”

The report data also reflects the insurance and reinsurance market opportunity, by making clear the insured vs the insurable and the size of the protection gaps around the world.

“The ability for the global (re)insurance industry, financial institutions, governments, and non-governmental organizations to prepare for large losses before they occur is critical to continued solvency and resilience,” said Rob Newbold, executive vice president at AIR Worldwide.

“With the insight provided by AIR’s global suite of models, companies can pursue profitable expansion in a market that is ever-more connected, and amid regulatory environments that are increasingly rigorous. These holistic analytics can give insurers and reinsurers greater confidence that the risk they’ve assumed is risk they can afford to take.”

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.