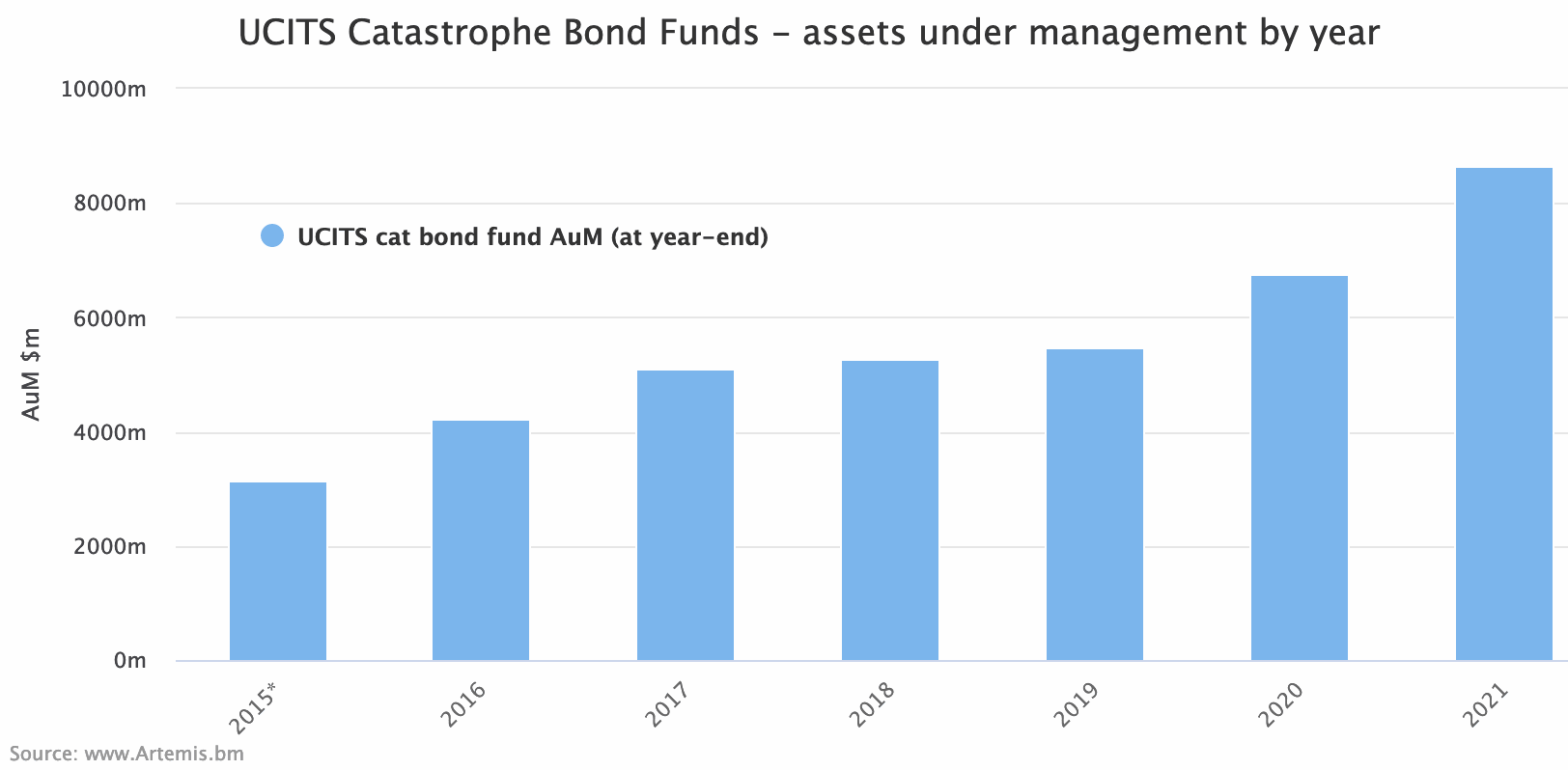

The main UCITS catastrophe bond funds as a group lifted their assets under management (AUM) significantly during 2021, to a new high of just over US $8.64 billion, representing 28% growth in AuM year-on-year.

We’ve tracked the growth of the UCITS catastrophe bond fund market and launched a new page featuring charts detailing this growth in cat bond fund assets, with the help of partner Plenum Investments AG, a specialist insurance-linked securities (ILS) and cat bond investment manager.

We’ve tracked the growth of the UCITS catastrophe bond fund market and launched a new page featuring charts detailing this growth in cat bond fund assets, with the help of partner Plenum Investments AG, a specialist insurance-linked securities (ILS) and cat bond investment manager.

With the overall catastrophe bond market having grown rapidly in 2021, taking annual issuance to a new record, as documented in our latest report, these UCITS cat bond funds and their managers have benefited, by being able to welcome new inflows from investors and expand their strategies, to support the reinsurance needs of the ceding company base.

The cat bond fund segment is one area of insurance-linked securities (ILS) that grew strongly in 2021, as catastrophe bonds largely avoided significant losses during the year and have largely recovered from prior year loss activity impacts.

In addition, the more stable returns of catastrophe bond funds over recent years have helped to encourage some investors in other reinsurance linked assets back to cat bonds, helping to grow some of the UCITS and ILS fund managers closed-end cat bond offerings as well.

Overall, UCITS catastrophe bond fund assets, from the main investment funds on offer in the market, rose 28% or $1.88 billion, from just under $6.76 billion at the end of December 2020, to this new high of just over $8.64 billion at the end of 2021.

This reflects the growing importance of UCITS funds in the catastrophe bond market and you can see how much they have expanded over time using our new UCITS catastrophe bond fund AuM charts.

As well as being able to analyse UCITS cat bond fund assets by year, our new page also displays the data by month as well, so you can more clearly see periods of inflow and outflow from the UCITS cat bond fund segment.

One clear sign of the growing importance of UCITS as a fund format in the catastrophe bond market, is the fact that while the main UCITS cat bond funds grew 28% in the last year, the overall cat bond market only grew by about 8%.

However, it is also important to note that while the $8.64 billion of UCITS cat bond fund AuM is significant, as a proportion of the outstanding cat bond market, there is a significant amount of cat bond risk capital held in other more private investment fund formats, mandates and other strategies that also invest in catastrophe bonds.

At the end of 2021, the largest UCITS cat bond fund was the GAM Star CAT Bond Fund, which took back the top spot from the Schroders GAIA Cat Bond Fund thanks to inflows at the end of the year.

The Fermat Capital Management managed GAM Star CAT Bond Fund ended 2021 at just over $2.47 billion in AuM, while the Schroder GAIA Cat Bond Fund was just under $2.35 billion in size.

These two funds swapped place for the top spot, in terms of AuM, in December 2021, with the Schroder managed strategy having been the larger at the end of November.

Twelve Capital and Securis Investment Management both grew their UCITS catastrophe bond funds by the largest percentages over the course of 2021, but several other ILS fund managers also experienced strong growth in UCITS cat bond fund assets.

There were also newcomers, including Plenum Investments’ “Dynamic” cat bond fund and Franklin Templeton’s first UCITS cat bond strategy.

The UCITS cat bond investment sector remains buoyant and we’d expect to see the main UCITS cat bond funds growing further in 2022, as they continue to support what is a growing piece of the overall ILS and reinsurance market’s capacity.

Analyse UCITS catastrophe bond fund asset growth using our new charts here.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.