Catastrophe bond returns remain very strong as the higher spread environment continues to deliver in 2023 and as a result the average return across UCITS cat bond fund strategies has now reached 3.07%, at March 17th.

The catastrophe bond investment market remains on-track for a record first-quarter of the year, with returns staying elevated and fund managers continued to claw back value that had been lost after hurricane Ian and the spread widening from 2022.

The forward-looking return potential of cat bond funds has never looked better and this is being borne out in the returns being report through the main UCITS cat bond fund strategies.

As we reported before, catastrophe bond investment funds structured in the UCITS format had experienced a record start to 2023, after which the average return across the leading UCITS cat bond funds had reached 1.77% as of Friday February 10th and then 2.62% by March 3rd.

The impressive returns have continued, with catastrophe bond funds structured in the UCITS format now having reached a year-to-date return of 3.07% by March 17th.

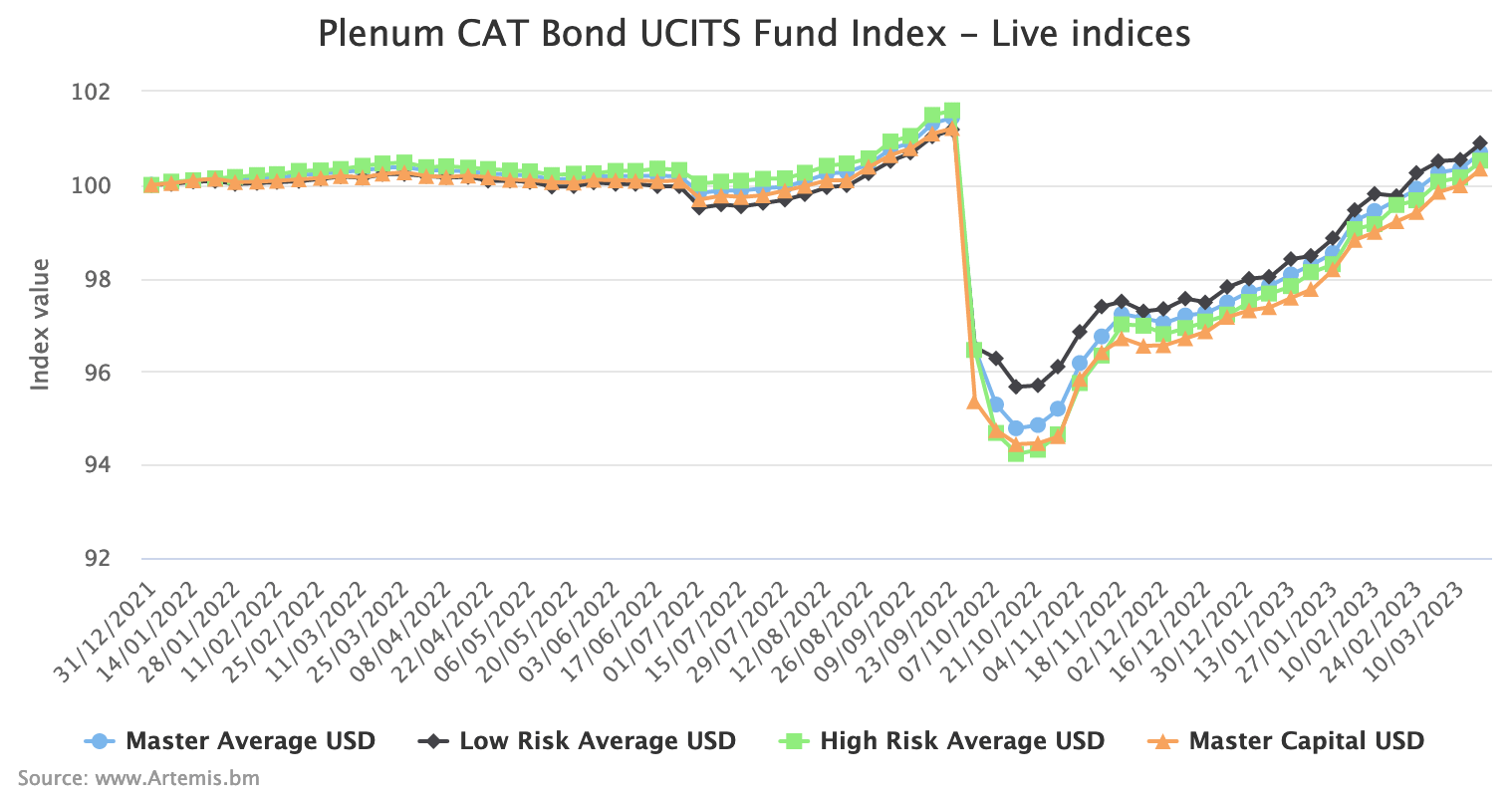

The strong performance has helped the Plenum CAT Bond UCITS Fund Indices gain 4.38% on average since hurricane Ian, as the recovery in value and elevated spreads drive returns.

More impressive is the fact that these cat bond funds are almost back to the levels seen before hurricane Ian, with the lower-risk group of cat bond funds only at -0.29% and higher-risk cat bonds funds only -1.06% off their pre-Ian high.

Analyse the performance of UCITS cat bond funds by clicking the chart below to see an interactive version.

As we reported before, some cat bond and ILS funds will recover to their pre-Ian levels by the end of the first-quarter of 2023.

The lower-risk cohort of UCITS cat bond funds are almost there already and could be within one-week of reporting, while the higher-risk cat bond funds may take till the end of the quarter, or slightly after to reach this important point in their recovery from the major storm.

These catastrophe bond fund indices, calculated by specialist insurance-linked securities (ILS) investment manager Plenum Investments AG, offer a useful source of real cat bond fund return information, focused on the UCITS cat bond fund category, with 14 live cat bond funds currently tracked.

The index provides a broad benchmark for the actual performance of cat bond investment strategies, across the risk-return spectrum.

Analyse interactive charts for this UCITS catastrophe bond fund index.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.