UCITS catastrophe bond funds as a group have increased their assets significantly over the last year, with accelerated growth of the cat bond market and rising interest in ILS investments helping to propel the UCITS cat bond funds we track to asset growth of roughly 58% in just one year.

Over that period, first place position for the largest UCITS cat bond fund has also changed, as Schroders has now overtaken GAM, after Schroders’ GAIA Cat Bond Fund overtook the GAM Star CAT Bond Fund (which is portfolio managed by Fermat Capital Management) in terms of assets held within the strategy.

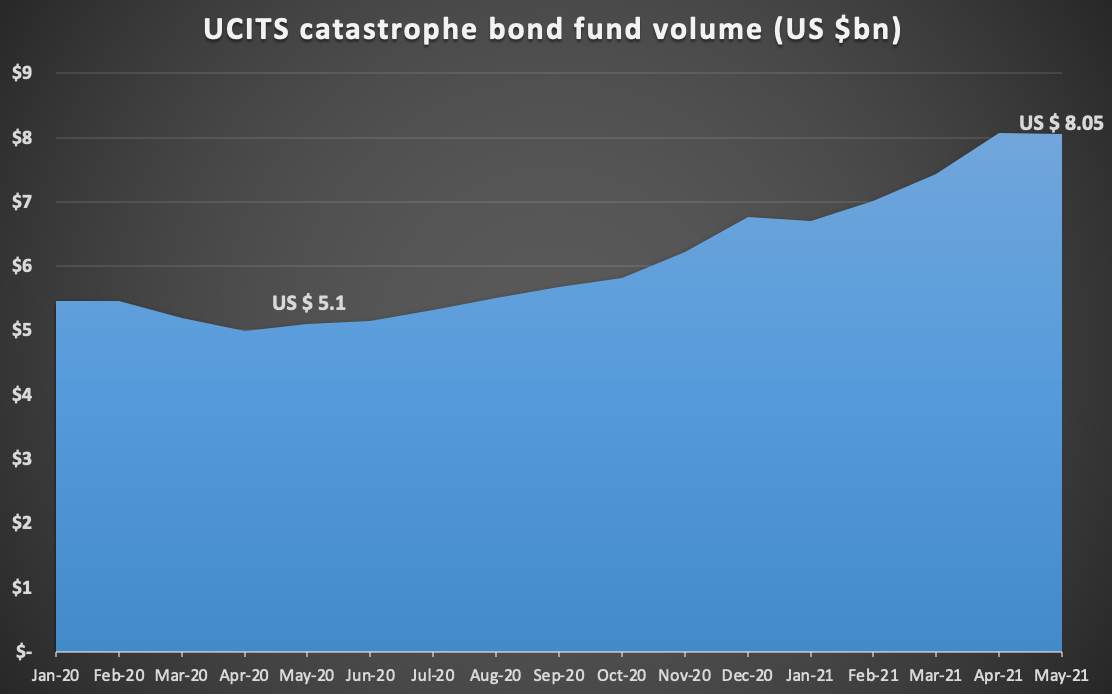

At the end of May 2020, a group of 15 main UCITS cat bond funds had accumulated catastrophe bond assets of just over US $5.1 billion.

By the end of May 2021, just one year later, that figure had grown considerably, with the same 15 UCITS cat bond funds counting some US $8.05 billion of cat bond assets under their management.

That’s almost 58% growth in a single year, reflecting the growing importance of UCITS funds in the catastrophe bond market.

Over the same period the outstanding market for catastrophe bonds had grown, but by a far smaller percentage, meaning the UCITS fund strategies have also taken market share of cat bonds.

Over that period, May 31st 2020 to May 31st 2021, the largest UCITS cat bond funds have all increased in size.

Growth is equally impressive over 2021 to-date, as the 15 UCITS cat bonds have increased their aggregate asset volume by 19% over the period, from just over $6.75 billion at the end of December 2020, to the over $8 billion recorded at the end of May 2021.

Schroders’ GAIA Cat Bond Fund strategy has experienced particularly strong growth, with its assets rising from just under $1.2 billion at the end of May 2020 (according to the date we’ve sourced) to an impressive $2.37 billion as of the end of last month, representing around 98% growth.

However, Twelve Capital’s UCITS cat bond fund actually grew by a greater proportion over the last year, increasing in size by a huge 151% to reach just under $1.5 billion by the end of May this year.

Similarly, Leadenhall Capital Partners’ Leadenhall UCITS ILS Fund grew by 92% over the year, to end May 2021 at around $511 million, fund data shows.

The GAM Star Cat Bond Fund, managed by Fermat, grew more slowly, only by 31%, to $2.26 billion over the same one-year period.

A year ago, the GAM UCITS cat bond fund was the largest by some $524 million or so, but now it has fallen behind Schroders offering by just over $100 million.

The growth achieved by some UCITS cat bond fund managers is a clear sign of investor demand for the cat bond asset class, as well as the elevated issuance in the market that has enabled this growth.

There is one important fact to consider though.

The catastrophe bond market is only so big, constraining the investment opportunity somewhat.

So managers of cat bond funds do have to be a little careful not to grow too quickly, or deployment of capital can become more challenging and of course inflows to funds that need to be deployed can affect execution pricing as well.

It’s no surprise then that cat bond pricing has softened somewhat over the last year, as clearly there has been ample capital and demand from these funds to support strong execution for sponsors.

This can become an issue for cat bond funds with specific risk and return targets, especially for those targeting higher returns, as these opportunities can be limited in primary issuance and raising too much capital can therefore make maintaining targets more of a challenge, especially if you need to deploy it and no new higher-yielding opportunities emerge.

Which can also drive secondary market price pressure, as investors look to source their targeted return profile through secondary market trades.

The larger UCITS funds tend to target a broader spread of the market for their investors, so that can be less of an issue.

But in a constrained market, such as cat bonds, being larger does not necessarily make managing the portfolio any easier.

In fact it can sometimes add layers of difficulty around selection of risks, that the smaller to mid-sized cat bond funds may not face in the same way.

But with issuance of new catastrophe bonds still accelerating and records set to be broken at the half-year, currently there is likely sufficient new paper to satisfy the majority of UCITS and other cat bond funds, although this constrained market still means that portfolio management is key in order to sustain target return profiles of funds.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.