U.S. commercial property insurance rates are now rising at their fastest pace since 9/11, according to the Council of Insurance Agents & Brokers (CIAB).

The statement supports recent data from broker Marsh who explained that commercial property insurance rates were up 21% on average during the first-quarter of 2020, which provides further impetus to reinsurance rates, which are likely to continue to rise in tandem to keep up.

In fact, while the state of the market at the January reinsurance renewals was called U shaped, as the front-end of primary insurance and back-end of retrocession were seen to have the sharpest increases in pricing, with reinsurance lagging in the middle, it’s now thought that the U shaped market has disappeared.

This is because reinsurance rates have accelerated significantly and may now be outpacing primary property insurance pricing and even retrocession pricing for the moment.

But the continued rate of increase in primary insurance markets in the United States should provide further impetus to reinsurance and retrocession rates, as well as helping to establish a new floor on pricing for catastrophe exposed risks which is a key goal of the market.

The CIAB says that the insurance market continued to harden in Q1 2020, which combined with the effects of the Covid-19 pandemic is causing stress in property and casualty P&C.

“Premium prices across all-sized accounts increased by an average of 9.6% in Q1 2020, compared to an average increase of 7.5% in Q4 2019. This marks the 10th consecutive quarter of increased premium pricing by account size.

“The hardening in Q1 2020 mostly impacted large accounts, whose premium prices increased by an average of 12.6%, followed by medium accounts with an average premium increase of 9.8%. Small accounts were impacted less than the other account sizes, with an average premium increase of 5.5%,” the CIAB explained.

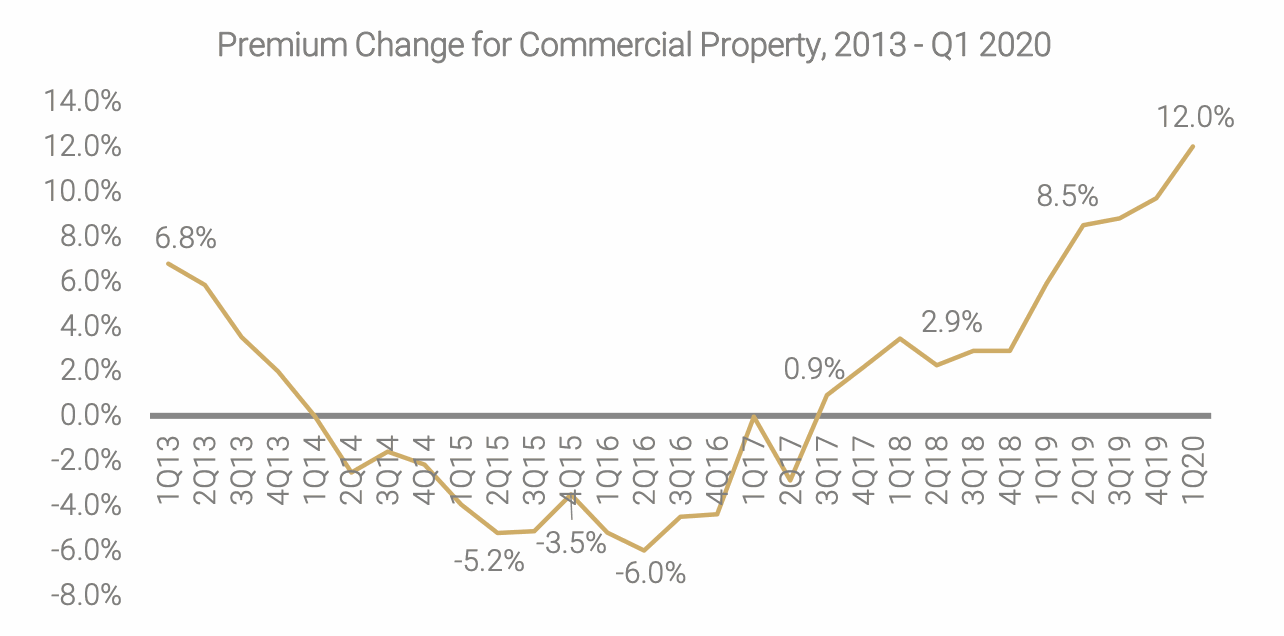

In commercial lines, the average price increase was 8.7%, with commercial property up 12% for the quarter.

“We are now in the midst of a hard market, premium increased steadily for 10 consecutive quarters,” explained Ken A. Crerar, President/CEO of The Council. “Umbrella, Commercial Property and Commercial Auto were the hardest hit, with Umbrella and Commercial Property seeing double digit increases—the largest since 9/11.

“Additionally, the uncertainty around COVID-19 put additional strain on the industry in the latter-half of March. Respondents noted the current pandemic affected carriers’ ability to collect premium and the availability of coverage by the end of Q1.”

Interestingly, the CIAB’s survey notes a significant increase in demand for business interruption (BI) cover, as a result of the pandemic.

“The percentage of respondents reporting an increase in demand for BI rose from 18% in Q4 2019 to 47% in Q1 2020, while the percentage of respondents reporting an increase in claims for BI jumped from 18% in Q4 2019, to 75% in Q1 2020. It is important to note that an increase in number of claims does not assume these claims were accepted, particularly those related to COVID-19,” the CIAB said.

In commercial property there has been a notable push for higher deductibles from carriers, which has also driven the addition of peril specific catastrophe deductibles on top of standard deductibles as well.

The CIAB said that this was noted for quake, flood and wind, which could result in some changes to reinsurance cover as well further down the line, as reinsurers look to work with adjusted deductibles in how they provide protection to insurance carriers.

In addition, the CIAB noted that catastrophe exposed property insurance accounts have become more difficult to place in some regions.

That suggests a potential opportunity for carriers or MGA’s to work with capital market investors and ILS funds to source catastrophe specific focused capacity to help in the provision of these cat exposed property products.

The chart below clearly shows the extent of the hard market so far, with further increases in property insurance rates expected, all of which will help to support firmer reinsurance pricing over the year or more ahead.

End.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.