Property insurance rates around the globe continue to accelerate higher, with commercial line rate increases leading the way and U.S. property rates accelerating fast, suggesting that reinsurance rates will continue to rise in tandem and to keep up.

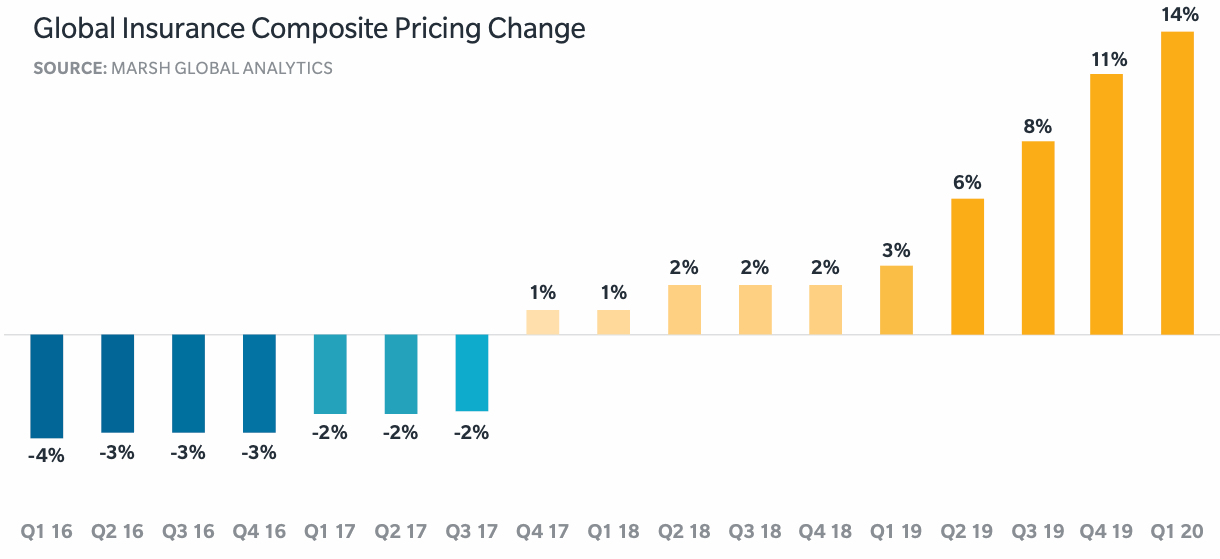

Following a number of years where catastrophe losses around the globe heavily impacted the commercial and homeowners property insurance markets, particularly in the United States, rate rises have now been seen for some ten consecutive quarters and the rate increases are still accelerating up to the end of Q1 2020.

Broker Marsh’s view on commercial insurance pricing can be seen below.

Commercial property insurance remains a key driver for overall insurance rates around the world, with the global rate rising by some 15% in the last quarter.

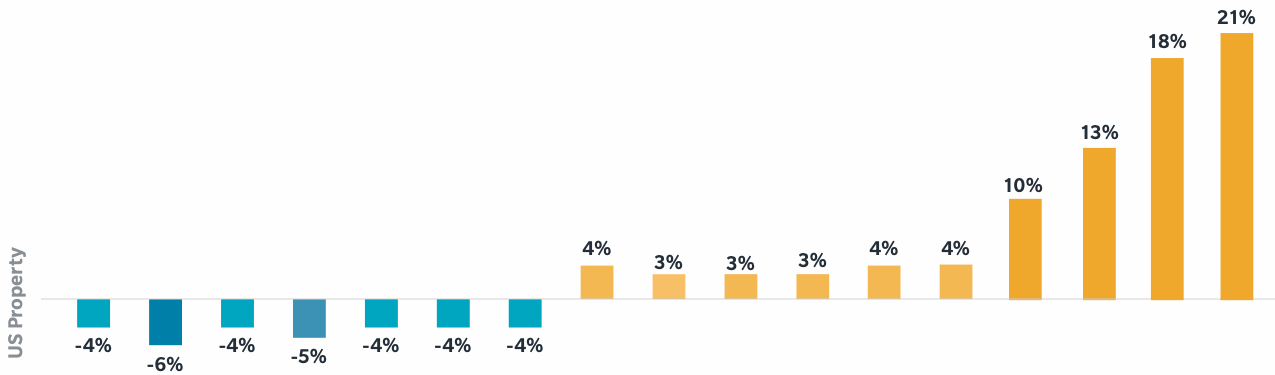

U.S. property insurance remains one of the fastest moving segments of the global commercial insurance marketplace, with rates accelerating by an impressive 21% in the last quarter.

Property insurance rates in the U.S. have now risen for an impressive ten consecutive quarters, with the 21% rise seen in Q1 2020 the highest recorded since Marsh’s survey began in 2012.

Marsh said that both catastrophe exposed and non-cat property insurance rates rose in the quarter, with increases similar on both sides.

There was little apparent change to deal structure parameters, in terms of limits and deductibles, the broker noted, although it will be interesting to see how these may evolve with the pandemic in play through the second quarter and beyond.

Property insurance rates also rose 10% in the UK in Q1 2020, where reduced capacity is helping to firm rates and it is now five consecutive quarters of increase.

In Latin America, property insurance pricing was up 9% in the quarter, seemingly a reaction to recent losses in Chile in particular due to rioting, but increased pricing was also seen in Colombia and Mexico.

Property insurance pricing rose 9% in Continental Europe, the sixth consecutive quarterly increase and continuing a trend started in early 2019. Some countries saw increases as high as 15%, Marsh reported.

In the Pacific region property insurance rates soared 23% in Q1, driven by the losses experienced in Australia during the summer months from bushfires, storms and other perils.

Finally, in Asia property insurance pricing rose 8%, with Hong Kong and Singapore experiencing double-digit increases to both catastrophe and non-catastrophe exposed property rates.

Here, Marsh said a lack of competition is an issue for the large and complex property accounts.

So overall, global property insurance rates have accelerated again this last quarter, as firming or perhaps even hardening appears to have taken hold.

Pricing in the commercial insurance market around the globe is expected to firm even faster given the impacts of and future implications from the Covid-19 coronavirus pandemic.

Capacity is likely to remain tight in certain areas, particularly those most catastrophe exposed, presenting a potential opportunity for reinsurance capital providers to step in where they have an appetite to move up the chain.

This could result in commercial property insurance rates becoming even more attractive over time and as a result drive further increases in reinsurance pricing as it also tries to keep pace.

Making allocations of ILS fund and investor capital into structures that access primary sources of catastrophe exposed property risk a very attractive proposition over the coming months.

Dean Klisura, President, Global Placement and Advisory Services at Marsh, commented, “Pricing was trending higher in the first quarter, prior to any meaningful impact from losses associated with COVID-19. However, COVID-19 will likely have an impact on pricing for the balance of 2020.”

ILS funds already access some primary U.S. property insurance more directly through partnerships with MGA’s and other underwriting agencies.

With rates accelerating away, that strategy is likely to continue presenting attractive margins where the volatility in the portfolios can be controlled and major catastrophe losses remain less prevalent.

If the rate acceleration in regions such as Europe, the UK, Asia and Latin America also continues, these regions could become more conducive for ILS funds to partner up with specialist managing general agencies (MGA’s) or underwriters, to access risk and provide a shorter market-chain back to reinsurance capital.

It’s a strategy that has only really been viable in the U.S. so far, given the rates available there in catastrophe exposed regions. But if property insurance rate increases persist across the globe it will become more viable elsewhere as well, perhaps presenting a new opportunity for alternative reinsurance capital to support pools of primary risk originated directly out of new global locations.

The persistent firming of commercial insurance pricing around the world can only help to ensure that reinsurance and retro rates stay firmer too, as price hikes flow along the market-chain to the benefit of all capacity providers.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.